Listen to this:

Did you know we can visually analyse whether the Bulls or the Bears are winning? There are different types of Candlesticks patterns help us see the price movements of any stock on the charts.

Candlesticks tell a comprehensive story, with the body and wicks of each candlestick revealing whether the bulls or bears are in control. Additionally, they provide key data such as the opening and closing prices, as well as the highest and lowest prices reached over a given period (day, week, or month).

It is important for any technical analyst in the stock market to understand the interpretation of candlestick chart patterns. By recognizing these patterns, they can make informed decisions about future price movements.

Candlestick patterns present a more visual presentation of the price action and give us more insights into how the prices will move further than bar charts.

In today’s blog, we will discuss 35 candlestick patterns that help us understand the price movement of any securities:

- How to Read Candlestick Charts?

- 35 Types of Candlestick Patterns:

- Bullish Reversal Candlestick Patterns:

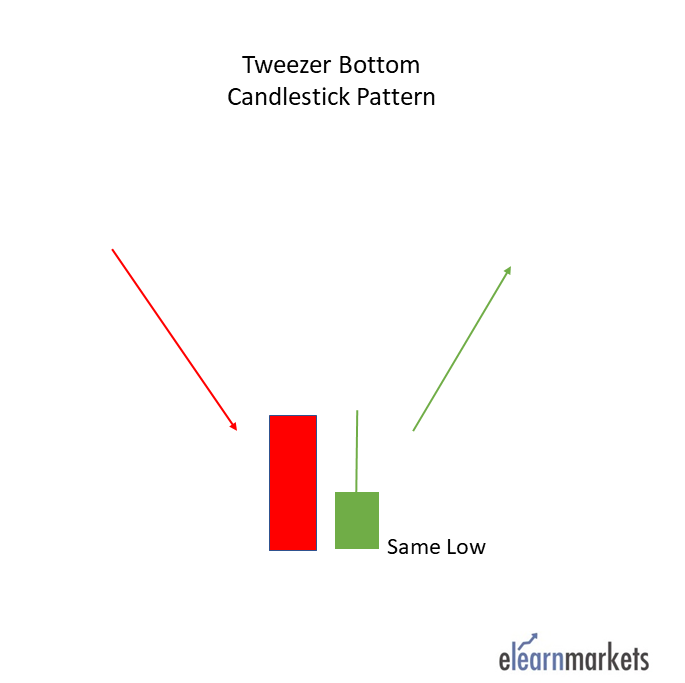

- 1. Hammer:

- 2. Piercing Pattern:

- 3. Bullish Engulfing:

- 4. The Morning Star:

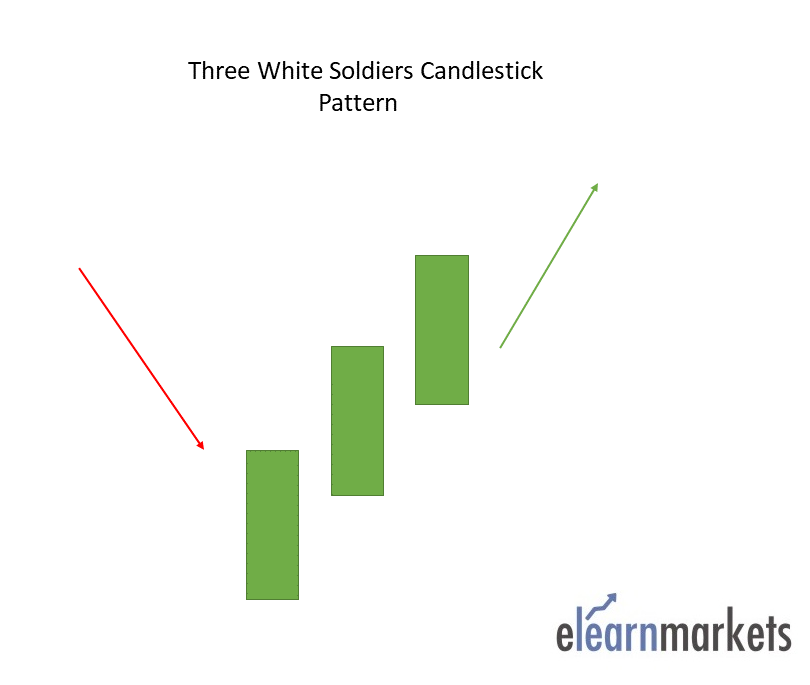

- 5. Three White Soldiers:

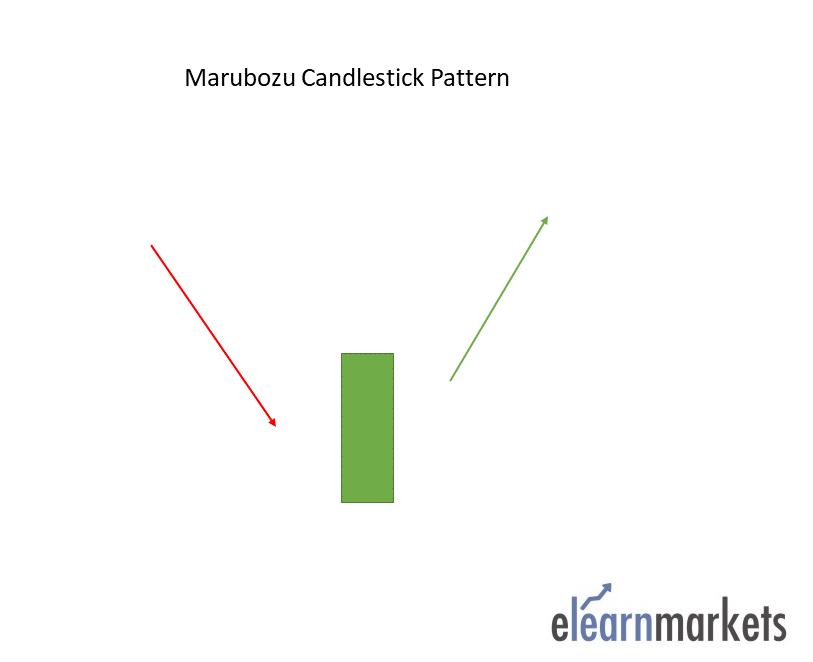

- 6. White Marubozu:

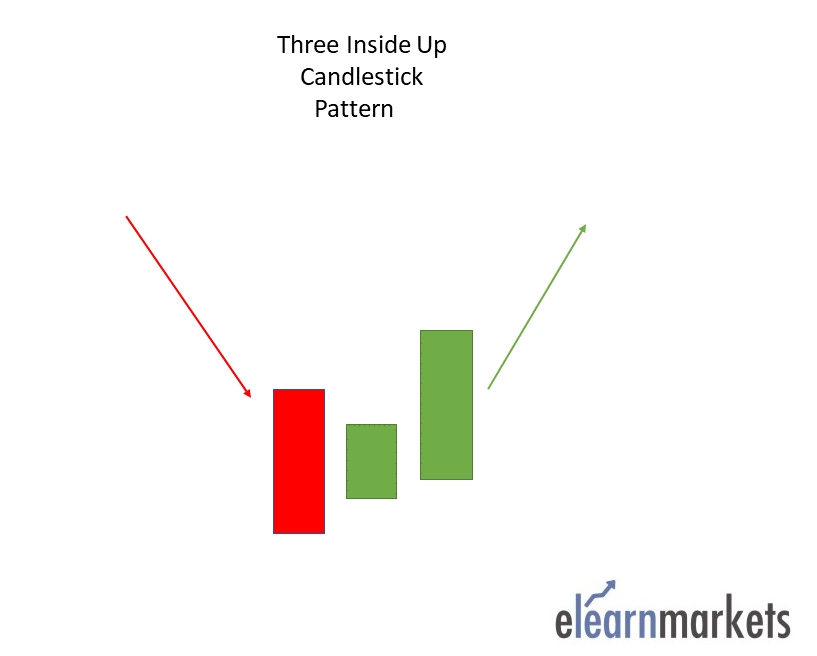

- 7. Three Inside Up:

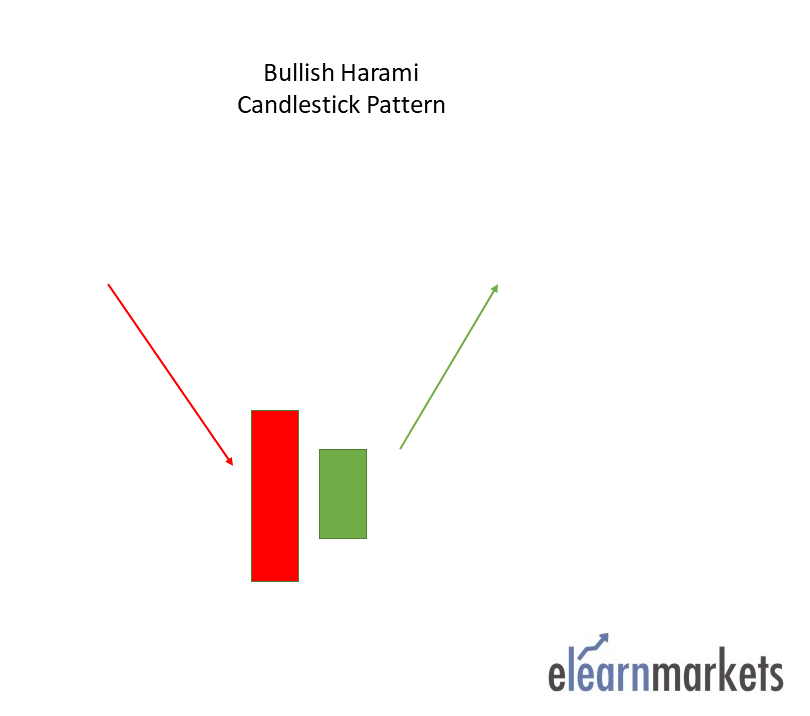

- 8. Bullish Harami:

- 9. Tweezer Bottom:

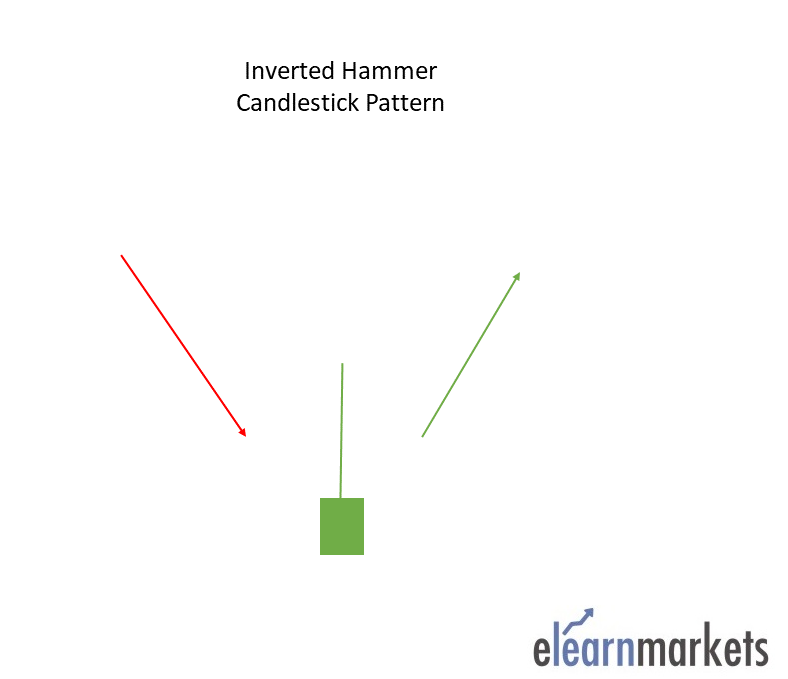

- 10. Inverted Hammer:

- 11. Three Outside Up:

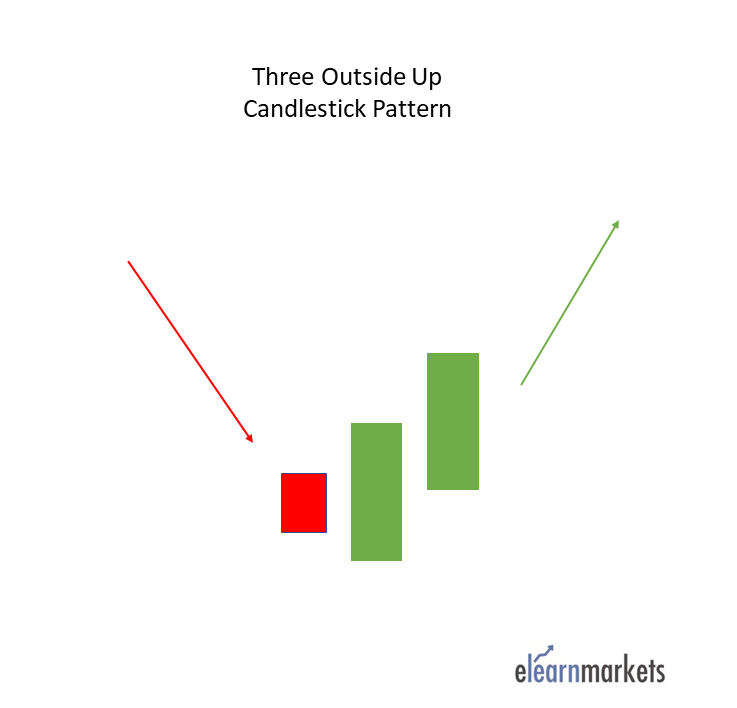

- 12. On-Neck Pattern:

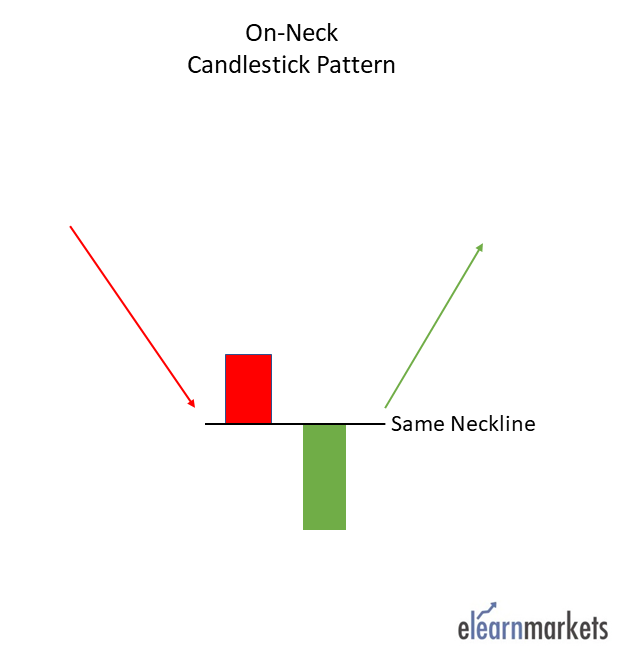

- 13. Bullish Counterattack-

- Bearish Candlestick Pattern:

- 14. Hanging man:

- 15. Dark cloud cover:

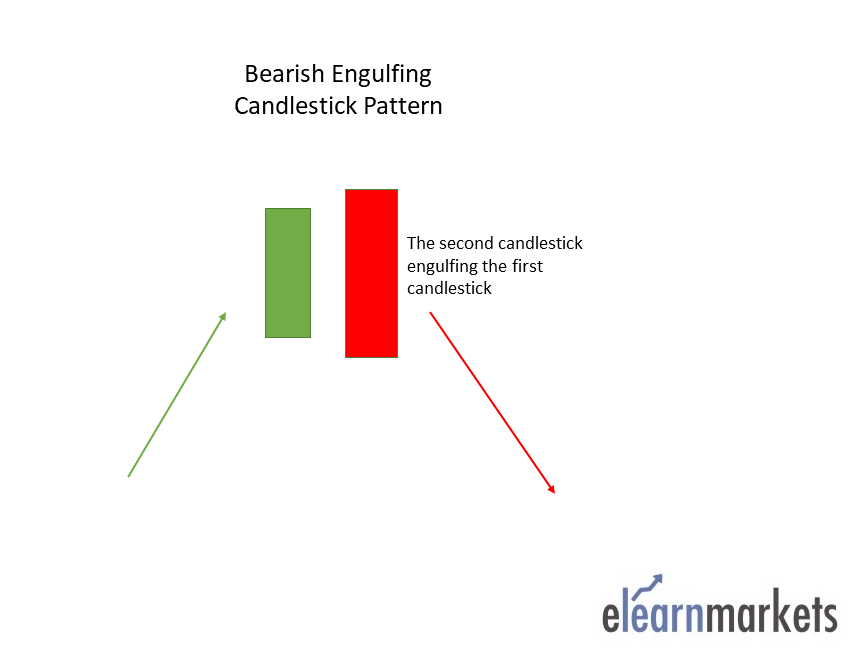

- 16. Bearish Engulfing:

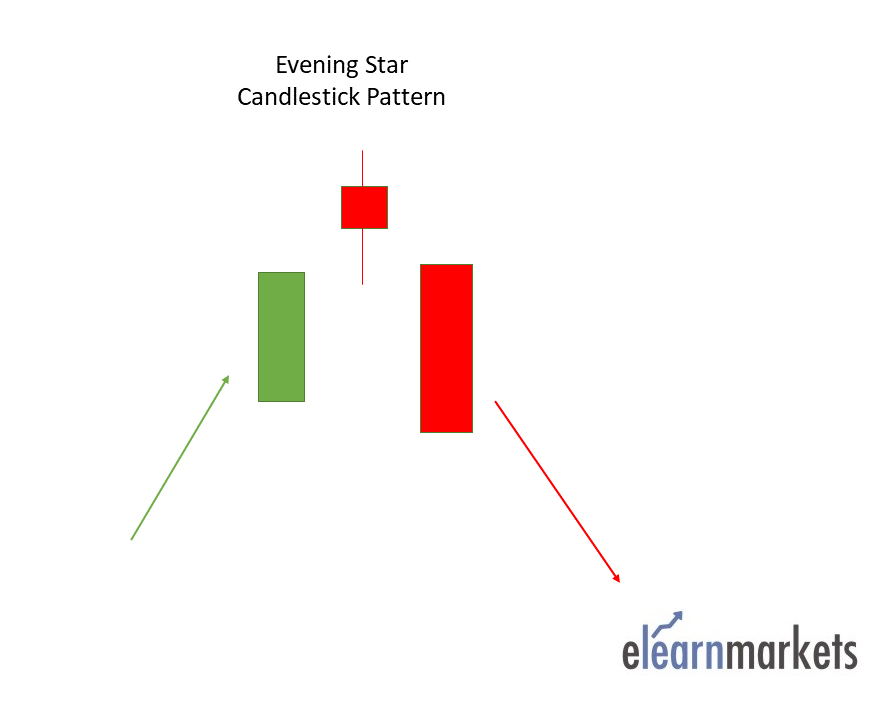

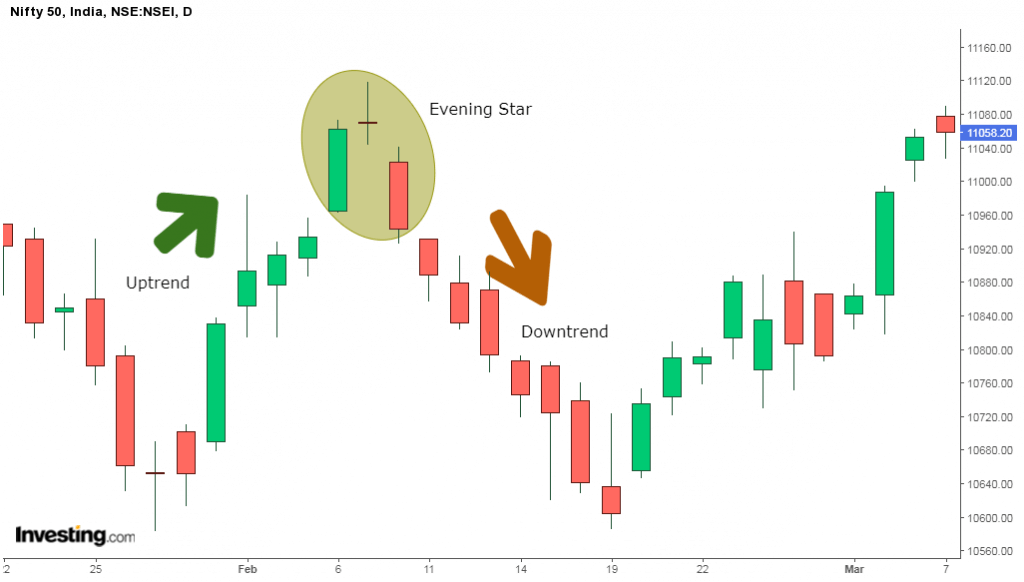

- 17. The Evening Star:

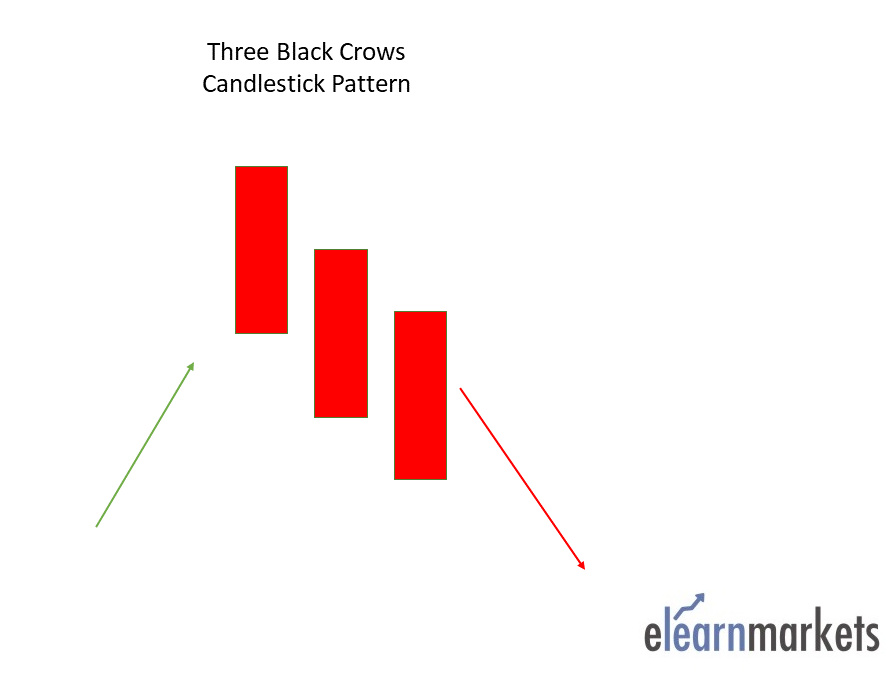

- 18. Three Black Crows:

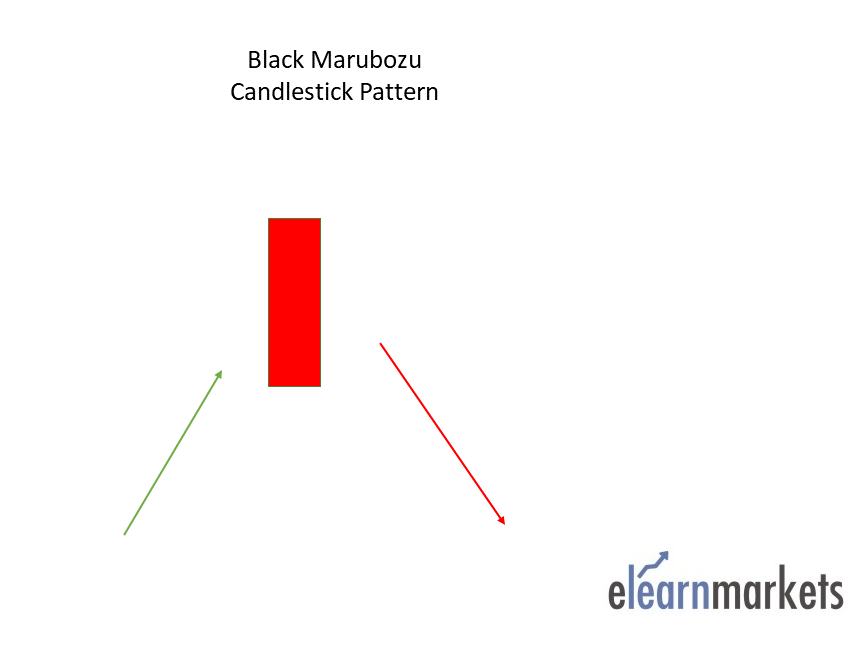

- 19. Black Marubozu:

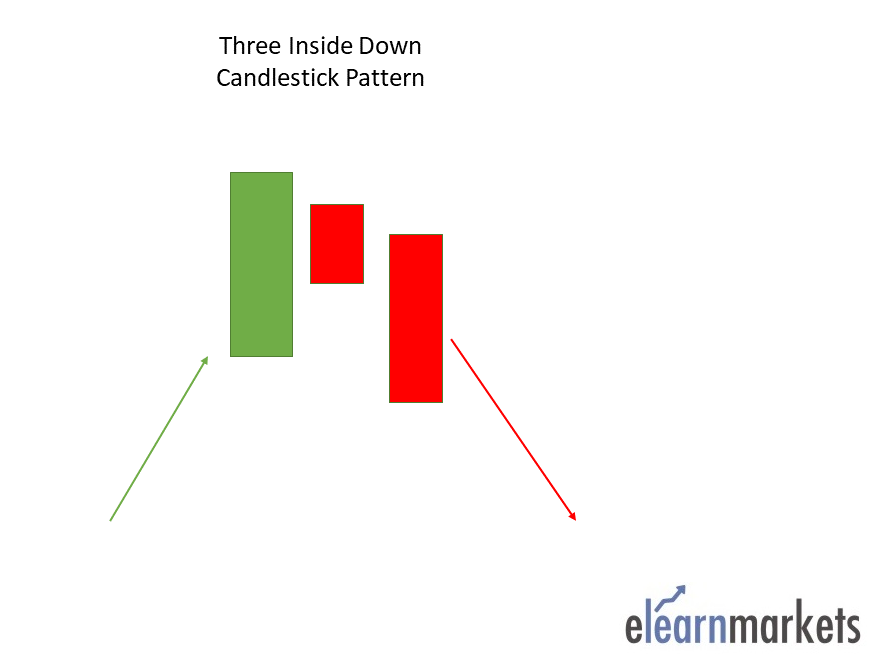

- 20. Three Inside Down:

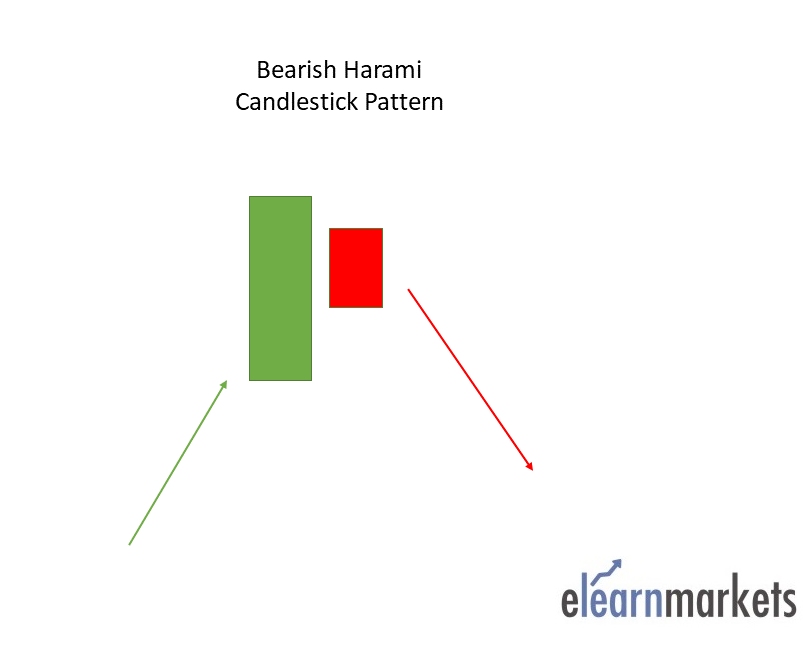

- 21. Bearish Harami:

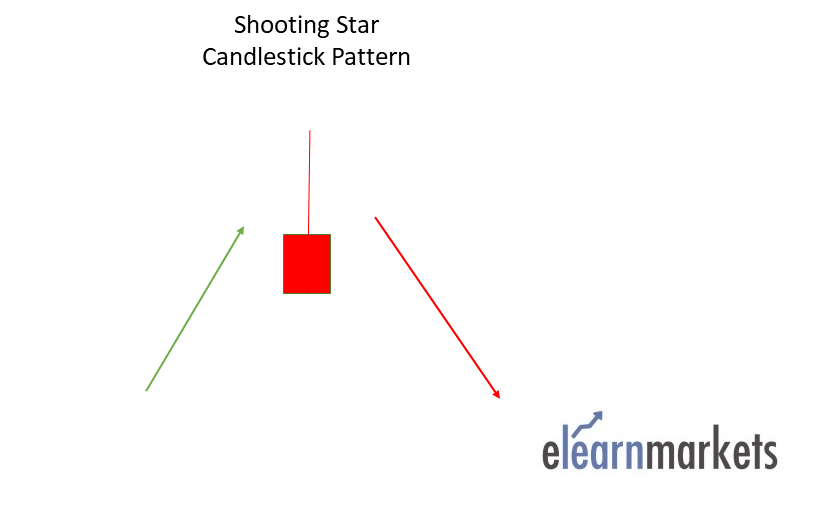

- 22. Shooting Star:

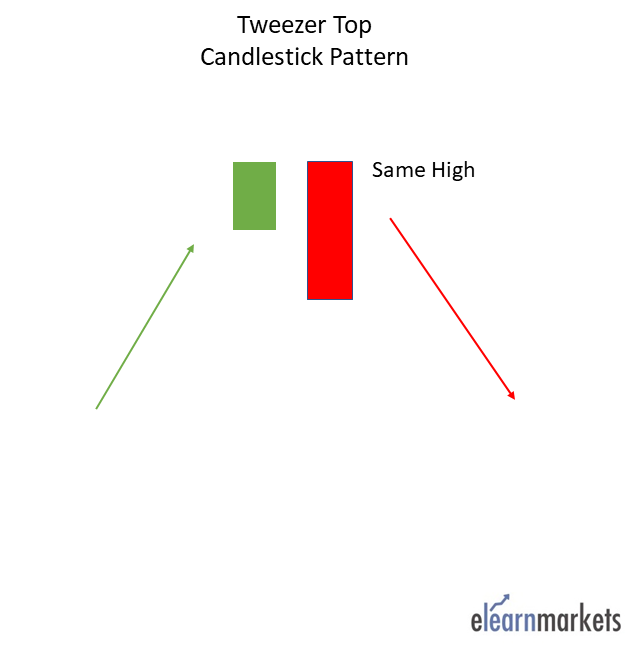

- 23. Tweezer Top:

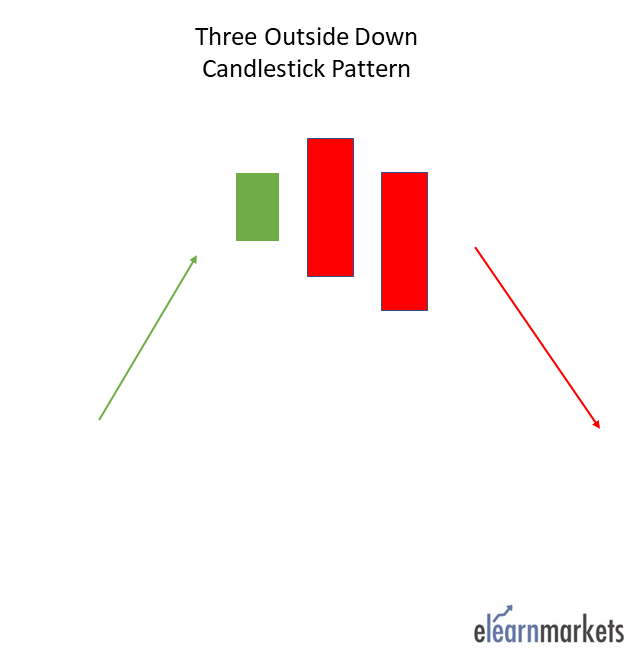

- 24. Three Outside Down:

- 25. Bearish Counterattack-

- Continuation Candlestick Patterns:

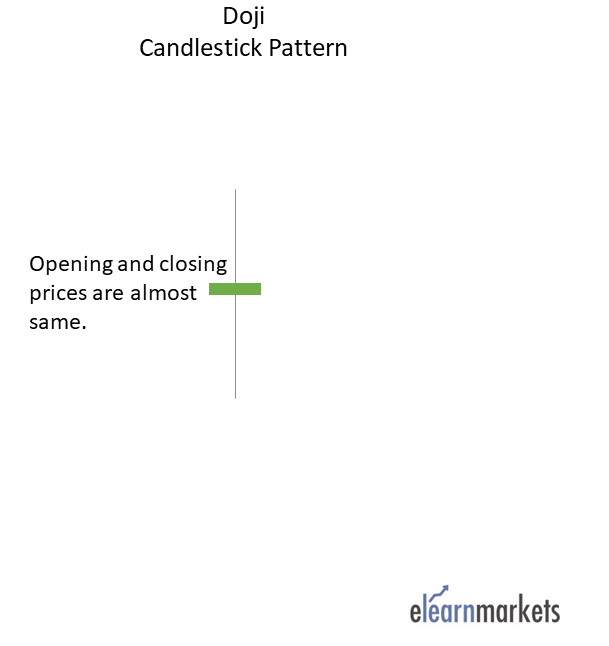

- 26. Doji:

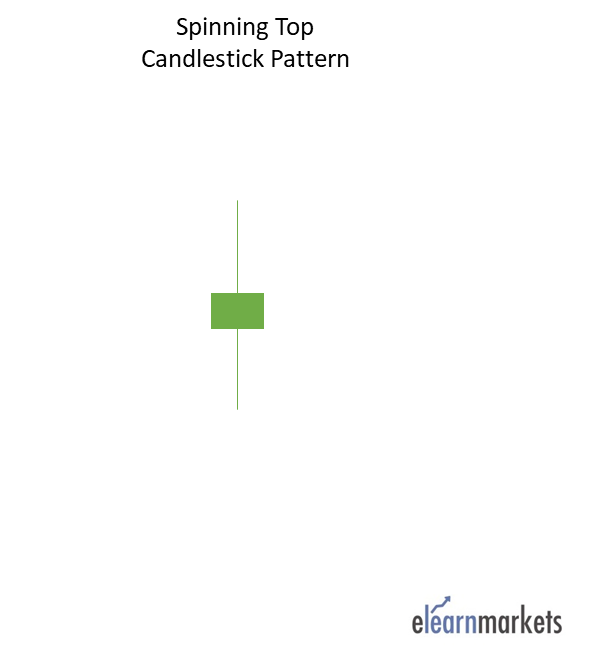

- 27. Spinning Top:

- 28. Falling Three Methods:

- 29. Rising Three Methods:

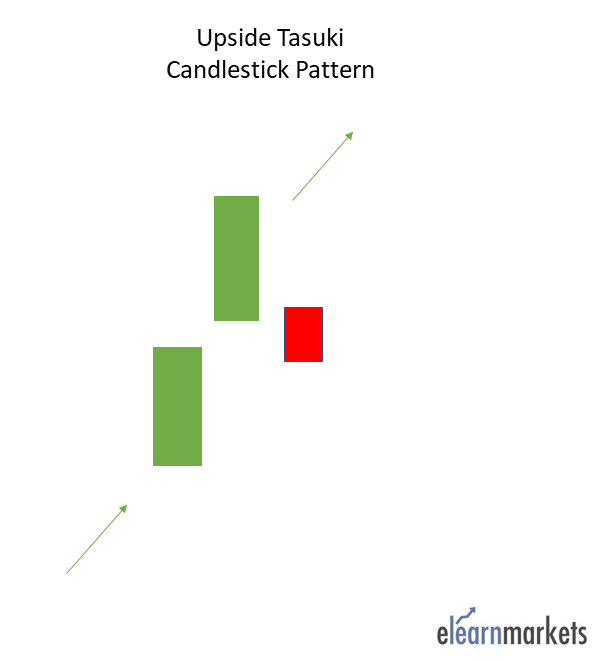

- 30. Upside Tasuki Gap:

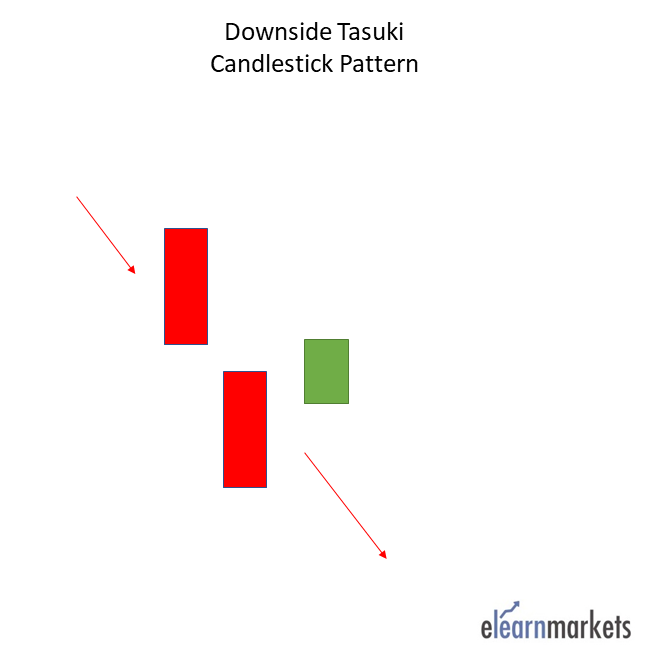

- 31. Downside Tasuki Gap:

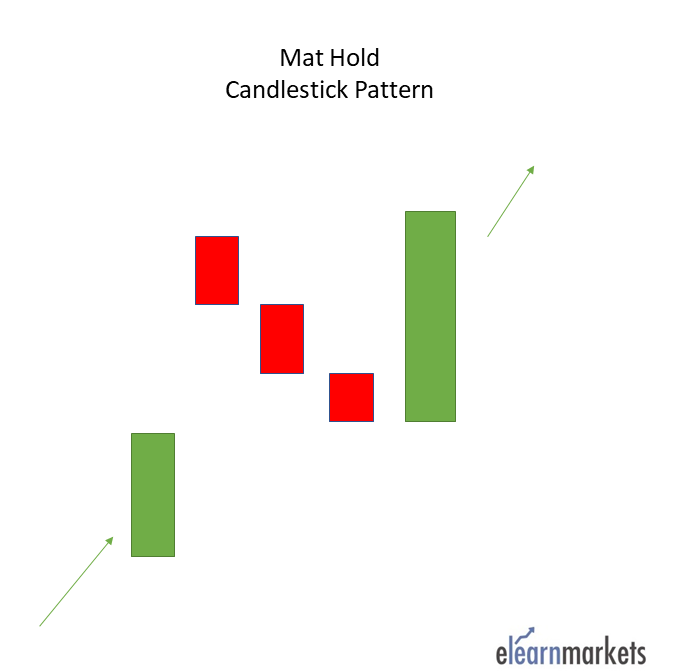

- 32. Mat-Hold-

- 33. Rising Window-

- 34. Falling Window-

- 35. High Wave-

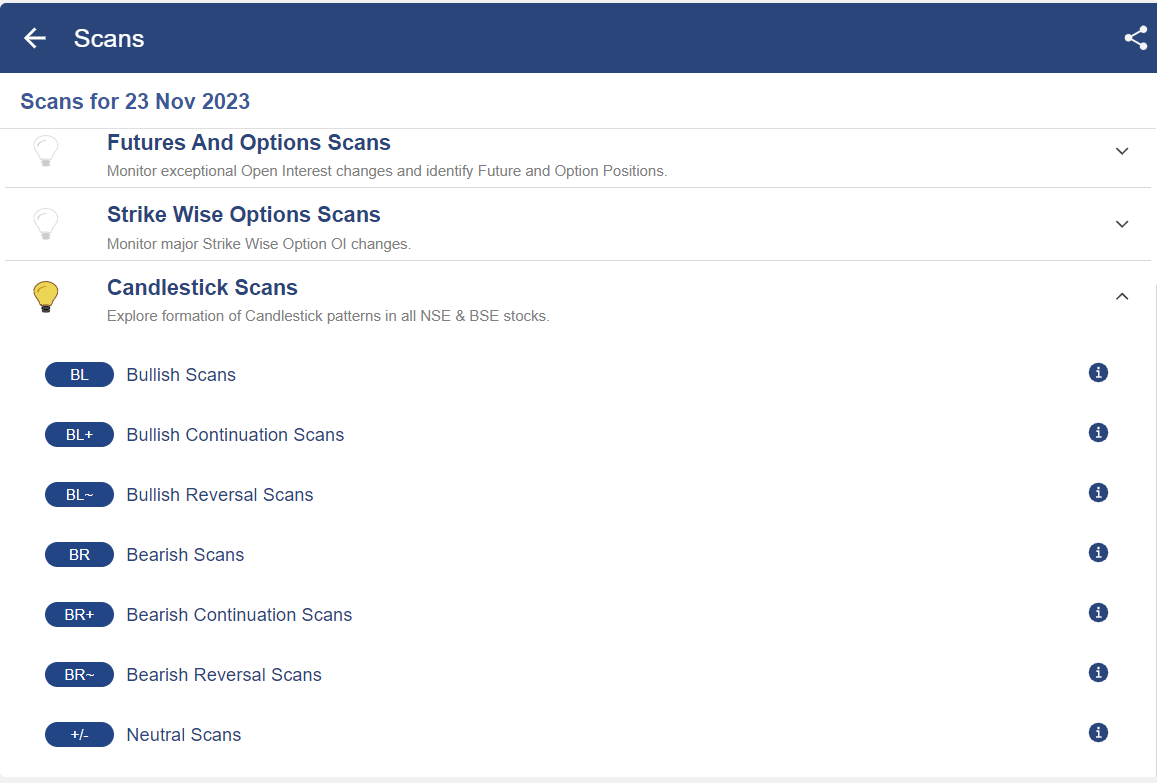

- Filter Stocks with Specific Candlestick Chart Patterns using StockEdge:

- Short Online Courses on Candlestick Patterns:

- Short Online Webinars on Candlestick Patterns:

- Bottomline:

- Frequently Asked Questions (FAQs)

How to Read Candlestick Charts?

Candlestick charts originated in Japan over 100 years before the West had developed bar charts and point-and-figure charts. In the 1700s, a Japanese man known as Homma discovered that as there was a link between price and the supply and demand of rice, the markets were also strongly influenced by the emotions of traders.

A daily candlestick chart shows the security’s open, high, low, and close prices for the day. The candlestick’s wide or rectangle part is called the “real body” which shows the link between opening and closing prices.

This real body shows the price range between the open and close of that day’s trading.

When the real body is filled, black or red, then it means that the close is lower than the open and is known as the bearish candle. It shows that the prices opened, the bears pushed the prices down and closed lower than the opening price.

If the real body is empty, white or green, then it means that the close was higher than the open, known as the bullish candle. It shows that the prices opened, the bulls pushed the prices up and closed higher than the opening price.

The thin vertical lines above and below the real body are known as the wicks or shadows, which represent the high and low prices of the trading session.

The upper shadow shows the high price, and lower shadow shows the low prices reached during the trading session.

Before we jump into learning about different candlestick charts, there are a few assumptions that need to be kept in mind that are specific to the candlestick charts.

- Strength is represented by a bullish or green candle, and weakness by a bearish or red candle. One should ensure that whenever they are buying, it is a green candle day, and whenever they are selling, ensure that it’s a red candle day.

- The textbook definition of a pattern states certain criteria, but one should state that there could be minor variations to the pattern depending on certain market conditions.

- One should look for a prior trend. If you are looking at a bullish reversal pattern, then the prior trend should be bearish, and if you are looking for a bearish reversal pattern, then the prior trend should be bullish.

35 Types of Candlestick Patterns:

The candlestick patterns can be divided into:

Below is the list of 35 Types of Candles in the stock market which is categorised in the above categories:

| Candlestick Pattern | Signal | Description |

|---|---|---|

| 1. Hammer | Bullish Reversal | Small body at the top with a long lower wick, indicating potential reversal. |

| 2. Piercing Pattern | Bullish Reversal | Bullish candle closes above the midpoint of the previous bearish candle. |

| 3.Bullish Engulfing | Bullish Reversal | Bullish candle completely engulfs the previous bearish candle. |

| 4.Morning Star | Bullish Reversal | Three-candle pattern indicating a potential bullish reversal. |

| 5.Three White Soldiers | Bullish Reversal | Three consecutive long bullish candles, suggesting strong buying pressure. |

| 6.White Marubozu | Bullish Continuation | Long bullish candle with no shadows, indicating strong buying interest. |

| 7.Three Inside Up | Bullish Reversal | Bullish candle follows a bearish candle, closing above the first candle’s open. |

| 8.Bullish Harami | Bullish Reversal | Small bullish candle within the range of the previous bearish candle. |

| 9.Tweezer Bottom | Bullish Reversal | Two candles with matching lows, suggesting a potential reversal. |

| 10.Inverted Hammer | Bullish Reversal | Small body with a long upper wick, appearing after a downtrend. |

| 11.Three Outside Up | Bullish Reversal | Bullish candle engulfs previous bearish candle, followed by another bullish candle. |

| 12.On-Neck Pattern | Bullish Continuation | Bearish candle followed by a bullish candle closing near the previous close. |

| 13.Bullish Counterattack | Bullish Reversal | Bearish candle followed by a bullish candle closing at the same level. |

| 14.Hanging Man | Bearish Reversal | Small body at the top with a long lower wick, indicating potential reversal. |

| 15.Dark Cloud Cover | Bearish Reversal | Bearish candle opens above the previous close and closes below the midpoint. |

| 16.Bearish Engulfing | Bearish Reversal | Bearish candle completely engulfs the previous bullish candle. |

| 17.Evening Star | Bearish Reversal | Three-candle pattern indicating a potential bearish reversal. |

| 18.Three Black Crows | Bearish Reversal | Three consecutive long bearish candles, suggesting strong selling pressure. |

| 19.Black Marubozu | Bearish Continuation | Long bearish candle with no shadows, indicating strong selling interest. |

| 20.Three Inside Down | Bearish Reversal | Bearish candle follows a bullish candle, closing below the first candle’s open. |

| 21.Bearish Harami | Bearish Reversal | Small bearish candle within the range of the previous bullish candle. |

| 22.Shooting Star | Bearish Reversal | Small body with a long upper wick, appearing after an uptrend. |

| 23.Tweezer Top | Bearish Reversal | Two candles with matching highs, suggesting a potential reversal. |

| 24.Three Outside Down | Bearish Reversal | Bearish candle engulfs previous bullish candle, followed by another bearish candle. |

| 25.Bearish Counterattack | Bearish Reversal | Bullish candle followed by a bearish candle closing at the same level. |

| 26.Doji | Neutral | Candle with open and close at the same level, indicating indecision. |

| 27.Spinning Top | Neutral | Small body with long upper and lower wicks, indicating indecision. |

| 28.Falling Three Methods | Bearish Continuation | Long bearish candle followed by small bullish candles, then another bearish candle. |

| 29.Rising Three Methods | Bullish Continuation | Long bullish candle followed by small bearish candles, then another bullish candle. |

| 30.Upside Tasuki Gap | Bullish Continuation | Bullish candle followed by a gap up and a bearish candle that doesn’t fill the gap. |

| 31.Downside Tasuki Gap | Bearish Continuation | Bearish candle followed by a gap down and a bullish candle that doesn’t fill the gap. |

| 32.Mat-Hold | Bullish Continuation | Bullish candle followed by small bearish candles, then another bullish candle. |

| 33.Rising Window | Bullish Continuation | Gap between two bullish candles, indicating strong buying pressure. |

| 34.Falling Window | Bearish Continuation | Gap between two bearish candles, indicating strong selling pressure. |

| 35.High Wave | Neutral | Candle with long upper and lower wicks and a small body, indicating volatility. |

Bullish Reversal Candlestick Patterns:

Bullish Reversal candlestick patterns indicate that the ongoing downtrend is going to reverse to an uptrend.

Thus, traders should be cautious about their short positions when the bullish reversal candlestick chart patterns are formed.

Below are the different types of bullish reversal candlestick patterns:

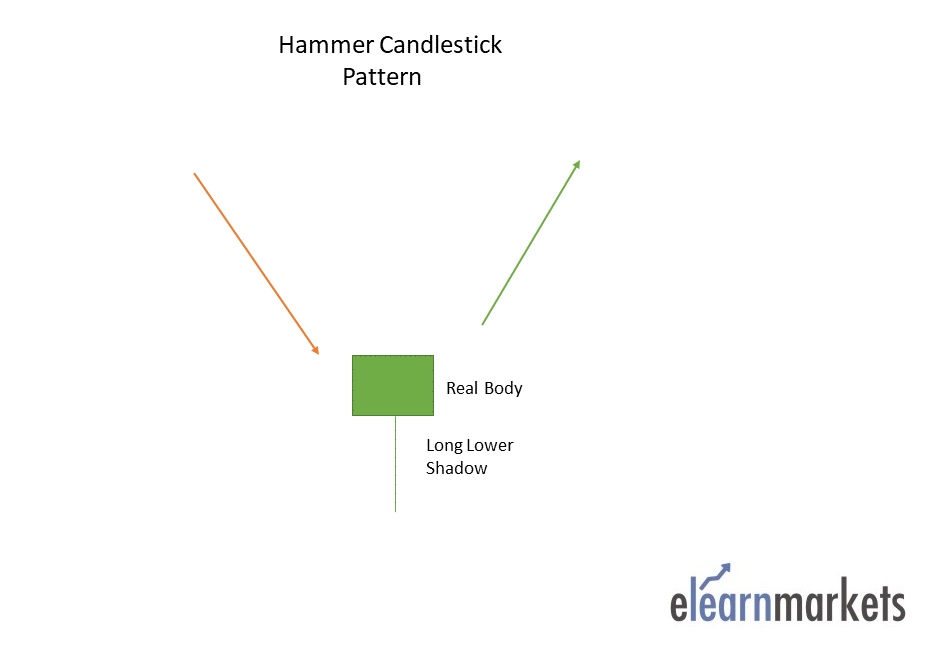

1. Hammer:

Hammer is a single candlestick pattern that is formed at the end of a downtrend and signals a bullish reversal.

The real body of this candle is small and is located at the top with a lower shadow which should be more than twice the real body. This candlestick chart pattern has no or little upper shadow.

The psychology behind this candle formation is that the prices opened, and sellers pushed down the prices.

Suddenly the buyers came into the market and pushed the prices up and closed the trading session more than the opening price.

This resulted in the formation of bullish pattern and signifies that buyers are back in the market and downtrend may end.

Traders can enter a long position if next day a bullish candle is formed and can place a stop-loss at the low of Hammer.

Below is an example of Hammer candlestick pattern:

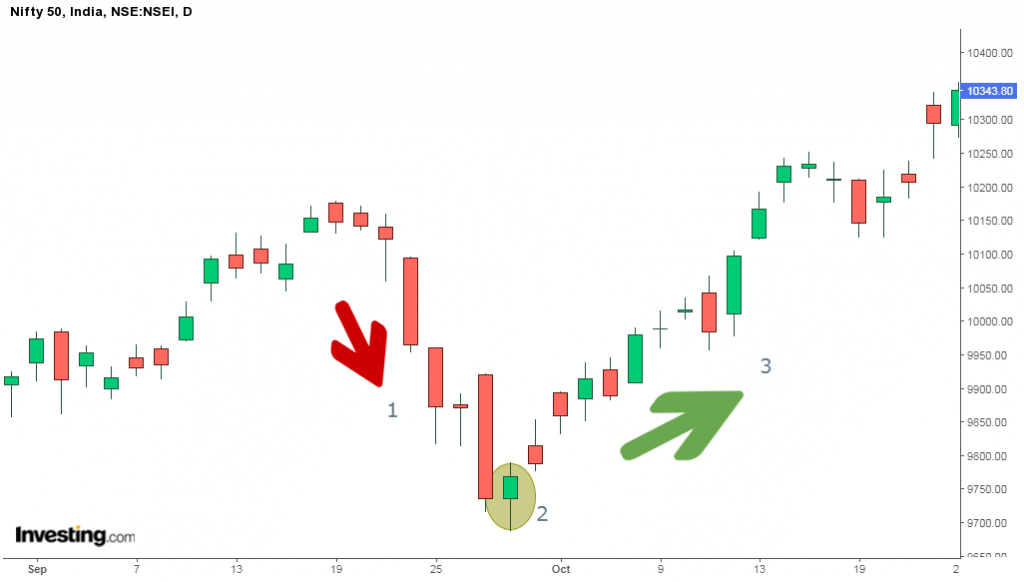

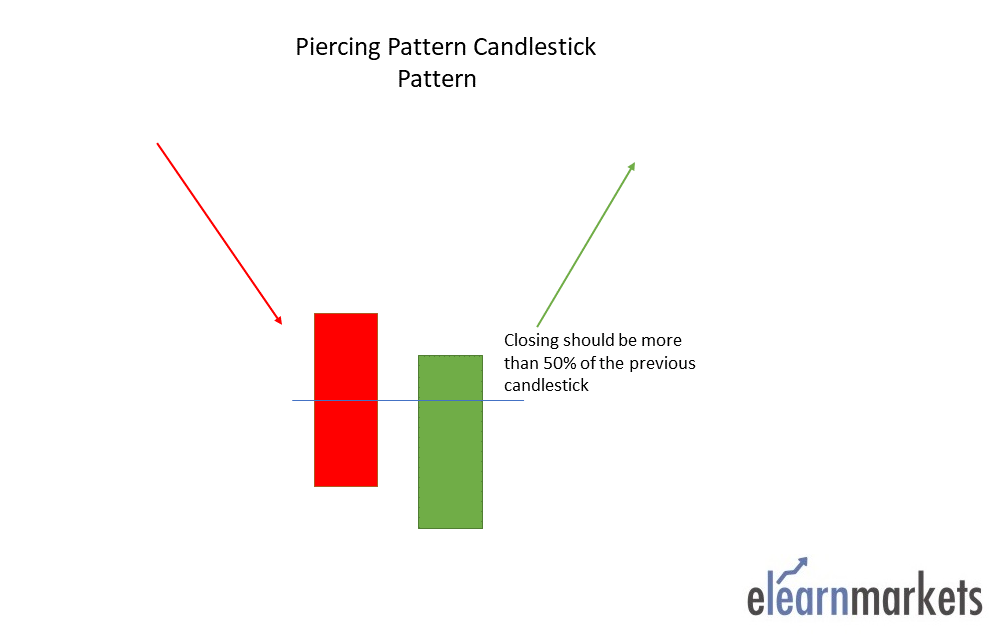

2. Piercing Pattern:

Piercing pattern is a multiple candlestick chart pattern formed after a downtrend indicating a bullish reversal.

Two candles form it, the first candle being a bearish candle which indicates the continuation of the downtrend.

The second candle is a bullish candle which opens the gap down but closes more than 50% of the real body of the previous candle, which shows that the bulls are back in the market and a bullish reversal is going to take place.

Traders can enter a long position if the next day a bullish candle is formed and can place a stop-loss at the low of the second candle.

Below is an example of a Piercing Candlestick Pattern:

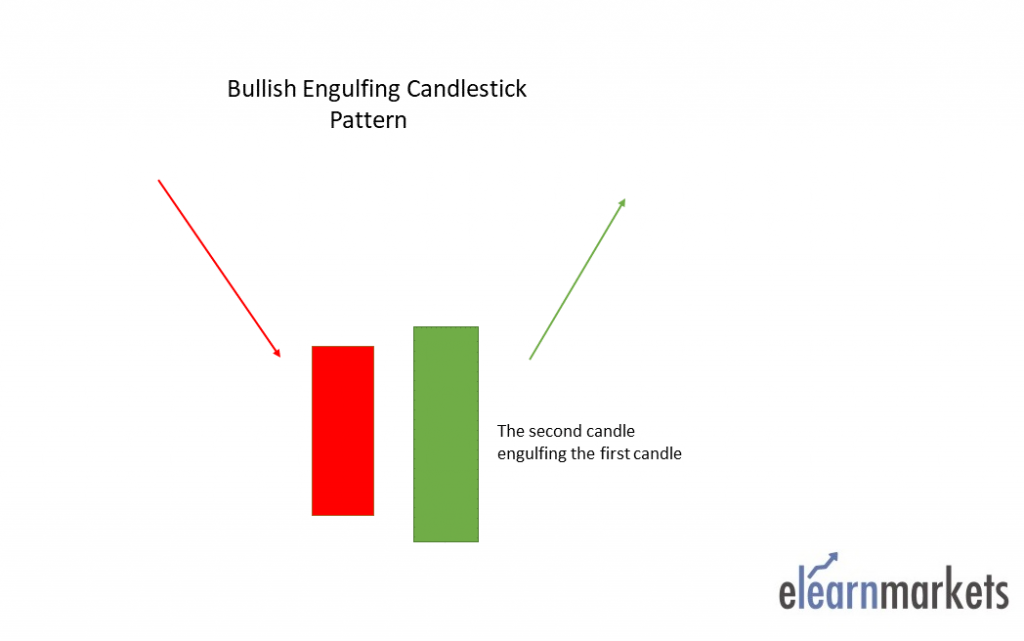

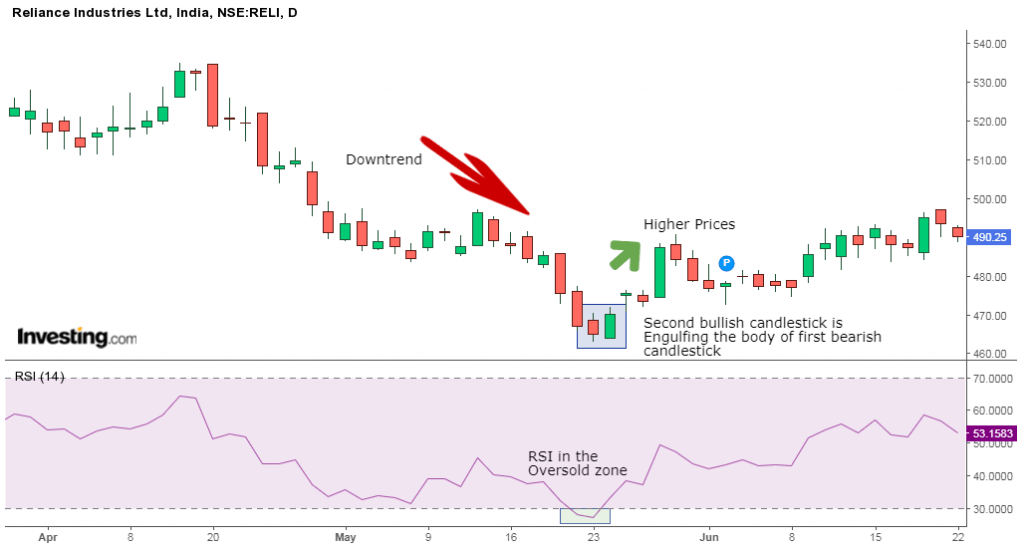

3. Bullish Engulfing:

Bullish Engulfing is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal.

It is formed by two candles, the second candlestick engulfing the first candlestick. The first candle is a bearish candle that indicates the continuation of the downtrend.

The second candlestick is a long bullish candle that completely engulfs the first candle and shows that the bulls are back in the market.

Traders can enter a long position if next day, a bullish candle is formed and can place a stop-loss at the low of the second candle.

Below is an example of a Bullish Engulfing Candlestick Pattern:

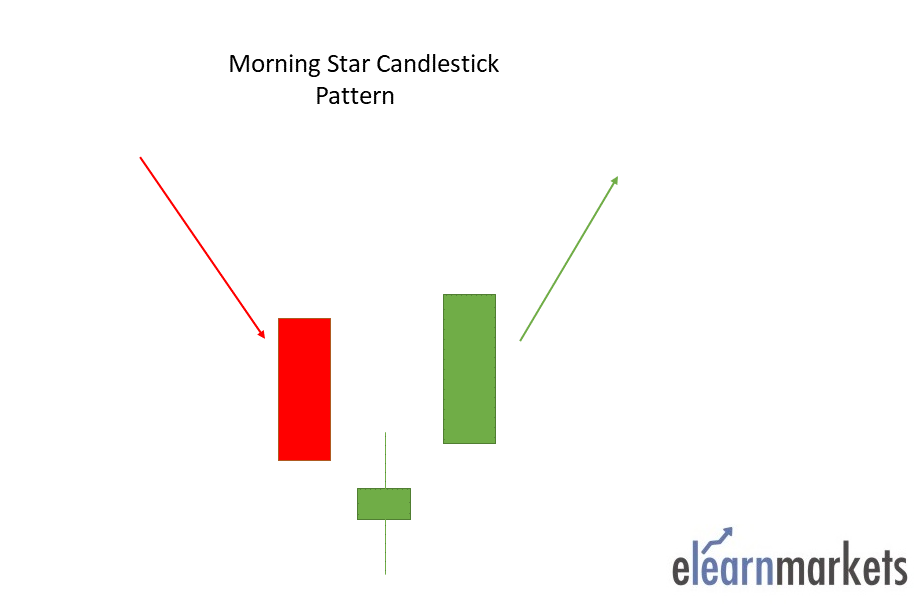

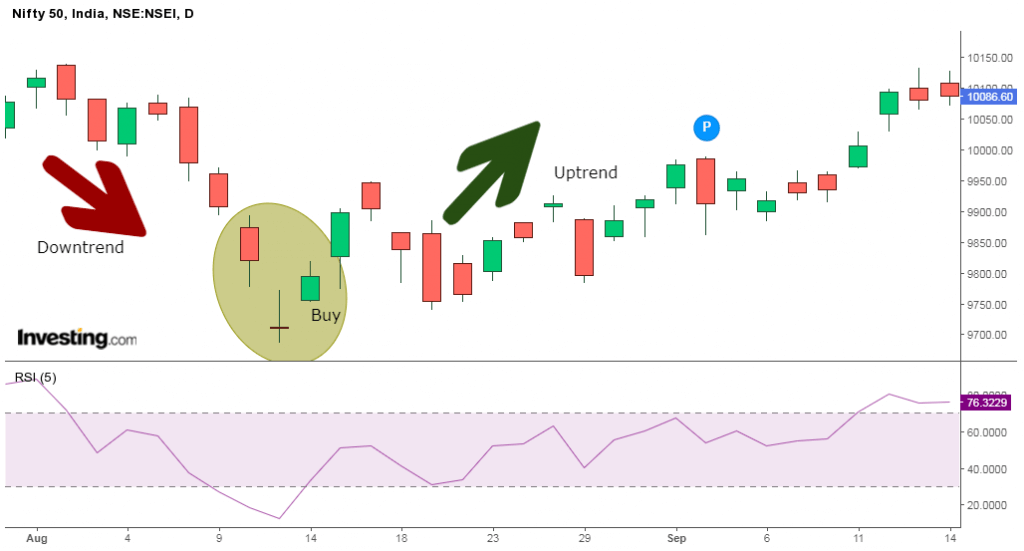

4. The Morning Star:

The Morning Star is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal.

It is made of 3 candlesticks, the first being a bearish candle, the second a Doji and the third being a bullish candle.

The first candle shows the continuation of the downtrend. The second candle being a doji indicates indecision in the market. The third bullish candle shows that the bulls are back in the market and reversal will take place.

The second candle should be completely out of the real bodies of the first and third candles.

Traders can enter a long position if the next day a bullish candle is formed and can place a stop-loss at the low of the second candle.

Below is an example of Morning Star Candlestick Charts Pattern:

5. Three White Soldiers:

The Three White Soldiers is a multiple candlestick pattern that is formed after a downtrend indicating a bullish reversal.

These candlestick charts are made of three long bullish bodies which do not have long shadows and are open within the real body of the previous candle in the pattern.

6. White Marubozu:

The White Marubozu is a single candlestick pattern that is formed after a downtrend indicating a bullish reversal.

This candlestick has a long bullish body with no upper or lower shadows, which shows that the bulls are exerting buying pressure, and the markets may turn bullish.

At the formation of this candle, the sellers should be cautious and close their shorting position.

7. Three Inside Up:

The Three Inside Up is a multiple candlestick pattern formed after a downtrend indicating bullish reversal.

It consists of three candlesticks, the first being a long bearish candle, the second candlestick being a small bullish candle which should be in the range the first candlestick.

The third candlestick should be a long bullish candlestick confirming the bullish reversal.

The relationship of the first and second candlestick should be of the bullish harami candlestick pattern.

Traders can take a long position after the completion of this candlestick pattern.

8. Bullish Harami:

The Bullish Harami is multiple candlestick chart pattern which is formed after a downtrend indicating bullish reversal.

It consists of two candlestick charts, the first candlestick being a tall bearish candle and second being a small bullish candle which should be in the range of the first candlestick.

The first bearish candle shows the continuation of the bearish trend and the second candle shows that the bulls are back in the market.

Traders can take a long position after the completion of this candlestick pattern.

9. Tweezer Bottom:

The Tweezer Bottom candlestick pattern is a bullish reversal candlestick pattern that is formed at the end of the downtrend.

It consists of two candlesticks, the first one being bearish and the second one being bullish candlestick.

Both the candlesticks make almost or the same low.When the Tweezer Bottom candlestick pattern is formed the prior trend is a downtrend.

A bearish tweezer candlestick is formed, which looks like the continuation of the ongoing downtrend. On the next day, the second day’s bullish candle’s low indicates a support level.

The bottom-most candles with almost the same low indicate the strength of the support and also signal that the downtrend may get reversed to form an uptrend. Due to this, the bulls step into action and move the price upwards.

This bullish reversal is confirmed the next day when the bullish candle is formed.

10. Inverted Hammer:

An Inverted Hammer is formed at the end of the downtrend and gives a bullish reversal signal.

In this candlestick, the real body is located at the end, and there is a long upper shadow. It is the inverse of the Hammer Candlestick pattern.

This pattern is formed when the opening and closing prices are near to each other, and the upper shadow should be more than twice the real body.

11. Three Outside Up:

The Three Outside Up is multiple candlestick pattern which is formed after a downtrend indicating bullish reversal.

It consists of three candlesticks, the first being a short bearish candle, the second candlestick being a large bullish candle which should cover the first candlestick.

The third candlestick should be a long bullish candlestick confirming the bullish reversal.

The relationship of the first and second candlestick chart should be of the Bullish Engulfing candlestick pattern.

Traders can take a long position after the completion of this candlestick pattern.

12. On-Neck Pattern:

The on neck pattern occurs after a downtrend when a long real bodied bearish candle is followed by a smaller real bodied bullish candle which gaps down on the open but then closes near the prior candle’s close.

The pattern is called a neckline because the two closing prices are the same or almost the same across the two candles, forming a horizontal neckline.

13. Bullish Counterattack-

The bullish counterattack pattern is a bullish reversal pattern that predicts the upcoming reversal of the current downtrend in the market. This candlestick pattern is a two-bar pattern that appears during a downtrend in the market. A pattern needs to meet the following conditions to be a bullish counterattack pattern.

- There must be a strong downtrend in the market for the formation of the bullish counterattack pattern.

- The first candle must be a long black candle with a real body.

- The second candle must also be a long (ideally, equal in size to the first candle) but a white candle with a real body. The second candle must close near the close of the first candle.

Bearish Candlestick Pattern:

Bearish Reversal candlestick patterns indicate that the ongoing uptrend is going to reverse to a downtrend.

Thus, the traders should be cautious about their long positions when the bearish reversal candlestick patterns are formed.

Below are the different types of bearish reversal candlestick chart patterns:

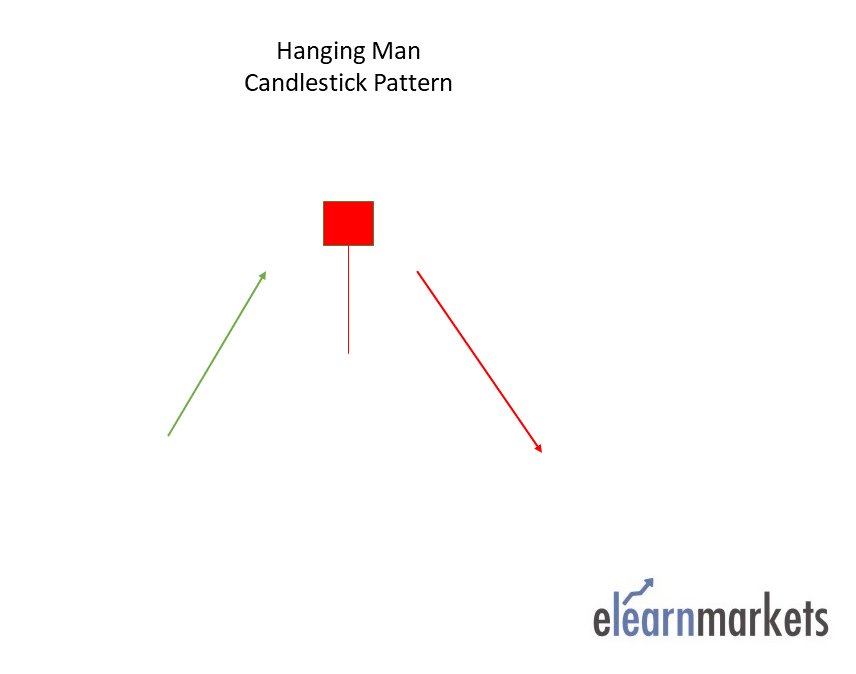

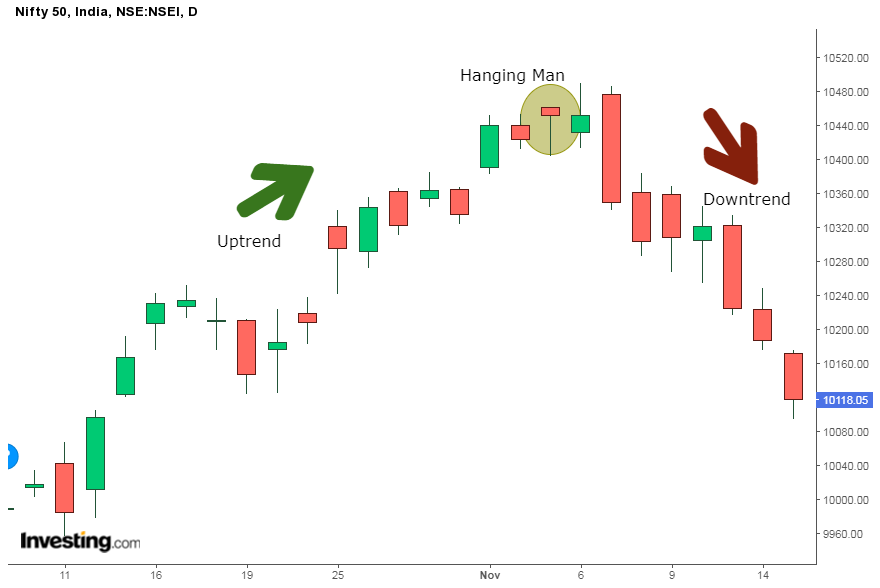

14. Hanging man:

Hanging Man is a single candlestick pattern that is formed at the end of an uptrend and signals a bearish reversal.

The real body of this candle is small and is located at the top with a lower shadow which should be more than twice the real body. This candlestick pattern has no or little upper shadow.

The psychology behind this candle formation is that the prices opened, and the seller pushed down the prices.

Suddenly the buyers came into the market and pushed the prices up but were unsuccessful in doing so, as the prices closed below the opening price.

This resulted in the formation of bearish pattern and signifies that seller are back in the market and uptrend may end.

Traders can enter a short position if next day a bearish candle is formed and can place a stop-loss at the high of Hanging Man.

Below is an example of Hanging Man Candlestick Pattern:

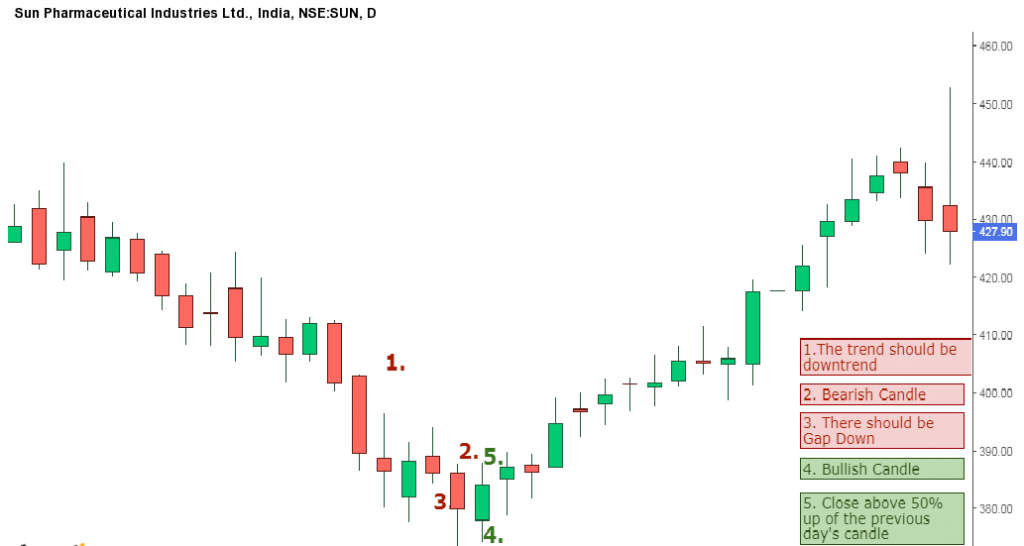

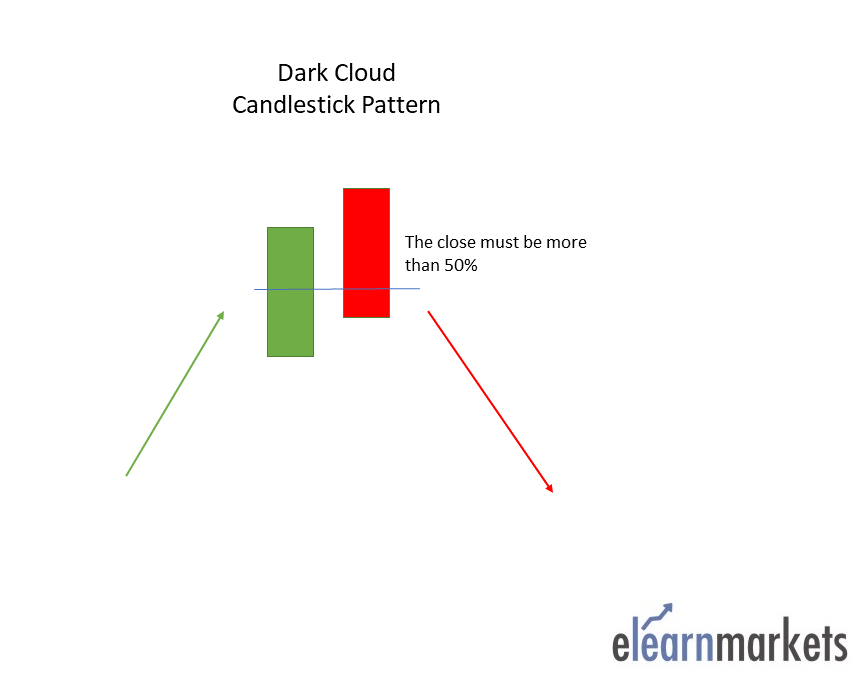

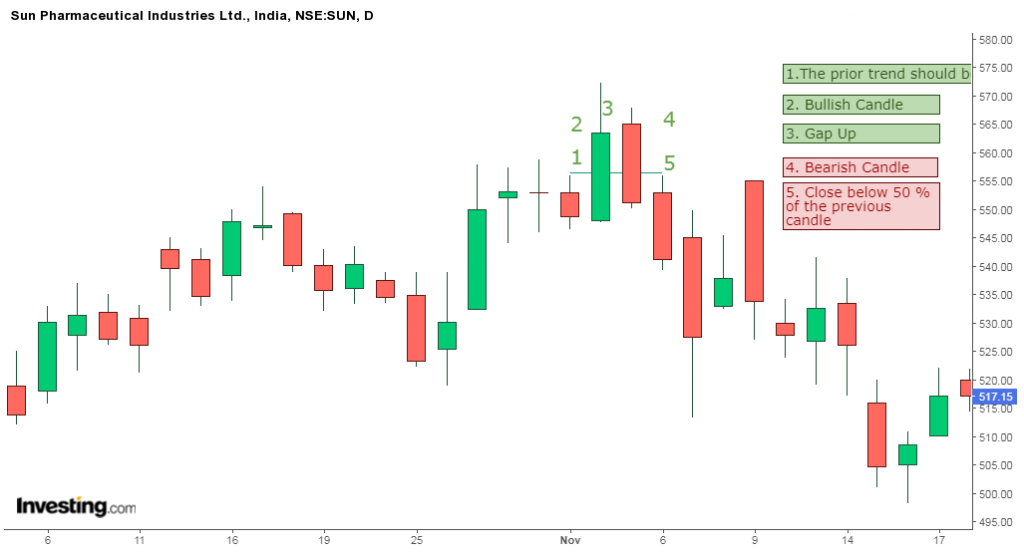

15. Dark cloud cover:

Dark Cloud Cover is a multiple candlestick pattern formed after the uptrend indicating a bearish reversal.

It is formed by two candles, the first candle being a bullish candle which indicates the continuation of the uptrend.

The second candle is a bearish candle which opens the gap up but closes more than 50% of the real body of the previous candle, which shows that the bears are back in the market and a bearish reversal is going to take place.

Traders can enter a short position if the next day a bearish candle is formed and can place a stop-loss at the high of the second candle.

Below is an example of a Dark Cloud candlestick pattern:;

16. Bearish Engulfing:

Bearish Engulfing is a multiple candlestick pattern that is formed after an uptrend indicating a bearish reversal.

It is formed by two candles, the second candlestick engulfing the first candlestick. The first candle being a bullish candle indicates the continuation of the uptrend.

The second candlestick chart is a long bearish candle that completely engulfs the first candle and shows that the bears are back in the market.

Traders can enter a short position if next day a bearish candle is formed and can place a stop-loss at the high of the second candle.

17. The Evening Star:

The Evening Star is a multiple candlestick pattern that is formed after the uptrend indicating a bearish reversal.

It is made of 3 candlesticks, the first being a bullish candle, the second a doji, and the third being a bearish candle.

The first candle shows the continuation of the uptrend, the second candle being a doji indicates indecision in the market, and the third bearish candle shows that the bears are back in the market and reversal is going to take place.

The second candle should be completely out of the real bodies of the first and third candles.

Traders can enter a long position if next day a bearish candle is formed and can place a stop-loss at the high of the second candle.

Below is an example of the Evening Star Candlestick Pattern:

18. Three Black Crows:

The Three Black Crows is a multiple candlestick pattern that is formed after an uptrend indicating a bearish reversal.

These candlesticks are made of three long bearish bodies that do not have long shadows and open within the real body of the previous candle in the pattern.

19. Black Marubozu:

The Black Marubozu is a single candlestick pattern which is formed after an uptrend indicating bearish reversal.

This candlestick chart has a long bearish body with no upper or lower shadows which shows that the bears are exerting selling pressure and the markets may turn bearish.

At the formation of this candle, the buyers should be caution and close their buying position.

20. Three Inside Down:

The Three Inside Down is a multiple candlestick pattern that is formed after an uptrend indicating a bearish reversal.

It consists of three candlesticks, the first being a long bullish candle, the second candlestick being a small bearish, which should be in the range of the first candlestick.

The third candlestick chart should be a long bearish candlestick confirming the bearish reversal.

The relationship of the first and second candlestick should be of the bearish Harami candlestick pattern.

Traders can take a short position after the completion of this candlestick pattern.

21. Bearish Harami:

The Bearish Harami is a multiple candlestick pattern formed after the uptrend indicating bearish reversal.

It consists of two candlesticks, the first candlestick being a tall bullish candle and second being a small bearish candle which should be in the range of the first candlestick chart.

The first bullish candle shows the continuation of the bullish trend and the second candle shows that the bears are back in the market.

Traders can take a short position after the completion of this candlestick pattern.

22. Shooting Star:

Shooting Star is formed at the end of the uptrend and gives a bearish reversal signal.

In this candlestick chart, the real body is located at the end, and there is a long upper shadow. It is the inverse of the Hanging Man Candlestick pattern.

This pattern is formed when the opening and closing prices are near to each other, and the upper shadow should be more than twice the real body.

23. Tweezer Top:

The Tweezer Top pattern is a bearish reversal candlestick pattern that is formed at the end of an uptrend.

It consists of two candlesticks, the first one being bullish and the second one being bearish candlestick. Both the tweezer candlesticks are almost or the same height.

When the Tweezer Top candlestick pattern is formed, the prior trend is an uptrend. A bullish candlestick is formed, which looks like the continuation of the ongoing uptrend.

On the next day, the high of the second day’s bearish candle’s high indicates a resistance level. Bulls seem to raise the price upward, but now they are not willing to buy at higher prices.

The top-most candles with almost the same high indicate the strength of the resistance and also signal that the uptrend may get reversed to form a downtrend. This bearish reversal is confirmed on the next day when the bearish candle is formed.

24. Three Outside Down:

The Three Outside Down is a multiple candlestick pattern formed after an uptrend indicating bearish reversal.

It consists of three candlesticks, the first being a short bullish candle, the second candlestick being a large bearish candle which should cover the first candlestick.

The third candlestick should be a long bearish candlestick confirming the bearish reversal.

The relationship of the first and second candlestick should be of the Bearish Engulfing candlestick pattern.

Traders can take a short position after the completion of this candlestick pattern.

25. Bearish Counterattack-

The bearish counterattack candlestick pattern is a bearish reversal pattern that appears during an uptrend in the market. It predicts that the current uptrend in the market will make and the new downtrend will take over the market.

Continuation Candlestick Patterns:

26. Doji:

Doji pattern is a price action candlestick pattern of indecision that is formed when the opening and closing prices are almost equal.

It is formed when both the bulls and bears are fighting to control prices but nobody succeeds in gaining full control of the prices.

The candlestick pattern looks like a cross with a very small real body and long shadows.

27. Spinning Top:

The spinning top candlestick pattern is the same as the Doji, indicating indecision in the market.

The only difference between the spinning top and the doji is in their formation, the real body of the spinning is larger as compared to the Doji.

28. Falling Three Methods:

The “falling three methods” is a bearish, five-candle continuation pattern that signals an interruption, but not a reversal, of the ongoing downtrend.

The candlestick pattern is made of two long candlestick charts in the direction of the trend i.e. downtrend at the beginning and end, with three shorter counter-trend candlesticks in the middle.

The candlestick pattern is important as it shows traders that the bulls still do not have enough power to reverse the trend.

29. Rising Three Methods:

The “rising three methods” is a bullish, five-candle continuation pattern that signals an interruption, but not a reversal, of the ongoing uptrend.

The candlestick pattern is made of two long candlesticks in the direction of the trend i.e. uptrend in this case. At the beginning and end, with three shorter counter-trend candlesticks in the middle.

The candlestick pattern is important as it shows traders that the bears still do not have enough power to reverse the trend.

30. Upside Tasuki Gap:

It is a bullish continuation candlestick pattern which is formed in an ongoing uptrend.

This candlestick pattern consists of three candles, the first candlestick is a long-bodied bullish candlestick, and the second candlestick is also a bullish candlestick chart formed after a gap up.

The third candlestick is a bearish candle that closes in the gap formed between these first two bullish candles.

31. Downside Tasuki Gap:

It is a bearish continuation candlestick pattern which is formed in an ongoing downtrend.

This candlestick pattern consists of three candles, the first candlestick is a long-bodied bearish candlestick, and the second candlestick is also a bearish candlestick formed after a gap down.

The third candlestick is a bullish candle that closes in the gap formed between these first two bearish candles.

32. Mat-Hold-

A mat hold pattern is a candlestick formation indicating the continuation of a prior trend.

There can be either bearish or bullish mat hold patterns. A bullish pattern begins with a large bullish candle followed by a gap higher and three smaller candles which move lower.

These candles must stay above the low of the first candle. The fifth candle is a large candle that moves to the upside again. The pattern occurs within an overall uptrend.

33. Rising Window-

The rising window is a candlestick pattern consisting of two bullish candlesticks with a gap between them. The gap is a space between the high and low of two candlesticks that occurs due to high trading volatility. It is a trend continuation candlestick pattern indicating strong strength of buyers in the market.

34. Falling Window-

The falling window is a candlestick pattern that consists of two bearish candlesticks with a gap between them. The gap is a space between the high and low of two candlesticks. it occurs due to high trading volatility. It is a trend continuation candlestick pattern, and it is an indication of the strong strength of sellers in the market.

35. High Wave-

The high wave candlestick pattern is an indecision pattern that shows the market is neither bullish nor bearish. It mostly occurs at support and resistance levels. This is where bears and bulls battle each other in an effort of trying to push the price in a given direction. This type of candlesticks depict the pattern with long lower shadows and long upper wicks. Likewise, they have small bodies. The long wicks signal there was a large amount of price movement during the given period. However, the price ultimately ended up closing near the opening price.

You can also download our Ebook on Technical Analysis which has all candlestick patterns in pdf format.

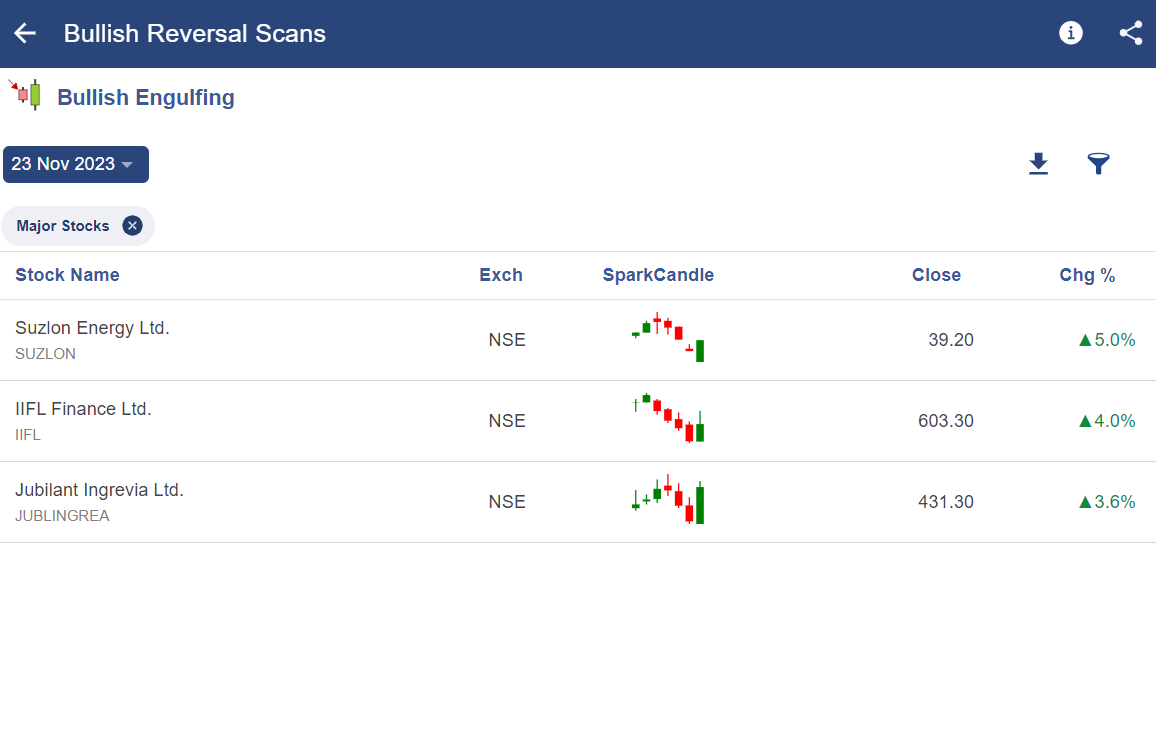

Filter Stocks with Specific Candlestick Chart Patterns using StockEdge:

You can filter out stocks using various candlestick scans available in StockEdge:

For example, below, we can see a list of stocks in which the Bullish Engulfing pattern was formed:

Short Online Courses on Candlestick Patterns:

Below are some Candlestick Pattern Courses that will help you in learning more about it:

1. Candlestick Made Easy-

As we have discussed above, With the help of the candlestick charts, traders can take trading decisions like when to enter or exit the stock by analysing them in the technical charts.

In this course, Candlestick Made Easy traders will understand various candlestick patterns and how to use them in trading.

2. Master Of Technical Analysis–

You can also learn about other technical tools like indicators, chart patterns, along with the other candlestick patterns in this free module, Master Of Technical Analysis.

Short Online Webinars on Candlestick Patterns:

Below are some webinars on candlesticks that will help you learn about these patterns:

1. Trade better with Candlestick-

In this webinar, the trainer, Mr Piyush Chaudhry, will help you understand candlesticks, spot candlestick patterns, differentiate between reversal and continuation patterns and understand when are they reliable and when they are not.

2. Psychology behind Candlestick Pattern –

In this webinar, Ms. Jyoti Budhia will help you understand the psychology behind the formation of these candlestick patterns.

3. Identifying trading opportunities using candlesticks analysis-

In this webinar, the trainer, Mr. Umesh Sharma, will help you identify trading opportunities using candlesticks analysis.

4. Trading made easy with Candlesticks in Tamil –

The webinar will cover how to understand and effectively use candlesticks to trade for indices/stocks in Tamil.

You can also watch the video on candlesticks charts from here.

Bottomline:

One should remember that all candlestick patterns that we have discussed above should always be used with other technical indicators, as sometimes the signals generated by these patterns can be false.

The above list of candlestick patterns helps in understanding the different types of candlesticks and their meanings.

Go through the 35 powerful candlestick patterns pdf to enhance your knowledge in technical analysis.

RELATED: If you wish to get an in-depth understanding of the taxes and charges that come with trading, consult GST experts online.

Frequently Asked Questions (FAQs)

What is the candlestick pattern?

Candlesticks are charts that show how prices have changed over a specific time period. They are frequently created by a financial instrument’s opening, high, low, and closing prices. When the opening price surpasses the closing price, a filled candlestick—typically black or red—is produced.

Which candlestick pattern is bearish?

The “falling three methods” are the name given to this bearish pattern. It is composed of three small green bodies, a long red body, and another red body. The green candles are all confined inside the bearish bodies’ range. It demonstrates to traders that the bulls lack the strength to buck the trend.

What is the 15-minute candlestick strategy?

Traders may be able to profit from changes in market sentiment by spotting inside candles on a 15-minute timeframe chart and trading in the direction of the breakout.

Which time frame is best for trading?

If you want to see the main trends and movements during the trading day, rather than just the small fluctuations (5-minute and, to a greater extent, 1-minute charts), choose a 10- or 15-minute chart time frame. Develop and test the technique on a 15-minute chart if you choose to trade on one.

As a beginner investor, I liked your approach to candlestick education which imparts knowedge about pricing pattern and movement of price of any given security. I’m thankful to the presentor and his team.

Hi,

We really appreciated that you liked our blog.

Keep Reading!!

I want to learn stock market

Hi,

Thank you for Reading our blog!!

You can also join our course on Technical Analysis to gain more insights on this subject

Amazing stuff

Hi,

We really appreciated that you liked our blog.

Keep Reading!!

Thank you yesterday i made 21 trades 3000 eur each and only lost 2 it was really helpful.

1 sujjestion please change colour of comment i really cant see anything i’m writing 😂😂

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Hi, Liked this stuff and it is really helpful to beginners. Suggest if you include few examples, that would help beginners to understand it better

Hi,

Thank you for your feedback!

We have included few examples on your request!

Keep Reading!

Enjoyed reading the article above, really explains everything in detail, the article is very interesting and effective. Thank you and good luck with the upcoming articles.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Just great learning with it. Please share more possible patterns if same are there.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Thank you very much for onlice educated.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Apka dil se dhanyawad

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Really nice and helpful….

Hi,

We really appreciated that you liked our blog.

Keep Reading!

I want to learn option trading

Hi,

You can check our courses on Options Trading from here.

Keep Reading!

good information

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Very helpful for beginners.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Good learning ,adding value to trade ,keep sharing..

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Nice Blog. Explained in a simple manner.

Thanks and regards

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Really nice and helpful keep sharing

Hi,

We really appreciated that you liked our blog.

Keep Reading!

how one can download this article.

Hi,

We really appreciated that you liked our blog.

Keep Reading!

Hi,

There is no option to download the blog but you can bookmark this page so you can come back and read whenever you need reference. Sorry for the incontinence caused.

Thank you for Reading!

Really

Helpful for beginners

Great 👍

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

thanks alot of information keren

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

I found a lot of useful information on your site. Thank you for the valuable information.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading

Excellent learning material.

Hats off to Vivek Bajaj and his team.

Vivek Bajaj is a Teacher in the real sense.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading

Great

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Right on. It’s more informative and easy to understand. Thanks a lot such a nice guideline.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading

Thank you for your very nice topic and Very significant Information for us.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

I like your article please kindly send me pdf to print out.Thanks.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Thanks for the information

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

thanks for sharing your valuable knowledge with us ….

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

It’s very usefull

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

SUPER AMAZING STUFF…

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Thanks for the information it’s very important for me

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

Great knowledge piece to understand candle stick patterns. My doubts on types & pattern of candles are clear now.

Thanks

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

heyyyy……thank you very much for this information. you made this in a very simple way it is very easy to understand.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

I must say ” Its Gagar me sagar” kind knowledge. I will come back again and again on this. Sakshi ji, I want to be associated with ELM initiatives. Please let me how can I?

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

1 no .

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

as a beginner, its very very useful & effective in the details. i really thanks for helping me.

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

amazing blogs you are great

very powerful information

Hi,

We really appreciated that you liked our blog! Thank you for your feedback!

Keep Reading!

its very helpful , i need a pdf of this so how can i download this ?

Hi,

We really appreciated that you liked our blog! However, there is no option to download the same.

Thank you for Reading!

Keep Reading!

Very nice

Hi,

We really appreciated that you liked our blog! However, there is no option to download the same.

Thank you for Reading!

Keep Reading!

Thank you sir for this textand keep going on

Hi,

We really appreciated that you liked our blog! However, there is no option to download the same.

Thank you for Reading!

Keep Reading!

GREAT , IT WILL BE HELPFUL IF WE GET IN PDF FORMAT

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!

GREAT , IT WILL BE HELPFUL IF WE GET IN PDF FORMAT

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!

Great…

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!

Thank you. I hope it will be helpful to me.Be blessed

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!

Good effort for beginner , Pls Provide this blog in Hindi too….

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!

Nice

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!

need to buy this document

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!

Wonderful job, thanks for this clear explanations and examples.

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!