key Takeaways:

- Counterattack candlestick patterns form after a trend with two opposite-colored candles closing at the same price.

- They signal a possible trend reversal due to strong buying or selling pressure.

- Bullish counterattack appears after a downtrend; bearish after an uptrend.

- Traders use them as early reversal signals, confirmed by the next candle.

- Entry is usually considered after confirmation, with stop-loss beyond the pattern’s range.

Reversal indicators are plenty when it comes to technical analysis and candlestick patterns. For example, the counterattack candlestick pattern is a trend reversal indicator that many traders employ to enter a positioning trade.

Today’s blog will discuss everything you need to know about this unique technical indicator.

What are Counterattack Candlestick Patterns?

This trend reversal candlestick pattern, also known as the counterattack lines candlestick pattern, consists of two candlesticks moving in opposite directions. It can occur during an uptrend or a decline and is valuable for identifying trend reversals.

The indication is regarded as a bullish counterattack pattern when it appears during a decline. Conversely, the indicator is known as a bearish counterattack pattern during an uptrend.

How to Interpret Counterattack Candlestick Patterns?

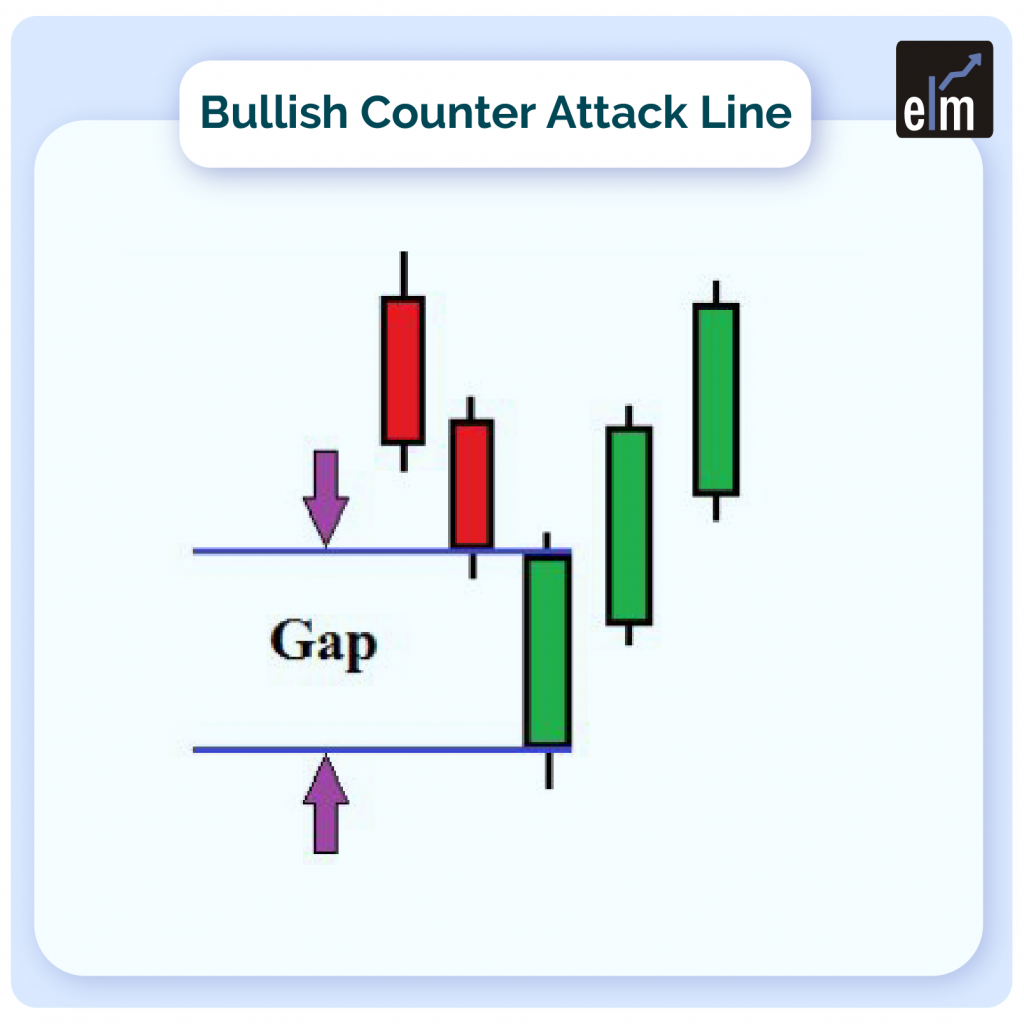

When you see the pattern in action, it becomes much easier to comprehend its meaning. For example, the bullish counterattack pattern can be seen here.

Take a look at this illustration. The bullish candle is coloured white, while the bearish candle is coloured black. The prices are clearly on the decline in this graph. Bears have a firm grasp on the market and have constantly lower prices.

This is demonstrated with the first black-coloured candle. The white candle produces a ‘gap down’ in response to the trend’s significant selling pressure and continues to decline until it reaches the session’s lowest point.

However, the bears lose pace at this point, and the bulls flood the market, lifting the price dramatically. Thanks to the bulls ‘ robust demand, the session closes positively at about the previous day’s closing point.

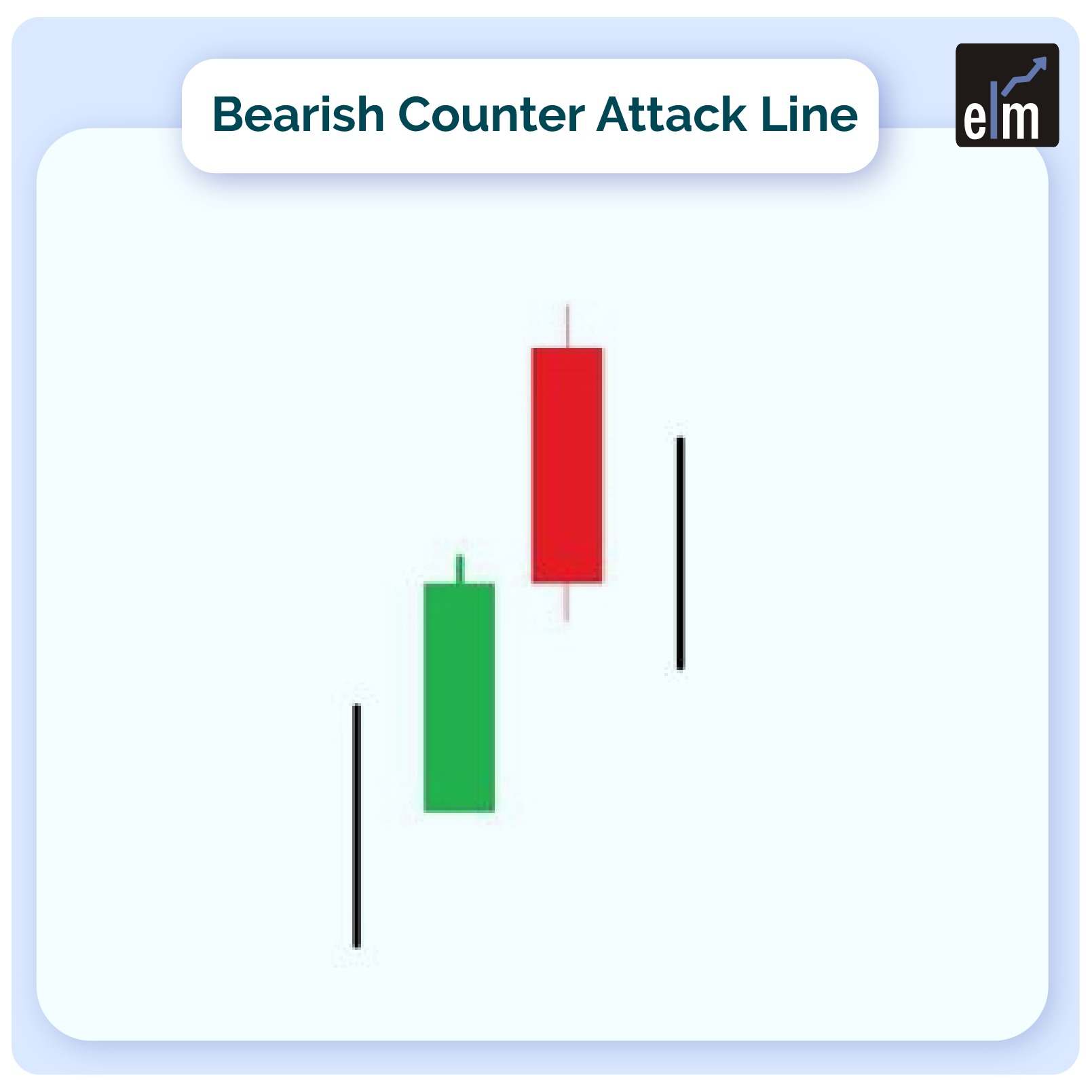

The prices are on an upswing in this candlestick chart. The bulls are a powerful force in the market, continually driving prices higher. The white-colored candle string demonstrates this. Due to the tremendous demand, the first black candle opens with a ‘gap up,’ implying that the price will continue to rise. However, the bulls lose steam at this point, allowing bears to enter.

The sellers then flood the market, driving the price down dramatically. The session closes unfavourably at about the point of the previous day’s closing due to the bears’ heavy selling push.

How to Use Counterattack Candlestick Patterns?

It’s one thing to notice the trend. However, using the detected pattern to enter a trade is different. As a result, before you embark on a trade based on the counterattack lines candlestick pattern, bear the following points in mind.

– To begin, keep an eye out for a strong trend. It could be either a bullish or bearish trend.

– Once you’ve determined the trend, look for a candle that opens with either a ‘gap up’ or a ‘gap down.’ The apertures should follow the current fashion.

– Pay attention to how this candle moves. The movement of the candle should be in the opposite direction of the current trend.

– Once that condition is met, make sure the candle in the middle is moving.

If all of the preceding conditions are met, a pattern can be dubbed a counterattack lines candlestick.

You can also join our course on Candlesticks Made Easy

– Once the pattern has been correctly spotted, it is best to wait for a confirmation candle before entering a trade. For example, in the case of a bullish counterattack pattern, you should only consider entering a trade if the candle that emerges after the pattern is also bullish. On the other hand, the bullish reversal is considered to have failed.

Notice how a bearish candle follows the bearish counterattack candlestick pattern? This candle verifies the trend reversal and should be used to enter the market.

Read More- All 35 Candlestick Chart Patterns in the Stock Market

Bottomline

Because the counterattack lines candlestick pattern is so specialised and uncommon, it’s best to pair it with other technical indicators before making a trade choice. This way, the odds of your trade taking an unexpected turn are reduced.

Frequently Asked Questions (FAQs)

What is the Counterattack Lines Pattern on Candlesticks?

On candlestick charts, the counterattack lines pattern is a two-candle reversal pattern. Either a decline or an uptrend may see it happen.

What is the Candlestick Pattern for Bullish and Bearish?

A black or full candlestick is bearish and suggests selling pressure since it implies that the closing price for the period was lower than the opening price. A white or hollow candlestick, on the other hand, indicates that the closing price exceeded the opening price. This indicates purchasing pressure and is bullish.