Nifty (weekly close approx. 9915.25):

Last week’s technical:

This week, on Monday, Nifty was mostly flat.

On Tuesday, Nifty corrected mostly due to sharp correction in ITC stock.

But, market recovered on Wednesday.

The Thursday and Friday saw quite volatile intraday trade in Nifty within a broader 80 points range.

Eventually Nifty closed the week with approx. 30 points of gain.

We had indicated this in our last weekly report that this week can be a week of consolidation if price closes below 5 DMA.

The market behaved in a similar fashion.

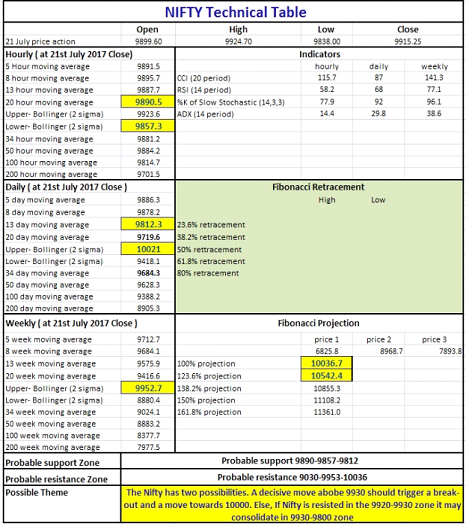

Hourly Technical:

In hourly time frame, Nifty has practically flat Bollinger bands which indicate further consolidation in a broader range of 9800 to 9930.

But Nifty can turn bullish if it breaks above 9930 zone.

On the downside, major hourly moving averages are situated in the zone 9880-9895.

But they do not hold much significance as the Nifty is stuck in a flat range for the last few days.

A decisive up or down move beyond the range will be crucial in the expiry week.

On the up-side, there is the much-awaited level of 10000 and on the downside, 100-hour moving average (presently at approx 9814.7) and 200-hour moving average (presently at approx. 9701.5) will be crucial.

The hourly ADX is losing momentum, while hourly RSI and hourly slow stochastic are range bound with bullish bias.

The hourly CCI is in the slightly overbought zone and indicating a neutral to a bullish bias.

The fact that Nifty closed near the highest point of the week, is in itself a bullish sign.

Figure: Nifty hourly chart

Daily technical:

In the daily time frame, Nifty is reasonably bullish.

This five days’ of consolidation was expected after approx 480 points of up move.

Nifty closed above all shorter-term moving averages.

On the downside, 13 DMA (presently at approx. 9812.3), 20 DMA (presently at approx. 9719.6) and 34 DMA (presently at approx. 9684.3) should be major support zones.

On the upside, the first psychological target is 10000, then 10030 to 10050.

The daily oscillators RSI, CCI and slow stochastic are showing bullish possibilities.

The next week, being an expiry week, there lies a possibility of upside breakout close to expiry.

Join: NSE Academy Certified Technical Analysis course on Elearnmarkets to become a technical analyst expert

Figure: Nifty daily chart

Weekly technical:

In the weekly chart, CCI, RSI and slow stochastic are looking bullish. 100% projection of last up move from the recent low of approx. 7893.8 comes at approx. 10036 as shown in the figure.

Above that, 123.6% projection lies at approx. 10542 and 138.2% comes at approx. 10855.

These are important levels in the longer term.

Figure: Nifty weekly chart

Figure: Nifty technical table

Watch the video below to learn how to analyze the above table:

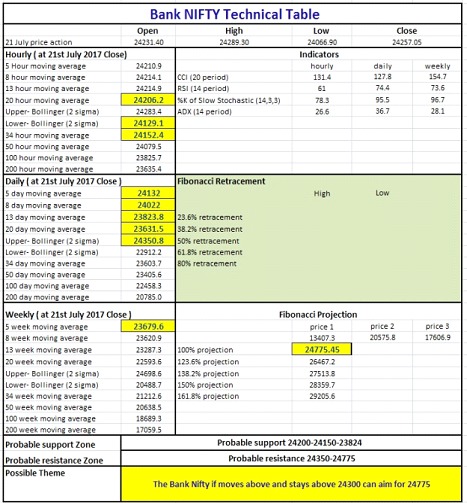

Bank Nifty (weekly close approx. 24257.05):

The Bank Nifty was in a slow and steady up move during the week. Multiple time price retraced to 20 hours and 34-hour moving averages and then eventually moved higher.

Hourly technical:

The Bank Nifty looks bullish to neutral in the hourly time frame.

This present up move is steadily being supported by 20 hourly and 34 hourly moving averages.

Any close below, 50 hourly moving average, which presently stands at approx. 24079, will give the first indication of a change of trend.

In the downside, 100-hour moving average (presently at approx. 23825.7) and 200 hour moving average (presently at approx. 23635.4) can act as support.

The hourly CCI is in bullish territory and hourly RSI and hourly slow stochastic are showing bullish to the neutral indication.

Figure: Bank Nifty hourly chart

Daily Technical:

In the daily time frame, Bank Nifty is bullish and is having a very slow and steady up move.

It is a steady move with price closing above 5 DMA for 15 days in a row.

If this move has to halt or reverse, the first indication will be provided by a close below 5 DMA which is presently situated at approx. 24132.

On the downside 8 DMA and 13 DMA are likely to act important supports which are presently situated at approx. 24022 and approx. 23824 respectively.

The daily CCI, RSI and slow stochastic are in the overbought zone and still maintaining bullish momentum.

But, any dip into the normal zone from overbought zone will indicate the possibility of fatigue or reversal.

Figure: Bank Nifty daily chart

Weekly technical:

The Bank Nifty is firmly bullish in Weekly time frame.

Price has been moving up in last three week after 2-3 weeks of flattish consolidations. 100% projection of last major up move, from December low of approx. 17607 comes at approx. 24775.

Weekly slow stochastic, RSI and CCI are showing upward momentum.

If the bullish momentum is maintained, The Bank Nifty may move towards 24775 or higher in the monthly expiry week.

Figure: Bank Nifty weekly chart

Figure: Bank Nifty technical table

In order to get the latest updates on Financial Markets visit Stockedge