Technical analysis’ Elliott Wave theory is used to explain price changes in the stock market. Ralph Nelson Elliott created the hypothesis after observing and identifying recurrent, fractal wave patterns. Consumer behaviour and stock price movements both exhibit waves.

The theory holds as these are recurring patterns, the movements of the stock prices can be easily predicted. Investors can get an insight into ongoing trend dynamics when observing these waves which also helps in deeply analysing the price movements.

So, in today’s blog let us discuss Trading with Elliott Waves:

What is the Elliott Wave?

The Elliott wave principle is a form of technical analysis that helps traders in analysing the financial market cycle.

With the help of this Elliott wave theory, traders can forecast market trends by identifying extremes in prices and investor psychology.

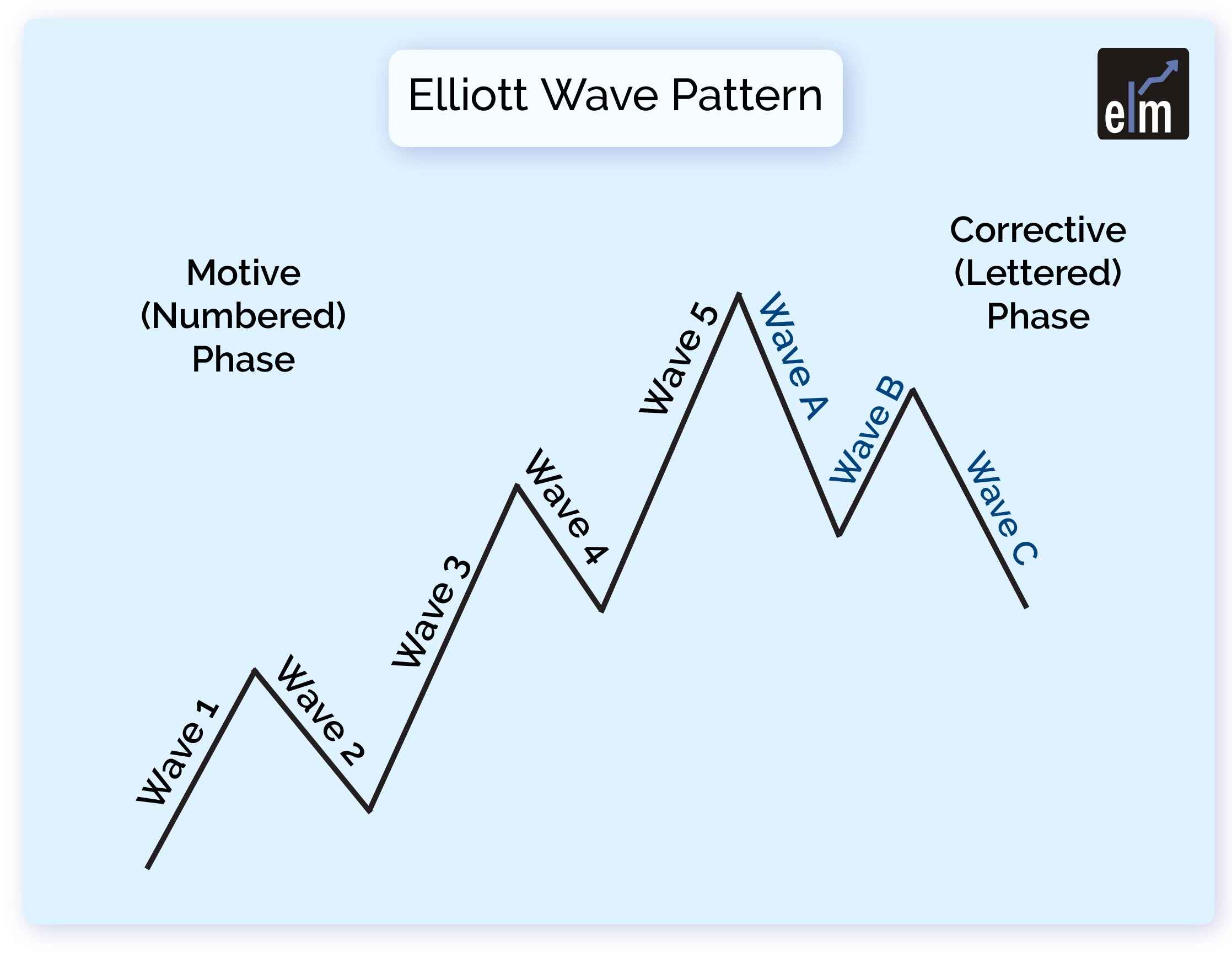

Elliott Wave Theory suggests that movements of the market follow a sequence of crowd psychology cycles. The Elliott Wave Patterns are formed according to the ongoing market sentiment, which alternates between bullish and bearish cycles.

How does Elliot Wave work?

The Elliott wave theory is a type of technical analysis that aids traders in understanding the cycles of the financial markets.

By spotting extremes in price and investor psychology, traders can predict market patterns using the Elliott wave theory.

According to Elliott Wave Theory, market movements are said to be influenced by a series of cycles in crowd psychology. The current market attitude, which alternates between bullish and bearish cycles, determines how the Elliott Wave Pattern is generated.

The concept of wave analysis as a whole does not equal to a typical blueprint formation where you just follow the instructions, unlike most other price formations. Wave analysis provides insights into trend dynamics and aids in a deeper understanding of price movements.

Decoding Elliott Wave Impulsive Pattern

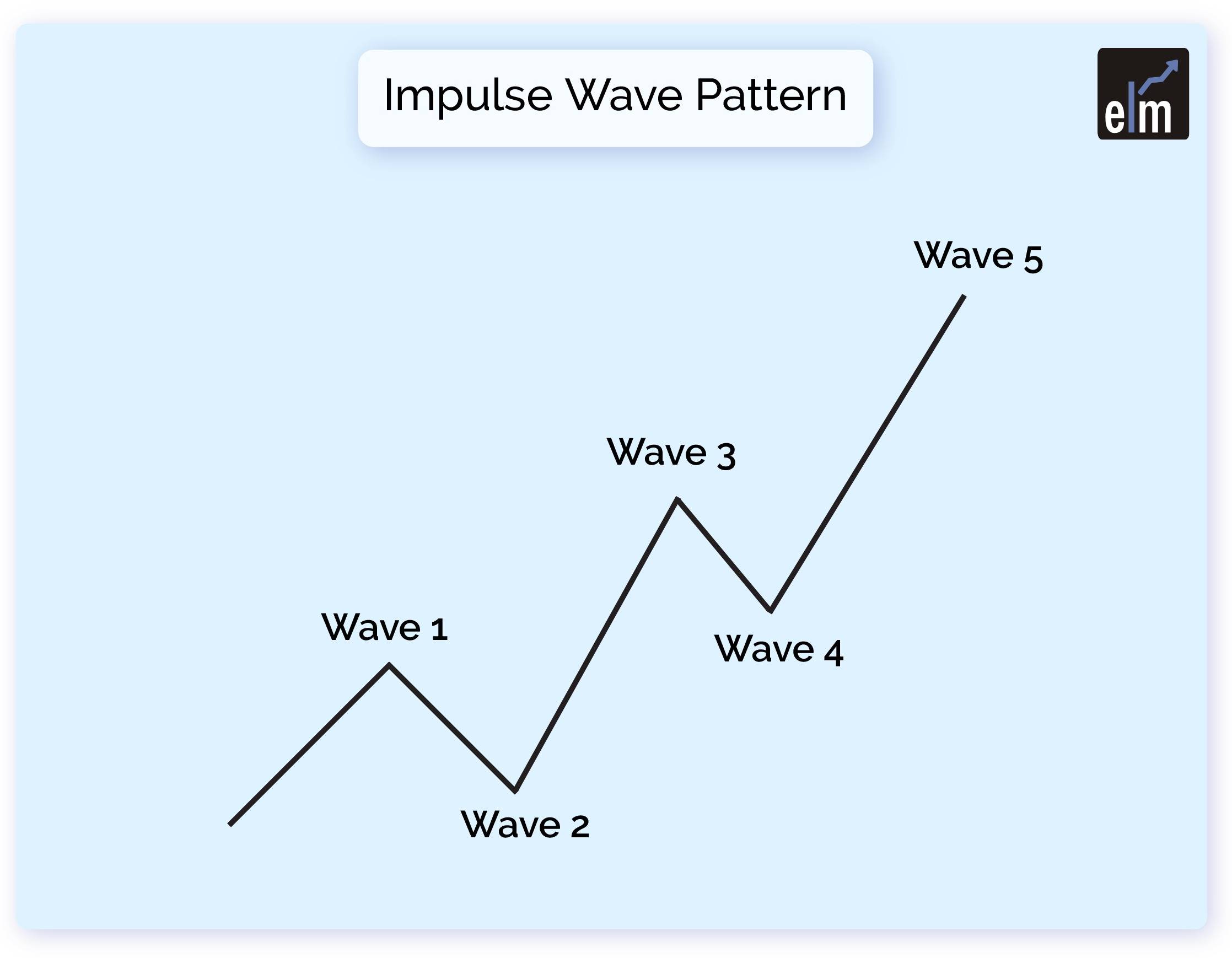

Five subwaves make up an impulse wave, which moves overall in the same direction as the trend of the largest degree.

The most prevalent and straightforward to identify motive wave in a market is this pattern. It is made up of five sub-waves, five motive waves, three of which are likewise motive waves, and two corrective waves. This is classified as a 5-3-5-3-5 structure, as was previously illustrated.

Its creation is governed by three unbreakable rules:

- Wave two cannot retrace the preceding wave more than 100%.

- Of waves one, three, and five, the third wave can never be the shortest.

- Wave four cannot ever advance past the third wave.

The structure is not an acceptable structure if one of these rules is broken.

Decoding Elliott Wave Corrective Pattern

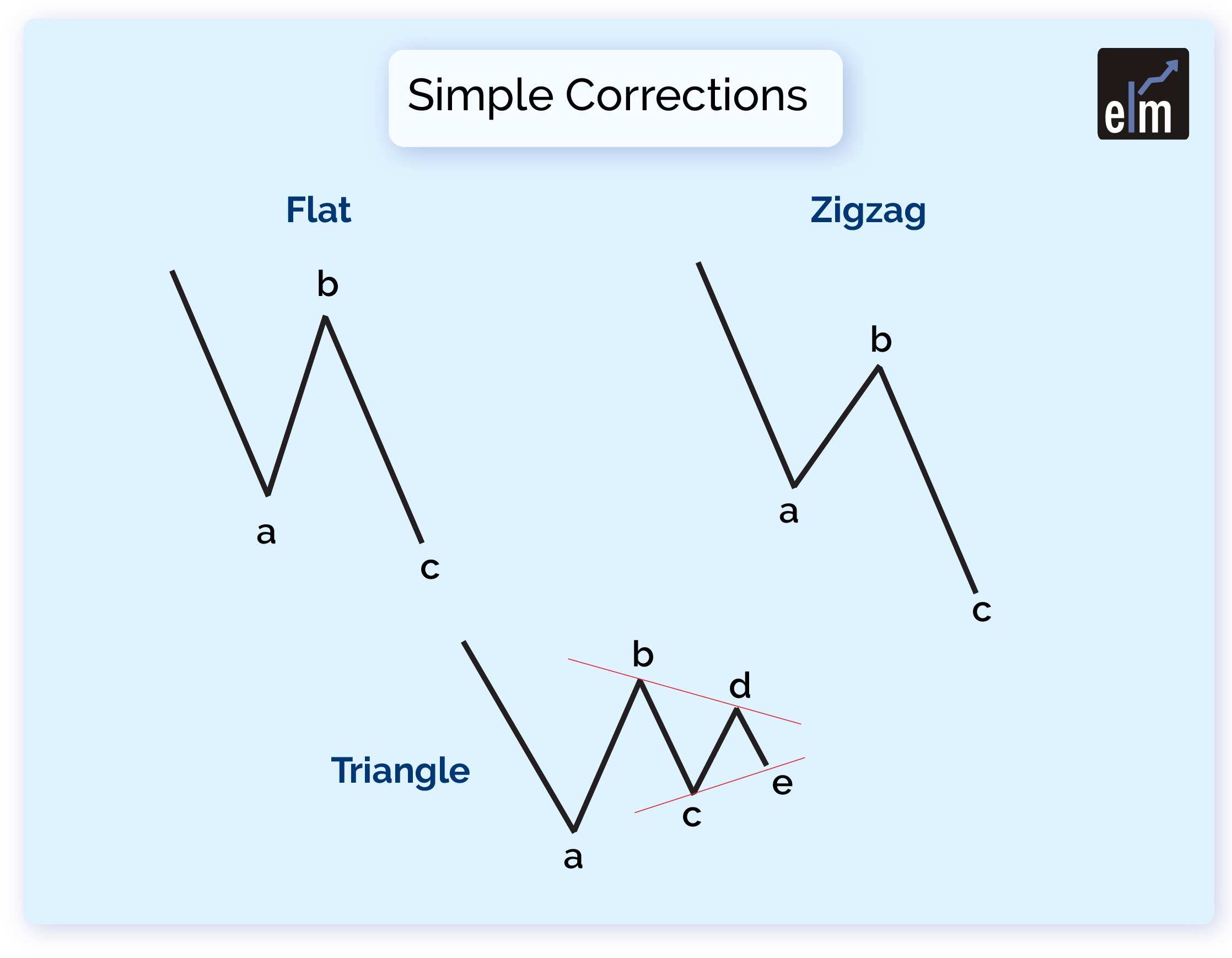

Corrective waves, also known as diagonal waves, are composed of three sub-waves or a combination of three sub-waves that result in a net movement that is perpendicular to the trend of the next-largest degree.

Its objective, like with all motive waves, is to move the market in the trend’s direction.

There are five sub-waves in the corrective wave. The diagonal is different because it might seem like a wedge that is either extending or contracting.

Depending on the sort of diagonal being observed, the sub-waves of the diagonal may not have a count of five. Every sub-wave of the diagonal, like the motive wave, never exactly repeats the previous sub-wave, and wave number three of the diagonal may not be the shortest wave.

Elliott Wave with Fibonacci

Corrective wave application emphasises the potential for cross-studying Fibonacci retracements. Fibonacci levels were not directly used by Elliott, although traders have done so to make the conventional theory more complex.

Which Fibonacci retracement levels might be applied at different stages in the trend are highlighted by the previously stated principles. The 23.6 percent -50 percent levels would be of special interest to a trader searching for a fourth wave given rule three, who would also be looking for it to be reasonably shallow.

Additionally, we can look for the correct A, B, and C move to represent a retracement of 50% to 61.8% of the overall 1-5 impulse move.

Bottomline

For many people all across the world, Elliott Wave theory continues to provide markets a sense of structure. The capacity to constantly adjust the theory whenever a rule is breached can make it difficult to employ the theory as a trading tool.

But it also significantly improves trend recognition’s level of clarity. Elliott’s original principles can be made as complex as a trader wants, but it is unquestionably an approach that many traders choose to prioritise in their market tactics.

Frequently Asked Questions

Does Elliott Wave really work?

The Elliott wave principle as it is currently applied is not a sound theory; rather, it is a powerful narrative skillfully conveyed by Robert Prechter. The story is particularly convincing because EWP seems to have the extraordinary ability to fit any historical market segment, right down to the smallest changes.

What is the Elliot wave theory?

A type of technical analysis known as Elliott Wave Theory searches for recurring long-term price patterns connected to enduring shifts in investor psychology and sentiment. According to the idea, there are impulse waves that initiate patterns and correction waves that run counter to the main trend.

Which is the longest wave in the Elliott Wave?

Typically, Elliott Wave (3) is the longest and strongest wave. Elliott Wave (3) is often a trend’s greatest and strongest wave.