As we all know, technical analysis is a method of analysis of financial instruments with the use of price data and statistical tools.

It tries to determine the future trend and movement of the price with the help past market data.

Just like fundamental analysts, technical analysts also have different styles of analysis.

Some prefer chart patterns while others prefer technical indicators.

Some people prefer both of them and use them efficiently.

Candlestick charts are also a part of the modern-day technical analysis.

Learn technical analysis in NSE Academy Certified Technical Analysis course on Elearnmarkets.

The Shooting star is one such widely followed candlestick pattern.

It is a bearish reversal pattern. It usually forms at the end of an uptrend.

Since it forms after an advance and takes the star position in the pattern before the trend reversal starts, it gets its name as the Shooting star pattern.

The shooting star is a single candlestick pattern.

The candle can represent different time periods, which can be as short as a minute, 5 minutes, an hour or as long as a day, a week or even a month.

The shooting star is made up of a black or white candle (up day or a down day).

It has a small body with a long upper shadow and a very small or negligible lower shadow.

The size of the upper shadow should be at least twice the size of the body of the candle.

The high low range of the candle should be comparatively large compared to the previous 10-20 periods.

By looking into the recent charts, we can identify the Shooting Star pattern in many of the widely recognized stocks of the Indian Stock Markets.

Some of the recent pattern formations can be seen as follows:

ULTRATECH CEMENT LIMITED

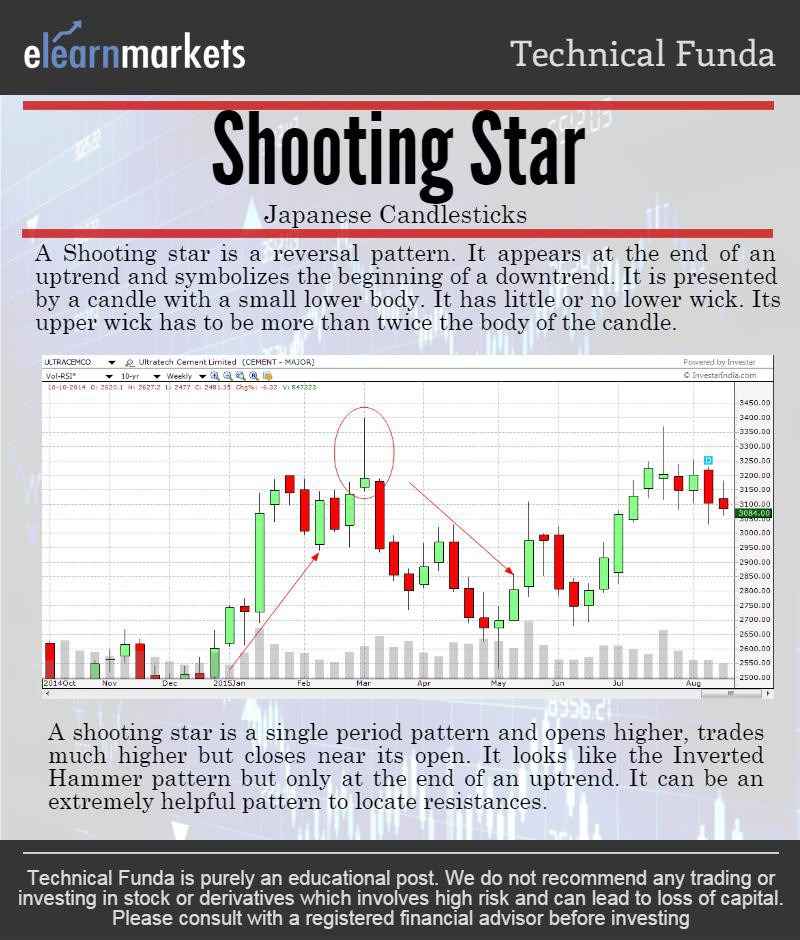

As we can see above in the chart of Ultra Cement Limited (ULTRACEMCO), after a series of up days, the stock has gone up to 3150 levels at the end of Feb 2015 from the levels of 2500 since the end of Dec 2014.

In the first weekly candle in the month of March 2015, the candlestick:

- Opens at 3159

- Makes a low of 2415, which can be considered negligible.

- Makes a high of 3398, which actually forms the upper wick of the candle

- And finally closes at 3189 which is the near the open of the candle.

Thus the above price movement made a weekly candlestick which formed the pattern of a shooting star.

Furthermore, a candlestick pattern is confirmed only when the candles of the periods succeeding the shooting star is in tandem with the pattern characteristics.

Here, the candle next to the shooting star is a big bearish candle.

It almost looks like a Marubozu candle with no(or negligible) upper or lower shadow.

The candle opened at 3180 and closed at 2947 confirming that the trend has reversed and is now bearish.

Bharti Airtel

With a consistent uptrend in the weekly charts from 340, It went up as high as 440.

It formed a shooting star pattern in the third week of July 2015.

After that series of four bearish candles has brought down the stock to levels of 360.

Know More: All you need to know about the Japanese Candlestick

Bottomline:

The Shooting star pattern basically indicates selling opportunities.

It can also signal to sell off existing positions.

But the textbook description, the shooting star should gap away from the previous candlestick.

The gap enhances the impact of the shooting star, but also the absence of it doesn’t indicate a loss of the essence of the pattern.