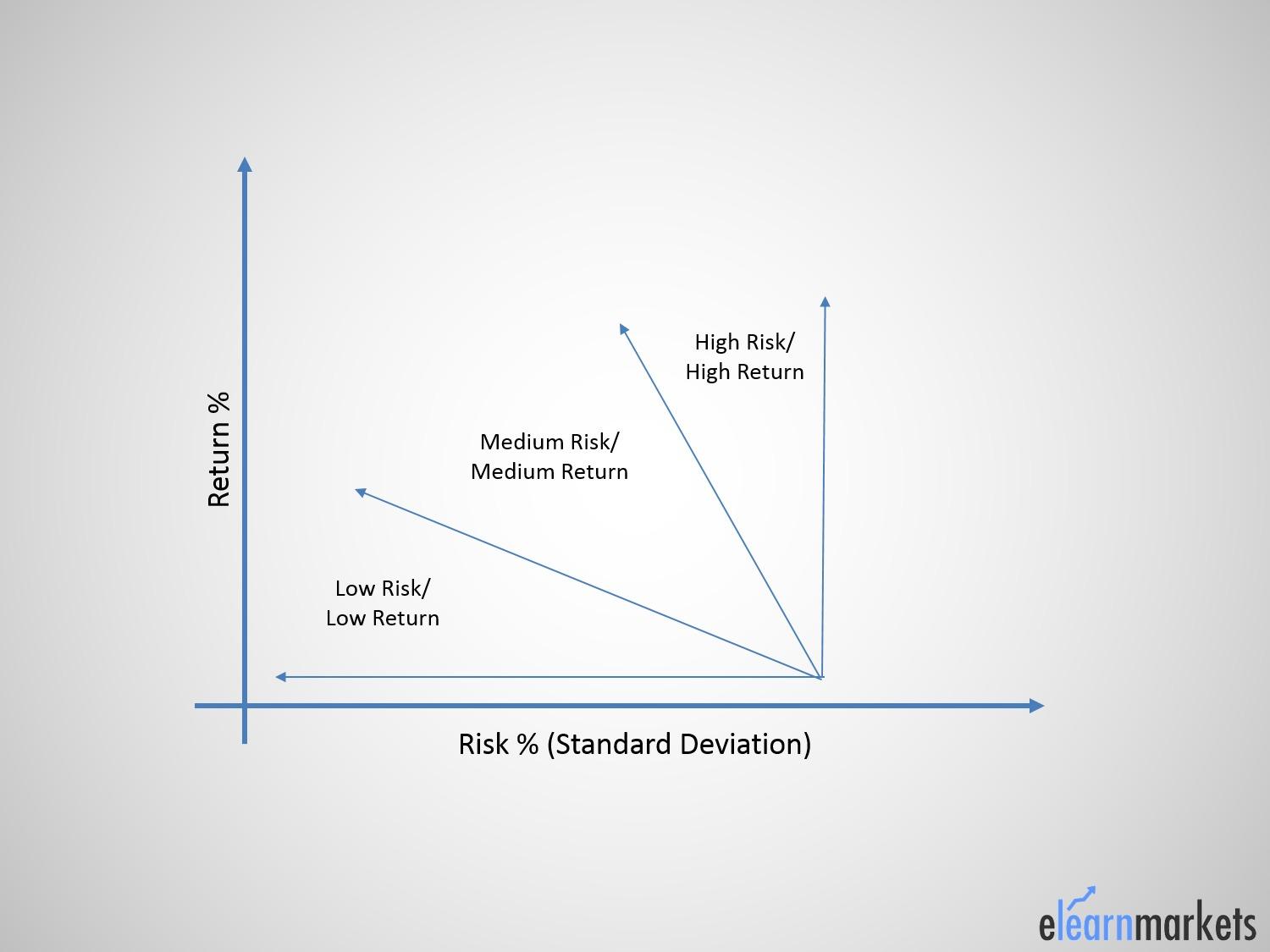

While investing it is important that you have quality assets in your portfolio which will generate a good return for you. But think twice, is it only about choosing the good stocks or good assets for your portfolio? The answer is a big no. It is not just choosing the best stocks or assets; it is also about managing the risk associated with it and creating a well-diversified portfolio.

As we know investment itself is a risk-oriented process. So, managing or eliminating the risk is also as important as choosing good stocks or assets.

Now the question may arise, if we are choosing a good quality stock or asset then where is the risk?

What do you mean by portfolio diversification ?

Let’s discuss this problem with an example.

A few months back one of my friends bought 3000 shares of a company by breaking his savings. He was very confident about the stock and within 2 weeks his return was more than 8 percent. Rather than booking partial or any profit, he went on to buy more stocks.

Suddenly that particular sector starts going down drastically and the stocks he purchased also started showing a negative returns. Within a month his portfolio shows a negative return which was more than 25 percent. Now he is not even ready to square off his position due to the fear of losing money and he is not being able to digest the loss he had to go through.

Now, what was his mistake?

His mistakes were-

- He invested all his money in one stock

- He was dependent on a particular sector.

- He invested in a particular asset class.

Always Invest in different Asset classes

According to Nasdaq.com “Investing in different asset classes and in securities of many issuers in an attempt to reduce overall investment risk and to avoid damaging a portfolio’s performance by the poor performance of a single security, industry, (or country)”

In simple language, portfolio diversification is an investment system or process which helps investors to reduce the risk of investment and maintain portfolio performance by investing in multiple asset classes rather than investing in a single security.

Learn to become your own portfolio manager in just 2 hours by Market Experts

Any particular security price depends on various factors like global factors, domestic factors, overall market performance etc. If some stocks start showing negative return due to any above-mentioned factors, others will help to balance that loss. So overall portfolio performance will not be affected that much.

Portfolio Diversification or Portfolio Di “worse” fiction:

Till now it is understood that what is portfolio diversification. But how to it do it in a right way is very much important.

People often make a common mistake by creating a huge portfolio that contains more than 20 to 25 stocks or more than that. Diversification is not about creating a portfolio of multiple stocks it depends on various factors. Let’s focus on them.

Mutual fund’s or Institutional investor’s portfolio contains 15 to 25 stocks. It is true that it varies depending on the market scenario but for an individual 10 to 15 stocks is sufficient for a diversified portfolio.

Managing the risk of Investment and creating an easily trackable portfolio should be the prime target.

Suppose a portfolio contains 10 stocks and 4 of them are from Automobile sectors. So any change in oil price or like so will affect the whole portfolio return. It is important to keep in mind that no particular news or any single factor should not affect most stocks of the portfolio.

Similarly, creating a portfolio by choosing stocks from every corner is also not important for a diversified portfolio. It is very difficult to track each and every different sector for different stocks.

Investment horizon and investment target should be predetermined by the Investor. Taking out the investment before the pre-planned time period is a very common thing. Investment without any goal or timeframe may affect the overall performance of that portfolio.

Investors who invest in mutual funds can also diversify their portfolio by choosing multiple mutual funds schemes. Five to seven types of schemes are sufficient for an individual investor.

Suggested Read : Portfolio Diversification Simplified

How much to diversify?

An investor should be cautious while creating a diversified portfolio. As mentioned earlier diversification is a process to minimize the risk factor of investment. But overdoing it may cause the same problem.

Now, what is over-diversification or how to understand that the portfolio is too much diversified?

As we know, a diversified portfolio contains stocks, bonds, assets etc. and investors spend lots of time choosing the perfect asset classes for the portfolio.

- Tracking each and every stock will be difficult if the portfolio is too much diversified.

- Risk to Reward ratio will be affected.

- Investment cost will increase.

- Investor will have less or no capital for new stocks or asset allocation.

- Weightage of different asset classes will be affected. Hence the overall balance of portfolio will hampered.

- Increase in investment due diligence.

- Investment standard will reduce.

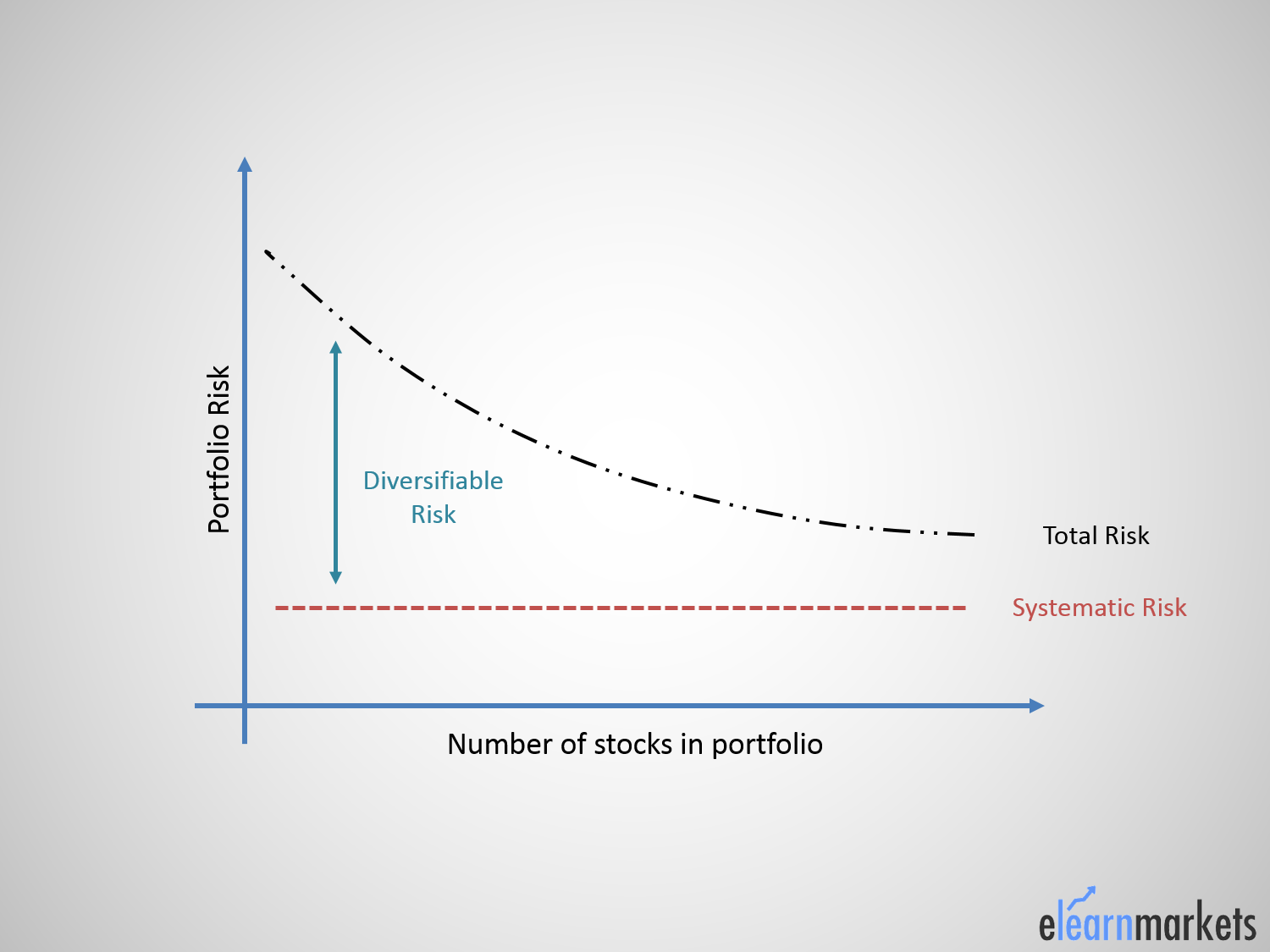

Portfolio Diversification is risk reduction

Yes, it can reduce the risk.

The risk to reward is the key factor of investment. New securities have its own risk to reward ratio. So whenever the reward is added to the portfolio the risk is automatically coming.

Whenever a new asset or stock is introduced into the portfolio the overall quality of the portfolio will automatically reduce so will its performance. Over diversification forces investors to choose low-quality stocks. There will be an obvious quality difference between the first stock added to the portfolio with the last one.

Each and every stock will influence the portfolio performance, the investor will have dumped his/her ideas in name of over-diversification.

Diversification is important but over-diversification is not so advisable.

Bottomline:

In the field of investment, an investor’ s prime target should be minimizing the risk and generating return which is more than the market return. You can learn how to invest in stock market with the help of Elearnmarkets app

A particular stock should not affect your overall return much. A diversified portfolio is very important to stay in the game for the longer period and reducing that risk.

Weightage calculation of different stocks or sectors is very important while creating a diversified portfolio.

Investors also can take the help of investment advisors for creating a well-diversified portfolio.