Retirement planning plays an important role in securing our future from a financial perspective. This makes it a significant element of financial planning that we should all focus on.

One of the components of retirement planning is a pension. Our pension plans play a very important role during our old age when we do not have a regular source of income.

They provide stability and financial security and also ensure that we live a good life in retirement without lowering our standards of living. Keeping this in mind, the Government of India has set up many schemes to help people plan their retirement early and peacefully.

One of these is the National Pension Scheme or NPS.

Table of Contents

What is the National Pension Scheme (NPS)

National Pension Scheme (NPS) is a voluntary, low-cost, and defined contribution retirement savings scheme designed to enable systematic savings during the working life of the individual.

It attempts to provide a solution to make sufficient retirement funds available to every citizen of India.

NPS was launched on 1 January 2004 to create and regulate the pension sector in the country and to inculcate savings habits for retirement among citizens.

It is designed based on a defined contribution basis, where the individual contributes to his account.

How NPS works?

The savings of individuals are pooled in a pension fund, which gets invested by PFRDA-regulated professional fund managers according to the stated investment guidelines.

Over the years, these contributions would accumulate and grow depending upon the returns generated on the investments.

Key features

Some of the key features of a retirement account under the National Pension Scheme are stated below-

1. PRAN card

The subscribers receive a Permanent Retirement Account Number (PRAN) card, which has a 12-digit unique number.

2. Tier I and Tier II account

There are two sub-accounts under the NPS account- Tier I and Tier II.

- Tier I account: This is the default account of the scheme. Upon registration, opening this account is compulsory.Withdrawals in this account have restrictions. Under section 80C and 80CCD of the Income Tax Act, 1961, you can avail a tax exemption of up to Rs. 1.5 lakhs.The minimum contribution here is Rs. 1000 per annum.

- Tier II account: This is a voluntary account that allows its holders to invest and withdraw their funds from NPS’s investment schemes with no extra charges. Unlike a Tier I account, this account has a tax exemption of up to Rs. 1.5 lakhs are only available for government employees. There is no minimum contribution or balance required on this account.

Who can join NPS?

An Indian citizen between the ages of 18 and 65, whether resident or non-resident, can join the National Pension Scheme either as an individual or as an employer-employee group subject to KYC documentation and submission of relevant information.

Once you have attained 60 years of age, you cannot further contribute to the NPS accounts.

Benefits

- Simplicity: The subscriber is required to open an account and get a Permanent Retirement Account Number (PRAN).

- Transparency: It’s a cost-effective and transparent scheme, where the contributions are invested in a pension fund scheme and the individual can check the investment value on a daily basis.

- Portability: Each individual is allotted a unique number called Permanent Retirement Account Number (PRAN), through which he/she will be recognized and it will remain the same even if the individual gets transferred to any other office.

- Tax benefits:An exclusive tax deduction is available for the investments made under NPS scheme (not possible for any other investment). Account-holders can avail a tax exemption of 10% of their gross income or ₹ 1,50,000, whichever is lower. According to the amendments made in Union Budget from F.Y. 2015-16, NPS subscribers can avail a tax deduction of additional Rs 50,000 under section 80CCD, in addition to the deduction of Rs 1,50,000 under 80 CCE. These tax deductions are only available for the money in the Tier I account.

Where and how to open an NPS account?

National Pension Scheme is spread through authorized entities known as Points of Presence (POP), where most banks (including public and private) are registered to act as POPs under the NPS scheme, apart from other financial institutions.

In order to invest in NPS, you are just required to open an account through Points of Presence (POP), which will help you in opening the account, including providing information about the scheme, assisting in filling the necessary forms, etc.

Offline Mode

- Find a Point of Presence (PoP) that’s nearest to you.

- Collect and fill out the subscriber form and submit it with the required KYC papers (address, age and identity proof).

- Make a minimum initial investment, if required.

- After doing so, you will receive a welcome kit, which will include your Permanent Retirement Account Number (PRAN) and a password to log in to your account online.

Online Mode

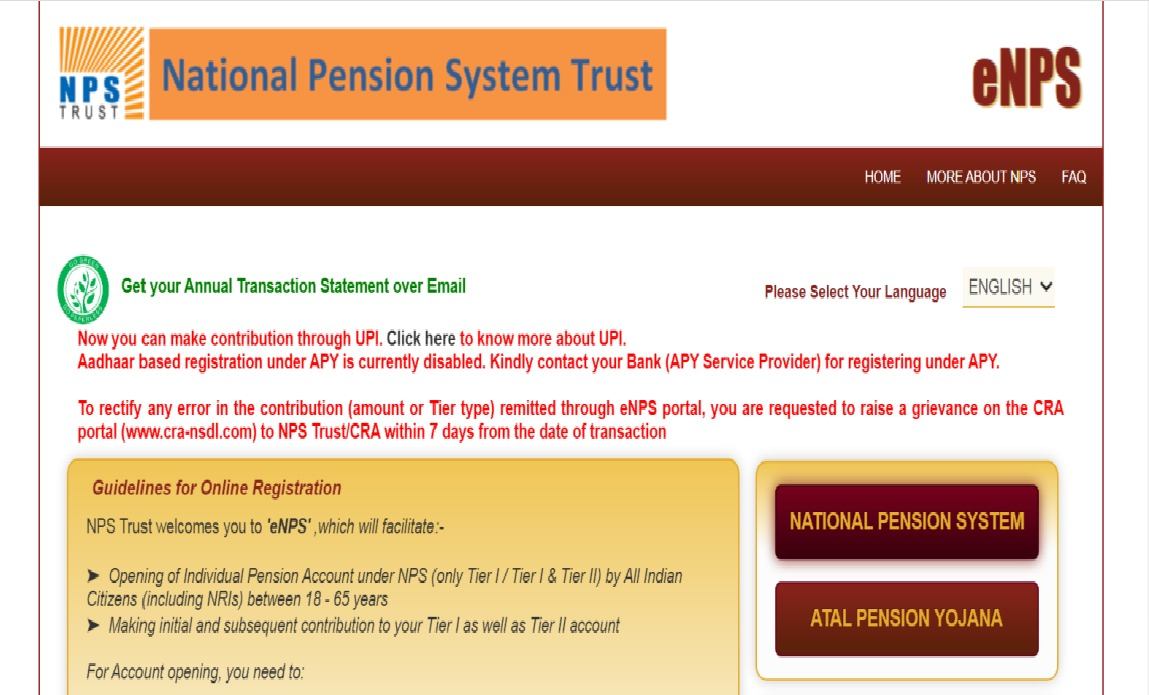

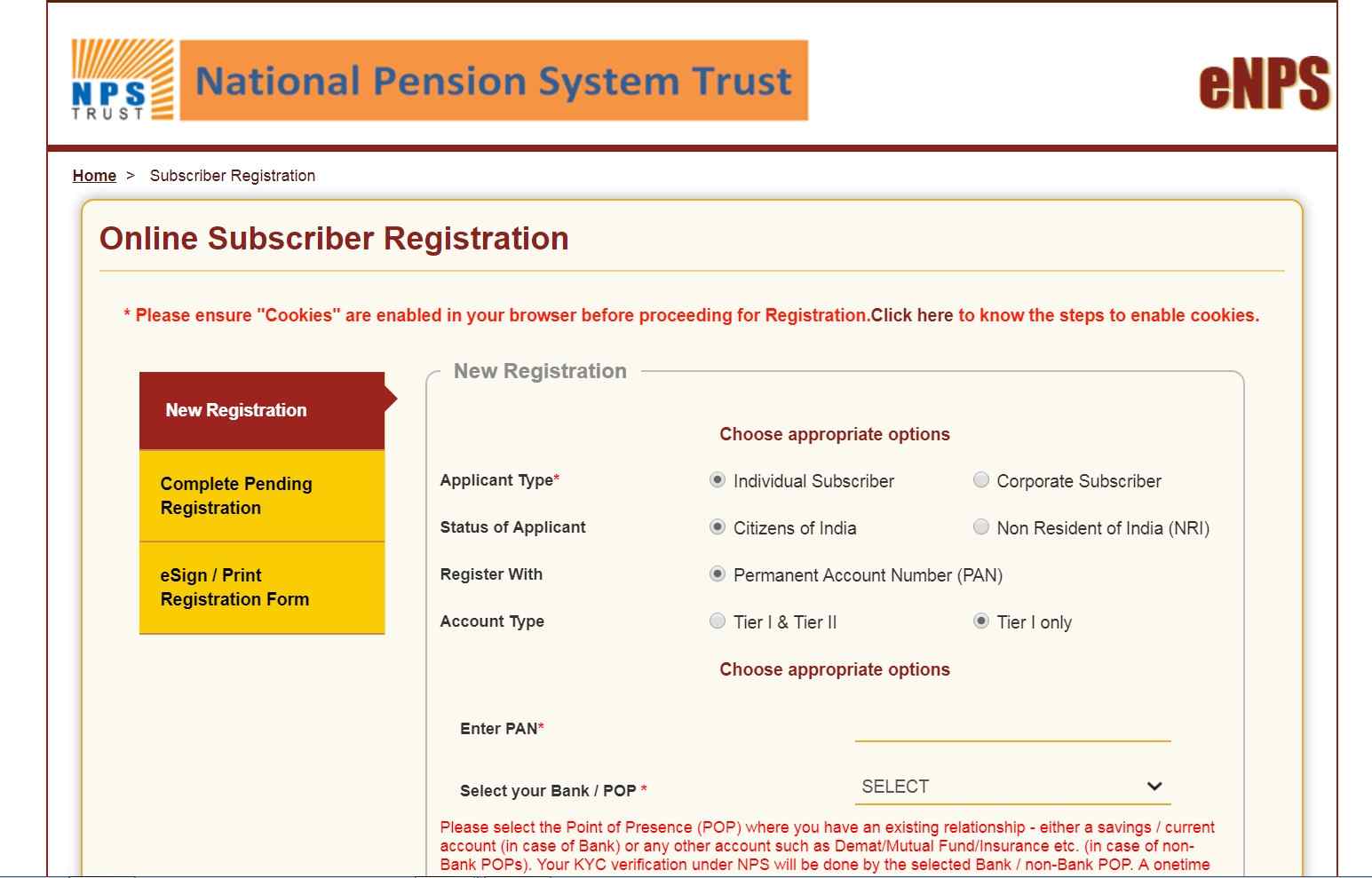

- Go to the official website of the National Pension System Trust.

- Click on the “National Pension System” to be led to the official registration page.

- Choose the type of account you want. Tier I is compulsory, while Tier II is optional. We will discuss these in detail later.

- You will receive an OTP to validate your registration. Use this OTP to generate your PRAN and password to your account.

Documents required for National Pension Scheme

The documents required to be submitted to the Points of Presence (POP) in order to open an NPS account are stated below-

- Registration form (completely filled)

- Address and identity proof

- Age proof

Various fund management schemes available

There are two ways to invest subscriber’s money which are stated below-

Active choice– Under this, the subscribers select the asset class to allocate the fund along with the percentage.

Auto choice– It is the default option under the NPS scheme, where the fund management and allocation are done based on the age profile.

Withdrawal Options

There are two possible cases –

Early withdrawal

After investing in the scheme for a minimum of three years, you can withdraw up to only 25% of the total funds deposited.

You can make such a withdrawal three times at a gap of 5 years during your entire tenure.

These restrictions are only for Tier I accounts. As mentioned before, withdrawals of all kinds are permitted in Tier-II accounts.

Withdrawal after 60 years of age

After 60 years of age, you are not allowed to deposit any money in the scheme. Now, you are allowed to utilize the funds in your account.

Here is the distribution of the total funds –

60% of the total funds are now your tax-free corpus. You can use it as you like.

40% of the funds have to be kept aside; they will be used to give you a regular pension amount from a firm registered under PFRDA (Pension Fund Regulatory and Development Authority).

In case of the death of the individual, the nominee receives the total amount as a lump sum.

NPS Vatsalya Scheme

Finance Minister Nirmala Sitharaman unveiled the NPS Vatsalya, a new program under the National Pension Scheme (NPS) for minors, during her Union Budget 2024–25 speech.

Through the program, parents and guardians can start their kid’s pension planning process by contributing amounts that grow until the youngster turns 18 years old. The accumulated sum will then be transferred to the previously created standard NPS.

What is NPS Vatsalya?

NPS Vatsalya provides families with a methodical way to guarantee their children’s financial stability in the future. Parents can provide a strong foundation for their children’s financial requirements as they grow up by taking part in this program. The NPS, which is commonly considered as a useful instrument for ensuring financial security in retirement, functions similarly to this new program.

The table that follows demonstrates how parents who invest on behalf of their minor children can make use of this new program.

This will help their children to learn the value of beginning to invest at a young age in addition to making investments on their behalf.

| Name of the pension scheme | 10-year returns (in %) | Monthly SIP (in Rs) | Invested amount(in Rs) | Estimated value(in Rs) | Total value of returns (in Rs) |

| UTI Pension Fund | 14.28 | 10,000 | 18,00,000 | 45,00,518 | 63,00,518 |

| HDFC Pension Management Company | 14.15 | 10,000 | 18,00,000 | 44,19,993 | 62,19,993 |

| Kotak Mahindra Pension Fund | 14.00 | 10,000 | 18,00,000 | 43,28,538 | 61,28,538 |

| ICICI Prudential Pension Fund Management | 13.97 | 10,000 | 18,00,000 | 43,10,432 | 61,10,432 |

| SBI Pension Funds | 13.25 | 10,000 | 18,00,000 | 38,93,772 | 56,93,772 |

| LIC Pension Fund | 13.02 | 10,000 | 18,00,000 | 37,67,629 | 55,67,629 |

Bottomline

The National Pension Scheme is looked upon as a better option in terms of equity exposure and cost. Moreover, it allows to plan for your retirement in a disciplined way and also provides additional tax benefits.

After knowing the details of the NPS, there is an important question to answer – is this scheme a good option for us? NPS is a great option for someone who is looking to build a retirement corpus with minimum risks and in a systematic manner.

Along with tax-saving opportunities, it also gives the account holder an opportunity to grow their wealth through investments in the stock market. However, there is little concern over liquidity and tax at maturity, which makes people reluctant to invest their funds. Hence, talk to a concerned professional and do your own research before investing in NPS.

Frequently Asked Questions (FAQs)

What is the National Pension Scheme ?

The Indian government introduced the National Pension Scheme, a voluntary contributory pension plan. Its goal is to give Indian citizens a retirement income.

Who can join the National Pension Scheme ?

The NPS is open to all Indian citizens who are between the ages of 18 and 65. Both those in the organized and unorganized sectors are included in this. Also, parents can invest in behalf of their minors.

How does the National Pension Scheme work?

Anyone can use approved Points of Presence (POPs) to open an NPS account. Throughout their working years, they consistently make contributions to their NPS account. They get a monthly pension after retiring, with a portion of the corpus paid out as a lump amount.

Very less number of blogs in India are as clean and well illustrated as yours. I had a question. Is there any norms as per which Government employees can not open an NPS.

Lovely just what I was searching for.Thanks to the author for taking his time on this one.