A Mutual Fund can be thought of as an organization that brings together a large group of people and invests their money on their behalf in a basket containing different securities. This basket contains equities, bonds, commodities like gold. This basket is divided into units or shares. Each share represents a holding in the Mutual Fund. If you are interested in knowing more details on mutual funds, you may join NSE Academy Certified Personal Financial Management.

The market value at which these shares can be bought or sold is called the Net Asset Value (NAV). These NAVs keep fluctuating according to the fund holdings in the market.

To start investing in mutual funds by your own, you can take help of Kredent Money App, a one-stop tool to assist you in your financial journey

People who manage these funds are called Fund Managers. Hence, investors who do not have adequate knowledge about the market or do not have time to analyse the market can invest through mutual funds. Any investor can start investing in Mutual Fund with a minimum amount, For example, Rs.100, Rs.500 etc.

Do you know your risk appetite?

“Successful investing is about managing risk, not avoiding it.” -Benjamin Graham

It’s important to understand that each mutual fund is a combination of risk and its corresponding return. Generally, higher the risk, it is compensated by higher returns. Hence an investor should choose a mutual fund based on his/her risk appetite. For example, lower the age higher the risk that can be taken, a person with a good job and a stable income can afford to take a risk, an elderly person or a retiree should take less risk etc.

Years to go, years to grow

Apart from the risk appetite,

There is one more important aspect to look upon, this factor weighs heavy influence on our Mutual Fund choices. And that is the ‘Investment Horizon’.

A fund’s investment horizon defines the amount of time an investor would want to stay invested in that particular investment scheme. Simply said, the investment horizon is the amount of time between when a person starts investing and when he/she gets their money back.

Investors may have a different time horizon depending on factors like age, income stream, money requirement etc.

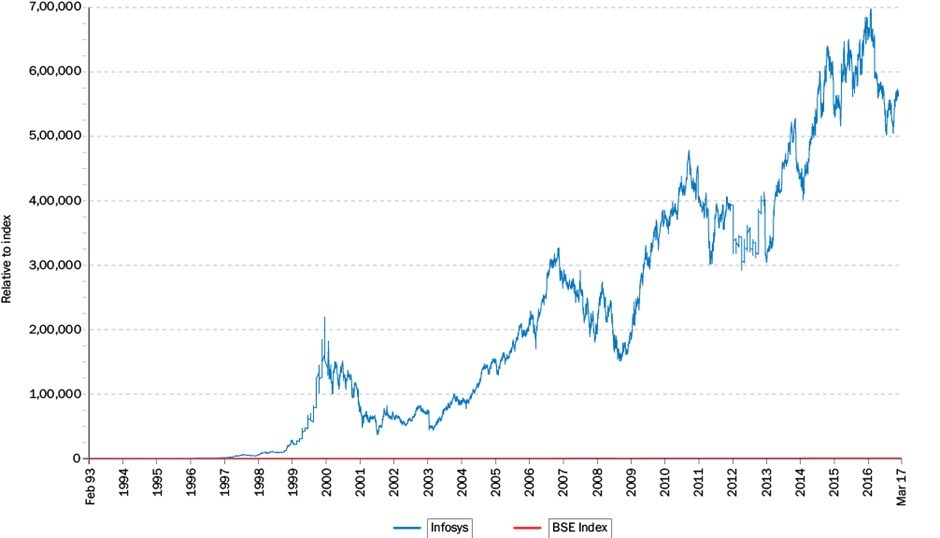

A person who invests from 1994 to 2004 earns less profit than a person who invested from 1994-2017.Therefore, generally a longer time horizon yields higher returns provided that the stocks invested in are of a good company. So an investor should perform analysis of the company before investing.

Double the money in shortest time?

In the real world, no Mutual fund can guarantee that the amount invested will get doubled in a stipulated period of time, even if a fund manager claims that he can double the money it will take a very long period of time. Hence investment getting doubled is a very hypothetical situation.

Historically it has been seen that a mutual fund that provides an annualized return of about 7.2% can double the investment in 10 years. However, the investment is doubled in terms of value and not in terms of purchasing power due to inflation. For example, Rs.10 lakhs becomes Rs.20 lakhs after 10 years but the investor will not be able to buy the same amount of products from Rs.20 lakhs which he could buy 10 years earlier due to the increase in the price of goods and services.

Plan to save? Plan tax

Under section 80C of the Income Tax Act, 1961 a person can claim income tax deduction when he invests in schemes like ELSS (Equity Linked Savings Scheme), Public Provident Fund (PPF), certain bank’s fixed deposits.

ELSS is of moderately high-risk profile hence should be taken up by an investor with a high-risk appetite. However, along with saving tax ELSS also helps in growing the money through investment in the equity market. The long-term capital gains are tax-free but have a lock-in period of 3 years (lock-in period is the period in which the money remains invested). For example, Mr.Aman earns Rs.1200000 p.a. and invests Rs.500000 in ELSS then he can claim up to Rs.150000 as a tax deduction but not more than that.

Save and Invest Systematically-SIP

“Stay committed to your decision but stay flexible in your approach” -Tom Robbins

SIP (Systematic Investment Plan) is a plan in which an investor can invest monthly or from a particular period in the mutual fund. In order to choose a good and suitable SIP, a person should consider certain things. Multi-sector exposure in a diversified portfolio makes the fund less risky since if one sector performs poorly the other sectors in the portfolio will balance it. Large-cap stocks are of established companies whereas stocks of small companies or start-ups are called small-cap stocks. The growth prospects of small-cap stocks in the growing economy are very high and vice versa., whereas large-cap stocks can survive the economic downturn. Therefore, an investor should ensure that the SIP is a blend of both. A fund manager or financial advisor should be consulted who can analyze various aspects of investment and suggest the right SIP.

The Bottom Line:

“Someone is sitting in the shade today because someone planted a tree a long time ago”

-Warren Buffett

So we may conclude that generally mutual funds give a return when invested in for a considerable period of time and in the right fund with adequate information comparison and research. Diversification is also important while investing in mutual fund. Anyone can diversify their investment by investing in multiple mutual fund schemes. Remember mitigating the market risk should be the main motto of an investor. Consulting with a Financial advisor also helps the investor to take better decisions.

Good write-up, I am normal visitor of one’s website, maintain up the excellent operate, and It’s going to be a regular visitor for a lengthy time.