The returns in financial assets vary from each other based on the user requirement and conditions of the market. Want to know more about Asset Allocation? Join NSE Academy Certified Financial Planning & Wealth Management course on Elearnmarkets.

It’s always a better idea to diversify your funds in the different asset classes to reduce the overall risk of a portfolio since all asset classes are not perfectly correlated to each other.

For making a diversified portfolio have different asset classes to reduce the overall risk, you can download Kredent Money App.

Hence diversification should be done across different sectors and asset classes to bring down the overall risk of the portfolio.

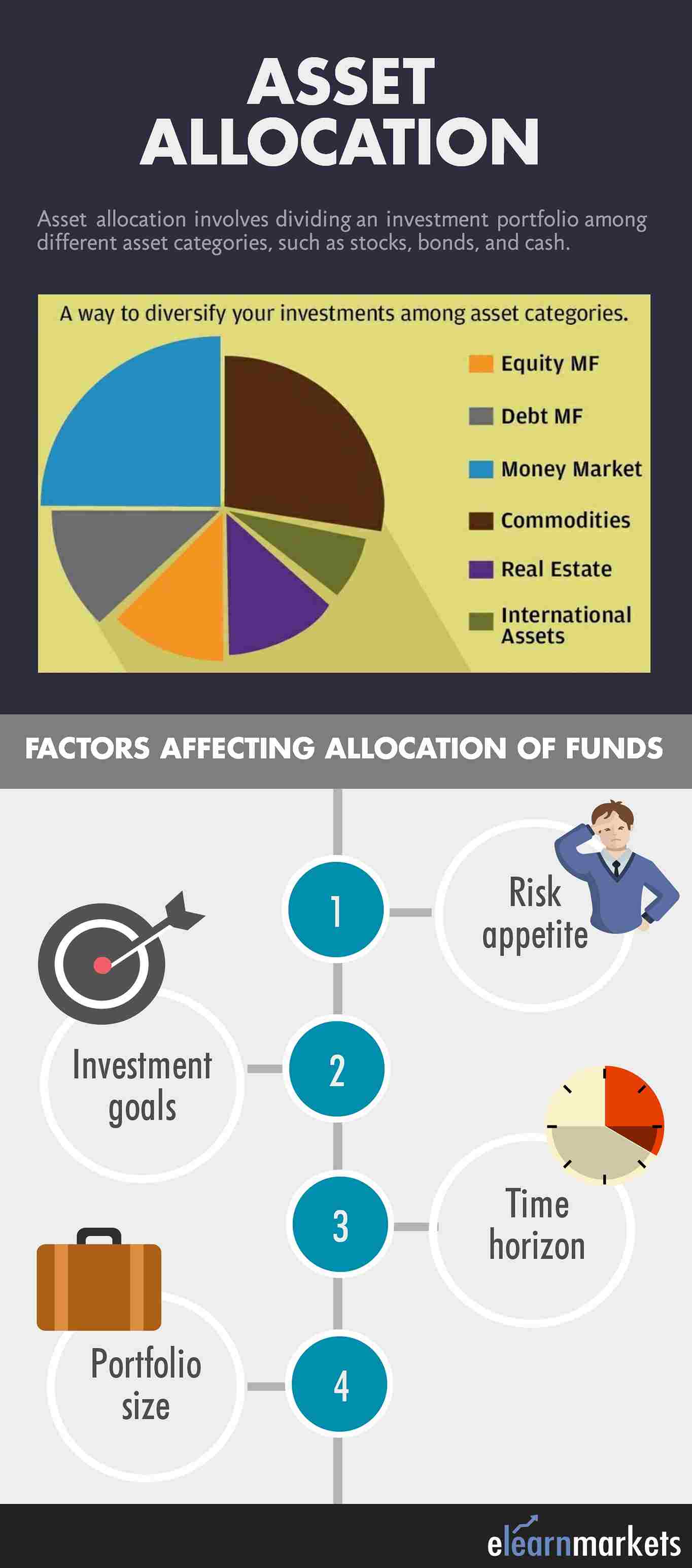

What is Asset Allocation?

Asset allocation is a very important concept in portfolio management theory.

It is an investment strategy through which a portfolio manager or an investor attempts to balance risk reward ratio by adjusting the allocation of funds in different asset class as per investor’s risk appetite, time horizon and goal.

Objective of Asset Allocation

The main goal of asset allocation is to reduce the overall volatility and maximize return.

Know More: Introduction to Asset Allocation

However, one need to understand that asset allocation itself cannot ensure a profit or eliminate risk.

Though one cannot give a guarantee, but say if your investment in one category is not performing well, you have assets in other category as well to cope up for your losses.

Any profit earned in the latter may offset the losses in the former, thus reducing the overall risk of your portfolio.

Factors affecting Fund Allocation

The selection of asset categories for your portfolio and the weight assigned to each category will depend upon the following factors-

1. Risk appetite

2. Time horizon

3. Size of the portfolio

4. Investment goals

A plain and a simple portfolio would comprise as low as three investment classes like stocks, bonds and cash alternative.

However, a more complex one would comprise more asset categories and further breakdown of each broad category.

For example, “stocks” can be categorized into further sub categories like small cap stocks, large cap stocks, high-beta stocks etc.

Types of asset allocation strategies

Strategic Asset Allocation

This strategy involves giving fixed weight to different asset classes in the overall investment horizon.

The portfolio return is simply the weighted average of the returns from various asset classes.

Asset Allocation Example

Say you invested 50% of the funds in equity which fetches 20% return, 30% in bonds yielding 10% return and 20% in real estate yielding 8% return, thus the mean return from the portfolio stands at 14.6%.

Tactical Asset Allocation

It involves slight short term deviation from the original asset allocation to make use of the attractive investment strategies or market fluctuations which exists for a short term.

Here the investor remains slightly active and once the short term profit has been earned, the portfolio is re-balanced to the initial portfolio mix.

Dynamic Asset Allocation

It is mostly meant for active investors who regularly track their portfolio.

Here the allocation is made in different asset classes based on the fluctuations in the market and the overall economy.

The investor may shift profits from a risky asset to a less volatile asset when market enters a correction phase and the vice versa when the market starts booming.

Conclusion

Deciding upon a proper asset allocation remains the single most important decision which you need make since it will more likely to impact your investment return.

In case you are not able to decide upon the asset allocation, don’t hesitate to seek the help of an expert.

Moreover, don’t forget to review your portfolio periodically to ensure that the chosen investment mix serves your investment requirement.

well explained.

Hi Raju,

Thank you for reading!

Keep Reading!

I’ve read some good stuff here. Certainly value bookmarking for revisiting. I surprise how much effort you set to create this type of excellent informative site.