Nifty (Close approx. 9908.05)

The market fell for the third consecutive session on Wednesday.

In today’s session, Nifty was down by 70.50 points and in the daily time frame, the 20 DMA or mid-Bollinger support (at approx. 9974.7) got broke and faced strong resistance (the Bearish tone was stated in yesterday’s report below 9970).

Nifty opened gap down pulled back and after making an intraday high of 9969, slipped about 75 points subsequently.

Hourly Technical:

In the hourly chart, Nifty is bearish, but oscillators (slow stochastic, CCI) are in the oversold zone.

Hence, there is a possibility of a pullback to short-term moving averages.

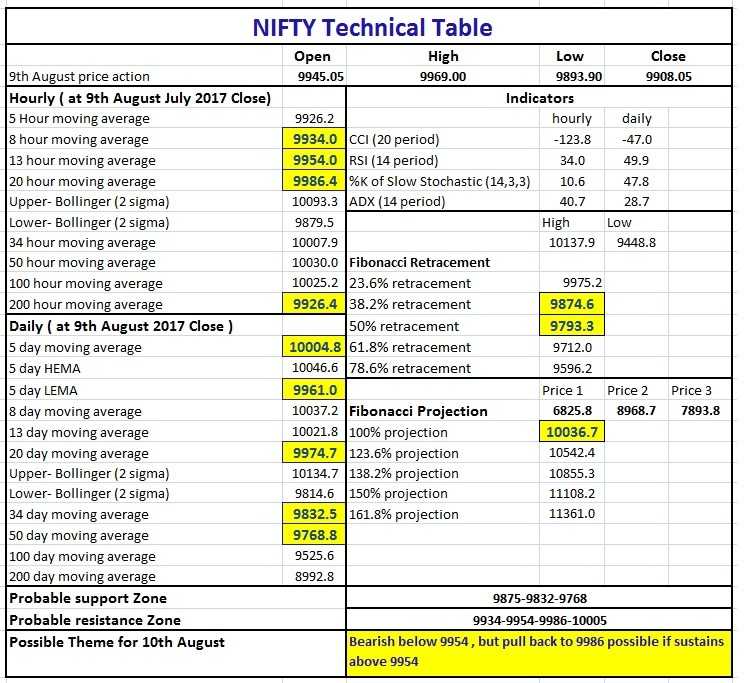

The probable resistance in the hourly chart could be seen at 200-hour moving average (presently at approx9926.4), 8 hours moving average (presently at approx 9934), 13-hour moving average (presently at approx 9954) and 20 hours moving average (presently at approx9986.4).

The probable support in the hourly chart could be seen at 38.2% Fibonacci retracement (presently at approx 9874.6).

The expected downward price level based on Fibonacci retracement of the up move from the previous bottom (approx. 9448.8 to 10137.9) comes at 9874.6 (38.2%), 9793.3 (50%), 9712 (61.8%) and 9896.2 (78.6%).

Hourly RSI is close to lower bound of the normal region.

Moreover, the rising ADX line also suggests downside momentum in the hourly price chart. Overall Nifty remains bearish in the hourly time frame.

Figure: Nifty Hourly Chart

Daily Technical:

In the daily time frame, the market broke 20 DMA or mid-Bollinger support (at approx 9974.7) with a gap down.

The 20 DMA line acted as a good resistance in today’s trade and gave a good correction after making a high of 9969 in the very first hour.

The next probable support in the daily chart remains at 34 DMA (presently at approx 9832.5), 50 DMA (presently at approx 9768.8).

The uptrend which started in the last week of December 2016 is still intact and the fall in the last few days could be a mere correction.

However, 50 DMA (at approx. 9870) and uptrend support (at approx. 9890) could act as a strong support for Nifty in the coming days.

On the upside, the probable resistance could be seen at 5 day low EMA (presently at approx 9961), 20 DMA (presently at approx 9974.7) and 5 DMA (presently at approx 10004.8).

Daily CCI, RSI and slow stochastic have turned down from the overbought zone which is a moderate bearish signal as of now.

Overall, Nifty in the daily time frame remains reasonably bearish in the near short term.

Become a technical analysis expert by joining: NSE Academy Certified Technical Analysis course.

Figure: Nifty Daily Chart

Figure: Nifty Tech Table

Watch the video below to know how to interpret the above table: