| Table of Contents |

|---|

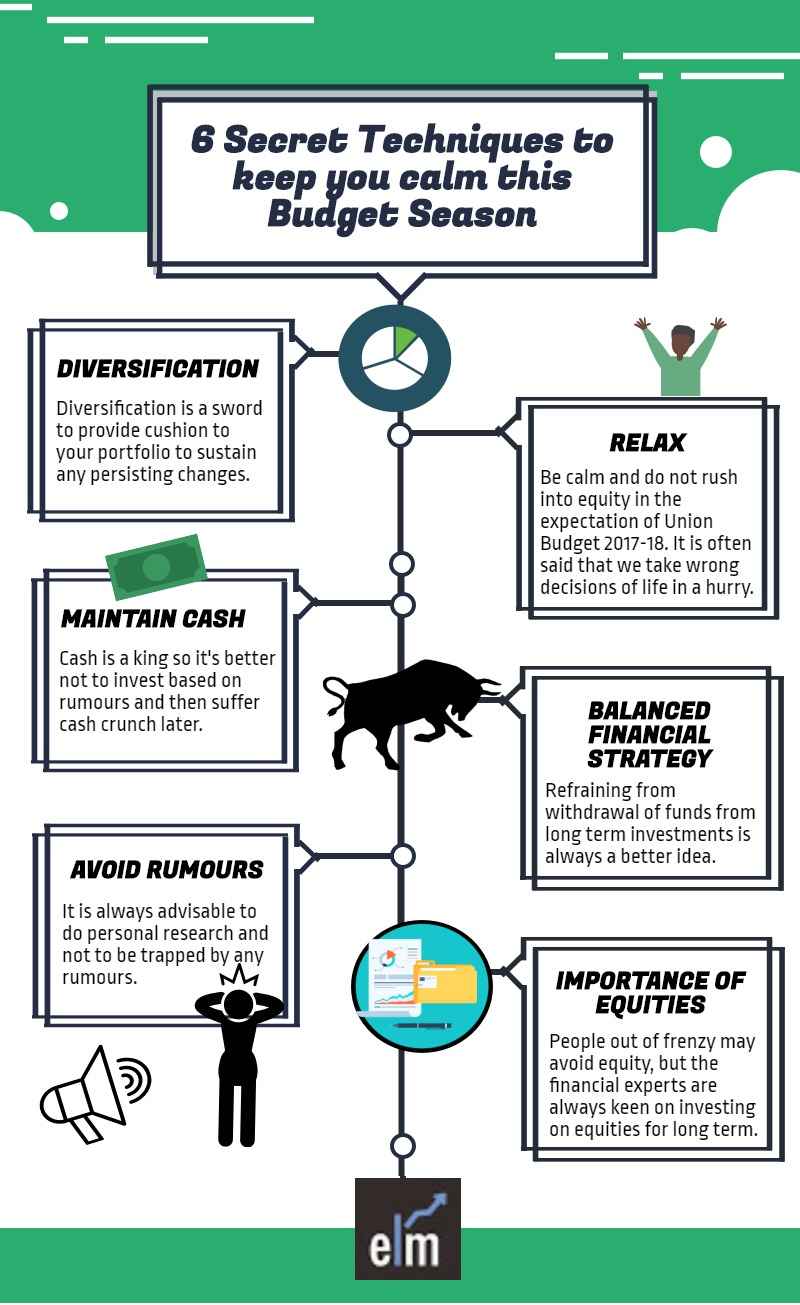

| Relax |

| Maintain a cash position |

| Balanced financial strategy |

| Avoid rumor’s and do dedicated Research |

| Importance of Equities |

| Bottomline |

The main agenda for most of the discussions throughout the country is the anticipation of Union Budget. People are expecting changes in taxation structure of the income tax slabs. Apart from this tax structure of the capital market instruments is also anticipated to shuffle. Announcements of public benefit schemes, demonetization notifications etc. are also expected to be in store of budget agenda.

The market may expect a substantial rejig too and traders may be keen to shuffle their existing portfolio looking at what the Union Budget 2017-18 may bring in. The experts suggest to take an easy way and not to reshuffle their portfolio based on the contradictory predictions around the corner of the Union Budget 2017-18 date.

Based on the experts/ financial advisor’s views, we bring before you 6 simple ways in which you should ease yourself in investment decisions without jumping over to any conclusions.

Diversification

The basic financial principles of investing are not going to change whether before or after the budget. Keeping your investment intact in your existing portfolio and possibly maintaining a portfolio of diversified asset class will give you enough cushion to sustain any persisting changes.

Lean in 2 hours: Become your own Portfolio Manager

Relax

The Union Budget 2017-18 is just a short timed phenomenon.

Do not agitate and make yourself uncomfortable anticipating something which may not be good for you.

It is often said that we take wrong decisions of life in a hurry.

Do not hurry and wait for the right time, even after the declaration of the Union Budget 2017-18 you will get enough time to take a balanced move.

Maintain a cash position

Maintaining a good deal of cash position is no harm.

One should not expend the cash balance in trying to invest based on rumors and then suffering cash crunch later.

Also Read: Holding Cash- an important decision

Balanced financial strategy

Government expends a substantial amount under long-term investments such as infrastructural development etc which takes substantial time to get completed.

But this does not mean that the Government will withdraw its investments seeing that the project will take a considerable long time.

Similarly, we should refrain ourselves from withdrawing fund from our long-term goals, which is surely not advisable.

Avoid rumor’s and do dedicated Research

There is a barrage of rumor’s that follow before or after certain events.

It is always advisable to do personal research and not to be trapped by any rumors.

Rumors are merely false information that tends to lure you for taking negative positions.

The Union Budget 2017-18 is soon going be on the air, wait for some time, analyze yourself and then taking any further step.

Importance of Equities

Experts think that this is the time to plunge into equities.

People out of frenzy may avoid equity, but the financial experts are keen on investing in equities.

Bottomline:

The crux of the discussion is to wait for the budget day and listen to what the Finance Minister has in store for us.

Let us all wait for 01st Feb 2017, listen to what has already been settled and then restructure our financial goal accordingly.

Happy Learning!!