Last week I went to Ranchi for six days to attend my friend’s marriage. People, there are away from the hustle and bustle of big city life and attention seeking business media. There wasn’t much access to media there unless I use my cell phone or turn on my laptop.

In the last one week, I felt so relaxed and calm that it made me realize the role of business media in investor’s life. In our earlier blog, we have discussed how media plays with the life of market participants and it’s better to avoid financial media in taking a decision.

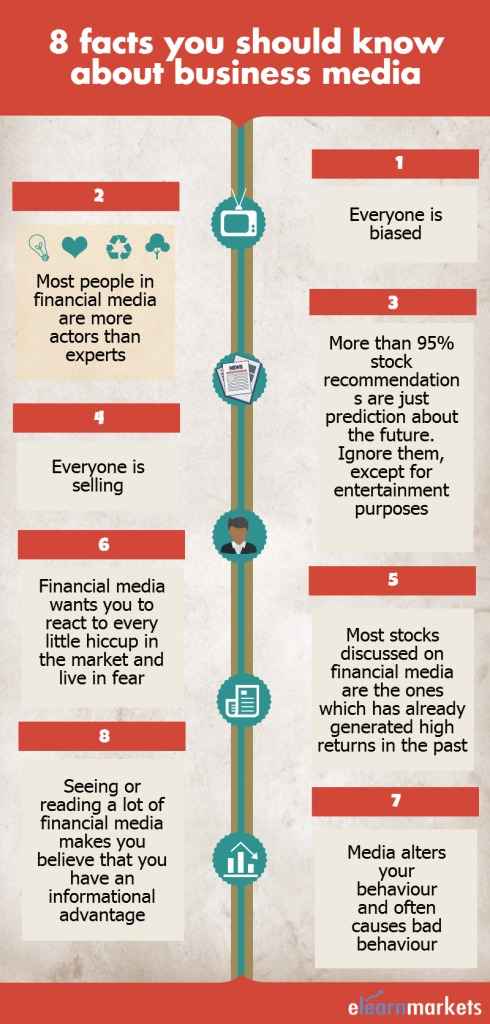

So if you are one of them who pays a lot of attention to financial media and base your trade based on their recommendation, here are eight facts you must know how media affect your mind and behaviour in the long run.

1. Everyone is biased

Most of the people we see on business media is paid. Since everyone is selling something, biasness is bound to occur. If you still want to base your decision on the financial media, it’s better to conduct your research rather than blindly following them.

2. People in business media are more actors than experts

The anchors and analysts on financial media try to create an authority bias through good English, use of high-fi jargons and with good dress up. These are the perfect ingredient to trap people.

Want to know more about some important facts of financial media, watch the video below:

3. Everyone is selling

Everyone is selling something or other thing in the market.

Some sell you the stocks they already hold (so that they become richer and richer when you buy), some tries to sell some financial products, some newsletter or any finance workshop.

You need to be extremely careful before entering into any deal.

4. More than 95% stock recommendations are just prediction about the future.

You will find many recommendations given by a lot of analyst in the market. It’s on you that which one to go with (but be very careful) and which one to avoid.

Learn basics of Financial market with Financial Market Made Easy Combo Course by Market Experts

If you are willing to read predictions (recommendations), go through the reports or recommendations made 8-10 years ago. You’ll understand why it’s better to avoid the current ones.

5. Stocks discussed on business media are the ones which have already generated high returns in the past

You will mostly find these financial actors making recommendations about the stock which has already given good returns in the past like ITC, Tata Motors, Reliance etc.

In reality, things do not move in such straight lines. You cannot make good returns from stocks which are in limelight. Rather look for counters which have a sound business model and away from these media coverage.

6. Business media wants you to react to every little hiccup in the market and live in fear

This is just so that you stick to their network and keep receiving the investment advice from their anchors and guest analysts (so that it can generate more advertising revenue for them).

7. Media alters your behavior and often causes bad behavior

It has been found that your well-researched and thought investment plan gets ruined due to the meaningless noise in the media.

It’s important to be very careful what you are listening, reading and digesting.

8. Seeing or reading a lot of Business media makes you believe that you have an informational advantage

You start imagining yourself wiser and smarter by listening to drama ridden daily media news or stories. Good books or letters from legendary investors like Warren Buffett, Howard Marks, etc provides you with real wisdom.

Bottomline

It’s not only the media people whom we should blame.

The biggest drive of what media shows is what the audience wants to see. Hence, it’s really important for us to decide what’s right for us and what’s not when it comes to consuming financial news and information.

The time which you will save from watching financial media can be spent in reading good books or conducting your research.

In order to get the latest updates on Financial Markets visit Stockedge