The government is ready to launch the new ETF (the first being launched in March 2014) which is based on the CPSE Index.

Also Read: Why to Invest in Gold ETF in India

Managed by Reliance Mutual fund (an arm of Reliance capital), it will launch the further fund offer (FFO) on 17th January.

The FFO (part of the government’s overall disinvestment program ) will remain open until 20th January and it will be open for all category of investors which includes retail investors, anchor investors, QIBs, retirement funds, non-institutional investors and foreign portfolio, investors.

However, the FFO will remain open on 17th January only for anchor investors and for another category of investors from January 18-20.

CPSE ETF

CPSE ETF, which works like a mutual fund scheme includes the shares of 10 biggest public sector companies- Coal India, GAIL, Bharat Electronics, ONGC, Container Corporation, Power Finance Corporation, Rural Electrification Corporation, Oil India, Indian Oil and Engineers India.

Know More: Basic Facts You Must Know About Mutual Fund Schemes

Benefit

The fund basically aims to benefit investors from the growth potential of India in the long term by investing in a diversified pool of public sector companies.

To manage your personal finances, download Kredent Money App, a one-stop tool to assist you in your financial journey.

The fund proposes to raise up to Rs 4500 crore in the FFO of CPSE ETF with a choice of keeping back the oversubscription amount up to Rs 1500 crore.

Moreover, a discount of 5% will be provided to all categories of investors as a part of FFO.

Valuation and past performance

The valuations of CPSE index still looks very attractive where its price-to-earnings stands at 12.23, which is much lower than Nifty 50 and dividend yield of 4% which is much higher than that of Nifty 50 Dividend Yield.

Moreover, it’s also a low-cost way to take exposure in the PSU’s.

In the past one year, its own benchmark Nifty CPSE is up by 33.06% whereas Nifty 50 has returned around 9%.

The performance of the first CPSE ETF (launched in 2014) vis a vis Nifty 50 index has been really impressive.

The annualised return of CPSE ETF stood at 14.5% since its inception as compared to 7.5% of the Nifty in the same period.

This makes it one of the best performing large-cap fund.

Want to know more about ETFs? Enroll in:NSE Academy Certified Financial Planning & Wealth Management course on Elearnmarkets.

Drawbacks

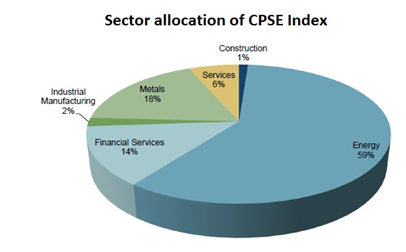

Moreover, the portfolio is actually concentrated towards a few sectors including metals, energy and financial services which make up to 90% of the overall portfolio which actually offers a greater risk element to this ETF.

Bottomline

Though there is some comfort with regards to the lower valuations for the underlying PSU stocks but the main point is that we need to dig in for the reasons for such cheap valuations.

The reason why private sector businesses are awarded expensive valuations could be that they run far more efficiently in their respective sectors.

However, the proposition to invest in CPSE ETF seems attractive due to the discount and the loyalty bonus but before investing conduct a full research about the underlying growth potential of the businesses and the time frame you want to hold it for.

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.