China Devaluing the Yuan

Price Movement Today: Markets were in for a round of another downfall today as the Nifty shed 108 points. The day started with a gap down open of 17 points at 8445. Throughout the day, it fell -1.28% to end at 8354. The stocks which gained the highest today were HCLTECH(+3.36%), TECHM(+3.31%), SUNPHARMA(+3.01%), INFY(+2.87%) and TCS(+2.53%). The biggest losers were HINDALCO(-7.12%), VEDL(-7.08%), BPCL(-6.19%), COALINDIA(-5.12%) and CAIRN(-5.05%).

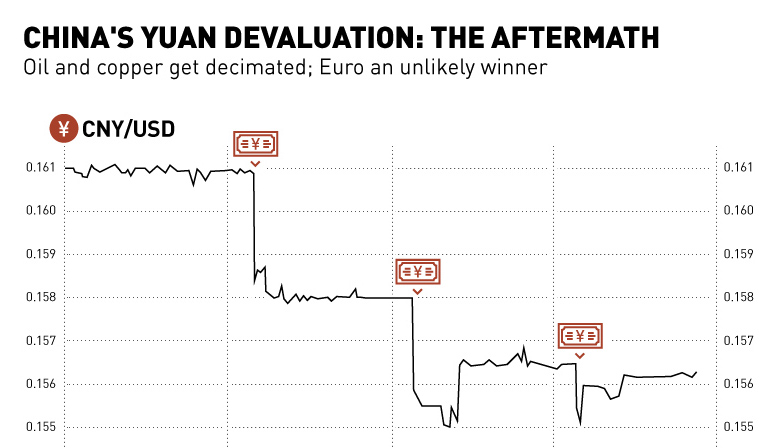

We are Coupled: With the fear of devaluation of the Yuan, the Global markets took a hit. The DJIA was down -1.21%, FTSE (-0.96%) and DAX(-2.37%). Hang Seng closed today after losing 600 points

Pockets of Strength: In the sectoral indices, the only gainers today were CNX IT(+2.44%) and CNX PHARMA(+1.19%). The sectors which lost the most were CNX REALTY(-5.67%), CNX METAL(-3.93%). The IT sector was considered as the safest bet today after the impact of the China Currency Devaluation. HCLTECH was the highest gainer today in the IT sector. The immediate support for HCLTECH is at 920 while the resistance is at 1020.

The Sun Rises: India’s largest drug maker Sun pharma posted its Q1 result on tuesday. The consolidated net profit was down 46% QoQ ( down 60.2 YoY) to Rs 479 crore. The net profit was deeply impacted by exceptional loss, higher tax expenses and lower other income. The topline however met expectations and is up by 10%(up 6.7% YoY) to Rs 6767.6 crore in June quarter compared to 6157 crore in last quarter.

The management said that the net profit for the quarter was adversely impacted due to one time items related to restructuring as well as exceptional charges related to impairment of fixed assets, goodwill and other related costs have arisen on account of Ranbaxy integration and optimisation measures. The company already issued profit warning (on july 20), saying FY16 revenue will remain flat or record marginal decline compared to FY 15.

Hence, profit may also be adversely impacted due to certain expenses/charges arising out of Ranbaxy integration as well as remedial actions. The stock since profit warning on 20th july has corrected around 15% and yesterday inspite of the poor bottomline figure, today it was up around 3% because this drop in profits was already factored in the price.

Today Indian markets saw a huge pressure due to Yuan’s devaluation and uncertainty over the GST bill. Sensex sinks 354 points while Nifty below 8400 mark after the weak European market open. Almost all global indices were down by around 1-3% due to China’s surprise currency devaluation. Seeing the fear in the global markets gold prices soared by Rs 600, its biggest one-day surge this year. It traded at its highest level in more than three weeks at Rs 26,000 per ten grams. IT and Pharma were the only two sectors trading positive while PSU, Realty,etc got really beaten down clearly indicating the market trend to be down.

Yuan Devaluation: China’s Devaluation has indeed impacted three prominent sectors of the Indian Markets:

- Metal Sector: China has been facing several lawsuits before for selling their metal products at lower than the cost price in many countries. The metal producers of India and many other global nations were impacted due to the rise in the metal exports from China. In order to fight the low price, the Indian government recently hiked the import duty in metals. But this has now been nullified due to the devaluation of the Yuan.

- Textiles Sector: China is the biggest competitor of India in the textile sector. Due to the devaluation of the Yuan, now the Chinese textile companies will be able to sell higher quality textiles at lower rates in India. In the lower segments of the textile industry, a 1.9 per cent devaluation will lead to a massive decline in the profits of the Indian Textile Companies.

- E-Commerce: With China being the prime producer of consumables of Mobiles, laptop garments, toys etc, we can expect them to get cheaper in the coming weeks. This can be one of the good impacts of the Yuan Devaluation. We can now expect more Big-Billion sales in the e-commerce sites in the near future.

Thus, we can say that it has been an eventful day in the Indian market market today. Lets keep our fingers crossed that the market recovers most of the losses from yesterday and today in the new couple of trading sessions.

BOTTOMLINE

Visit blog.elearnmarkets.com to read more blogs.

Get data at one particular place and also create your own combination scan based on your own technical and fundamental parameter on Stockedge.