Weekly Nifty and Bank Nifty Technical Analysis:

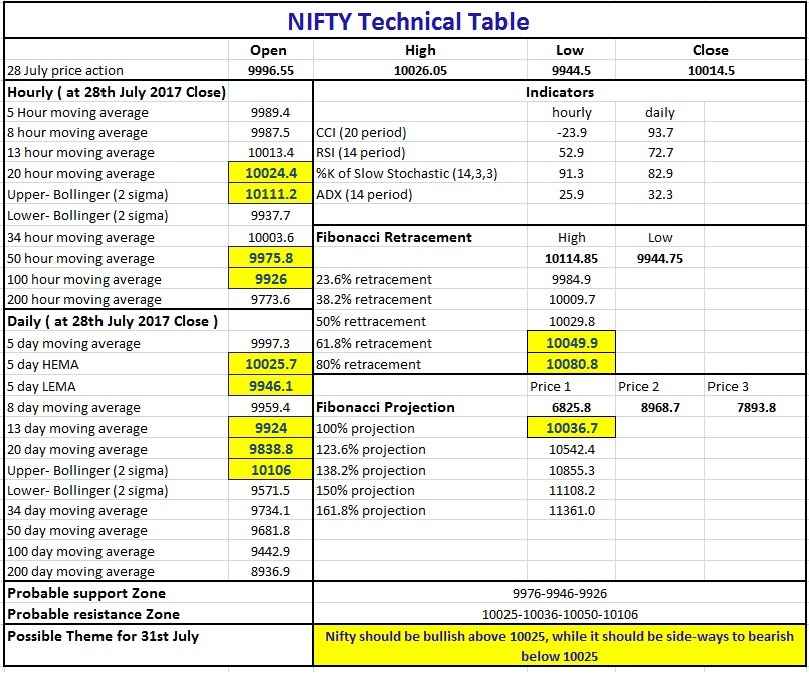

Nifty (Close 10014.5): This week, Nifty opened above the small consolidation band as shown in our last weekly report and continued uptrend. On Thursday, there was bearish engulfing pattern formed on hourly chart and market corrected on second half of Thursday and most part of Friday on back of that. Towards the end of Friday, Nifty bounced back almost 70 points from its intraday lows.

Nifty Hourly Technical: Nifty is just above the upward sloping trend line as shown in the hourly chart. There are two possibilities. Nifty may either obey this trend line and resume its uptrend from here, or it can break the trend line and eventually break the 100 hour moving average to extend its correction.

On the downside, 50 hour moving average, 100 hour moving average and 200 hour moving average should be logical support levels to look at, which presently stand at approx. 9976, 9926 and 9774 respectively.

On the upside, hourly mid Bollinger (presently at approx. 10025), approx. 10050 (61.8% retracement level of the present fall) and approx.10081 (approx. 80% retracement of the recent fall) should act as possible hurdles.

Hourly CCI, RSI are in neutral zone, while hourly slow stochastic is just entering in neutral zone from over sold zone. Hourly ADX is losing momentum. Overall, neutral to slightly bearish on momentum parameters. But, multiple hourly closes above the hourly mid-Bollinger line will likely negate bearishness.

Figure: Nifty Hourly chart

Nifty Daily Technical: The Nifty is Neutral to bullish in daily time frame. On the downside, supports may emerge near 13 DMA (presently at approx. 9924), 20 DMA (presently at approx.9839). There can be correction even to 34 DMA or 50 DMA, but the overall bullishness that started from December 2016, will not be altered until and unless Nifty breaks 100 DMA (presently at 9443 approx.).

On the upside, upper Bollinger band (presently at 10106 approx.) should act as resistance.

Daily RSI and daily slow stochastic are in overbought zone, while daily CCI has just entered into the normal zone. ADX is neutral to bullish.

Figure: Nifty Daily chart

Nifty Weekly Technical: In weekly chart, Nifty remains firmly bullish. Weekly CCI, RSI, slow stochastic, ADX are bullish. Weekly close above 10036 (approx. 100% projection of the move from approx.6826 to approx. 8969, from Dec 2016 low of approx. 7893) will open up Nifty for higher projection targets (10542, 10855, 11108, 11361 etc.) as shown in the following weekly chart.

Figure: Nifty Weekly Chart

Figure: Nifty Tech table

Bank Nifty (weekly close approx. 24811.30):

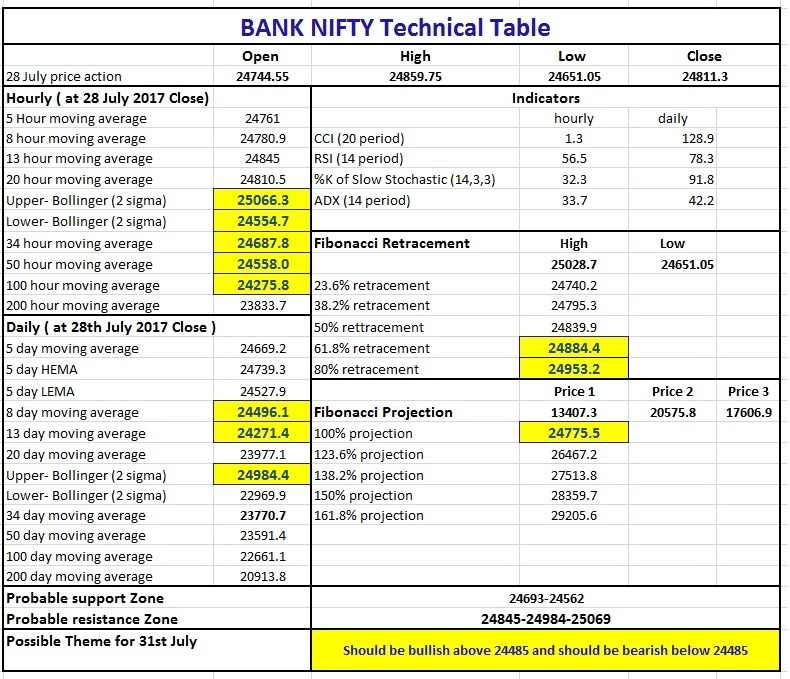

Bank Nifty: This week Bank Nifty continued the steady uptrend. On Thursday just before expiry there was a bearish engulfing pattern formed in hourly chart, which resulted in a corrective down move. Towards the end of the week, Bank Nifty took support near 34 hour moving average and had a minor 160-170 point bounce.

Bank Nifty Hourly Technical: The very recent up move which started from end of June has been all through very steady and supported by 34 hour moving average on the downside. This time also, Bank Nifty has bounced back from 34 hour moving average (presently at approx. 24687.7) on Friday.

On the downside, 34 hour moving average, and 50 hour moving average may act as probable immediate supports.

On the upside, 13 hour moving average (presently at approx. 24845) is the borderline between the bulls and the bears for now. Once, above that, Bank Nifty can resume its uptrend and aim for new highs.

Hourly CCI, RSI are in neutral zone, while hourly slow stochastic is just showing possibility of bottoming out. Hourly ADX is trending down.

Figure: Bank Nifty Hourly chart

Bank Nifty Daily Technical: In daily chart, Bank Nifty is bullish to neutral. Daily CCI, RSI, slow stochastic are in overbought zone and daily ADX is trending up.

On the down side, support may emerge at 5 DMA (approx. 24669 presently), 8 DMA (approx. 24496 presently) and 13 DMA (approx. 24271 presently).

On the upside, the bank Nifty can move to daily upper Bollinger line (presently at approx. 24984) or higher.

Figure: Bank Nifty Daily chart

Bank Nifty Weekly Technical: Weekly CCI, RSI, slow stochastic, ADX are in respective overbought zones and indicating firmly bullish momentum of Bank Nifty in the weekly time frame.

On the downside, major weekly support remains near 8 week moving average (presently at approx. 23800).

The most significant point is that, Bank Nifty gave weekly close above 24775 (approx. 100% projection of the move from approx.13407 to approx. 20576 from December 2016 low of approx. 17607). This opens up bank Nifty for higher Fibonacci projection targets (26467, 27514, 28360, 29206 etc. as shown in the weekly chart and tech. table below).

Figure: Weekly Bank Nifty chart

Figure: Bank Nifty Tech table