Larson and Toubro ( LT ) lost nearly 45% from the top of 1880 formed back in July 2015. Currently it is consolidating near an important level of 1100. Since mid-January 2016 , it has been taking support at the level of roughly 1100.

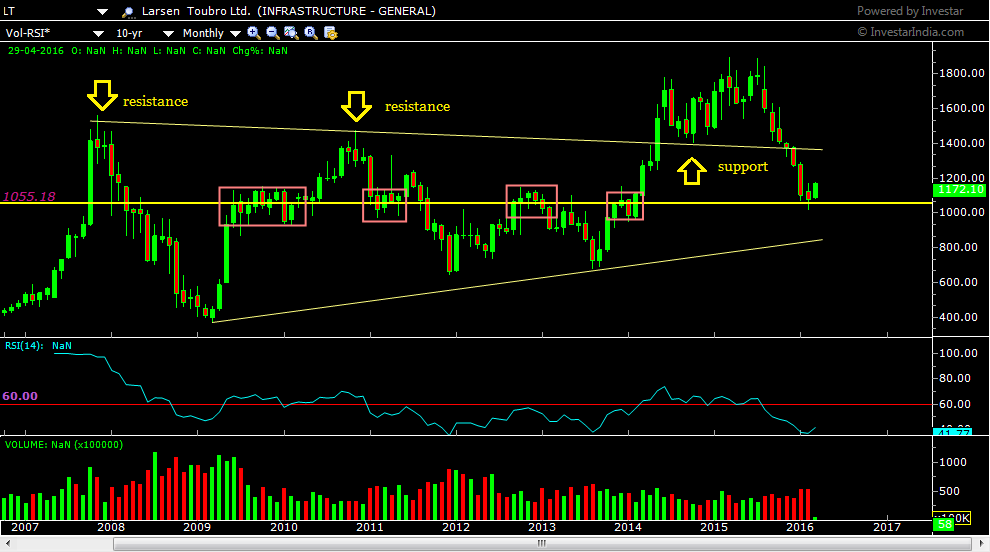

As we can see on the monthly chart of LT below, since 2007, the resistance and support trendlines have been playing very important roles in deciding the support and resistance zones for the stock.

An instance of Change of polarity is also visible on the chart. In 2008 and 2011 we see the resistance trendline acting as the resistance however in 2014, after a breakout on the upside, the trendline acted as the support. However the trendline has been breached in the recent correction witnessed.

The boxes drawn on the chart also highlight price activity in the zone of 950-1150 in the past. This proves that the zone is important in terms of supply and demand for LT. The fact that the price of LT has come to this level and shown a reversal upside is a plus for the stock.

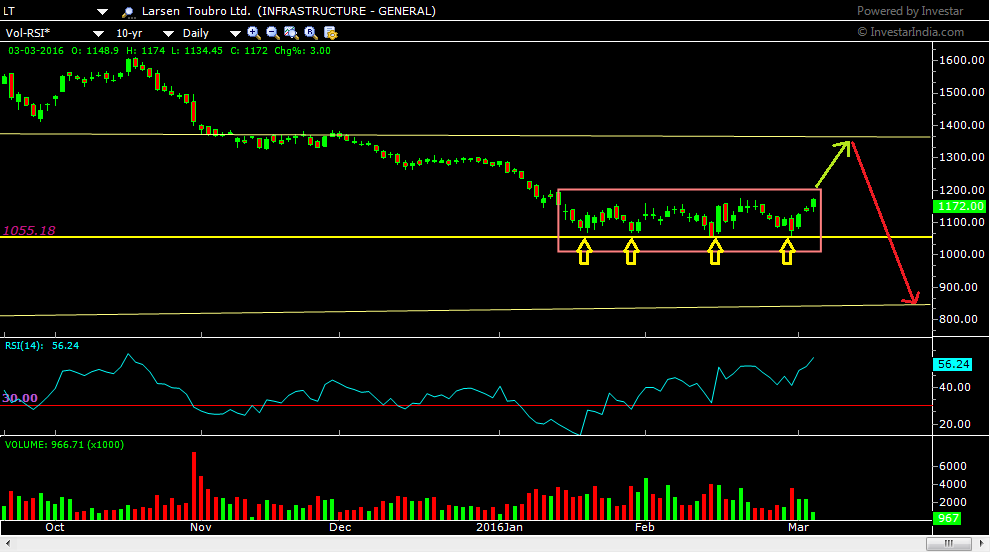

In the daily chart of LT, lets take a closer look at the recent price movement.

On taking a closer look, the level of 1055 comes out as the integral support level, from where the stock has bounced up four times. The box shows a consolidation phase and an upside breakout will ensure continued upside movement. However, the resistance is not very far, the trendline which we discussed above, also visible on the chart, poses resistance in the price zone of 1360-1390. RSI in lower window, drawn in blue line has also shown a positive divergence.

However, as shown in Chart #2, The upside appears to be restricted to the level of 1360 due to the presence of a resistance trendline. In case the prices turn lower again from the resistance level, then the support level at 850 will become a possible level for the stock. However that is a distant thought and more like a Plan B that the main agenda of this post.

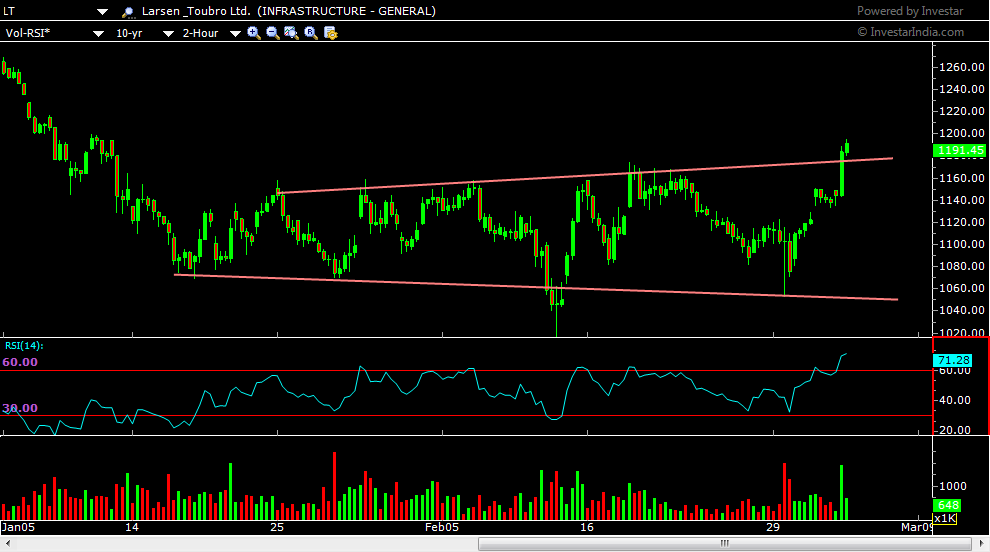

Another interesting phenomenon has occurred as I prepare this article. Below we have the 2 hours intraday chart of LT, showing that the consolidation , is more of a broadening triangle , and has given a breakout on good volumes, thereby reinstating the upside in this stock.

Also, if you take into consideration the general market sentiments, you will know that the market in general has been extremely positive since the budget, whereas LT has not shown the same sentiment to that extent in-spite of being a high beta stock. This coupled with the consolidation and the low volumes on the recent declines(visible on the chart above) adds to our hopes for this stock to perform better in coming days.

We welcome your feedback and comments on this article. If you have doubts related to the technical jargons mentioned in the article, you are encouraged to refer to the articles linked. You can also check NSE Academy Certified Essential Technical Analysis.