Nifty close 9859.5: Nifty opened 100 points gap up on positive global cues after extended weekend. The next set of triggers will come from Manufacturing PMI data ahead of RBI tomorrow.

Hourly Technical:

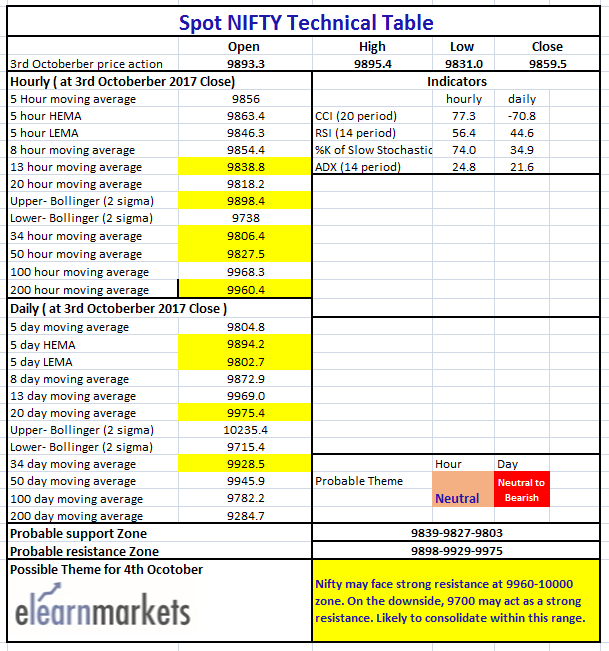

In the hourly chart, Nifty opened higher but went range bound after the initial hour of trade. The probable support in the hourly chart comes at 13 Hour moving average (presently at approx. 9838.8), 50 Hourly moving average (presently at approx.9827.5) and 34 Hour moving average (presently at approx. 9806.4).

On the upside, it may face resistance at upper Bollinger line (presently at approx. 9898.4) and 200 Hour moving average (presently at approx. 9960.4).

Figure: Hourly Chart

Daily Technical:

In the daily chart, Nifty may face strong resistance at 9975-10000 zone. Presently it is in a 5 Day High-Low EMA band, which indicates consolidation; breakout on either side will set Nifty’s direction going forward.

The probable support in the Daily chart comes at 5 Day Low EMA (presently at approx.9802.7).

On the upside, Nifty may face resistance at 5 Day HEMA (presently at approx. 9894.2), 34 DMA (presently at approx. 9928.5) and 20 DMA (presently at approx. 9975.4).

Figure: Daily Chart

Figure: Tech Table