Bank Nifty opened below its 5 Day High EMA at (24202 approx) today . The Index traded in a range of 208 points throughout the day and closed below its 5 Day low EMA of (24103 approx).

Hourly Technicals:

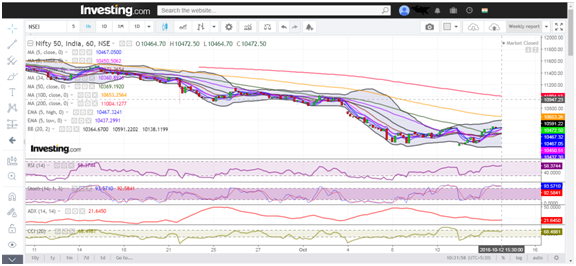

In the Hourly Chart, Bank Nifty has closed marginally above its 5 Hour High EMA of (24103 approx).The Index is likely to face immediate resistance around 24219 mark. If Bank-Nifty trades and closes below the 34 hourly moving average it might find its next support area below the lower end of the Bollinger Band ( 23800 approx).

Hourly RSI stands midway between the normal range while the CCI has closed towards the above the positive range. The ADX is indicating lack of momentum.

Figure: Bank-Nifty Hourly Chart

Daily Technicals:

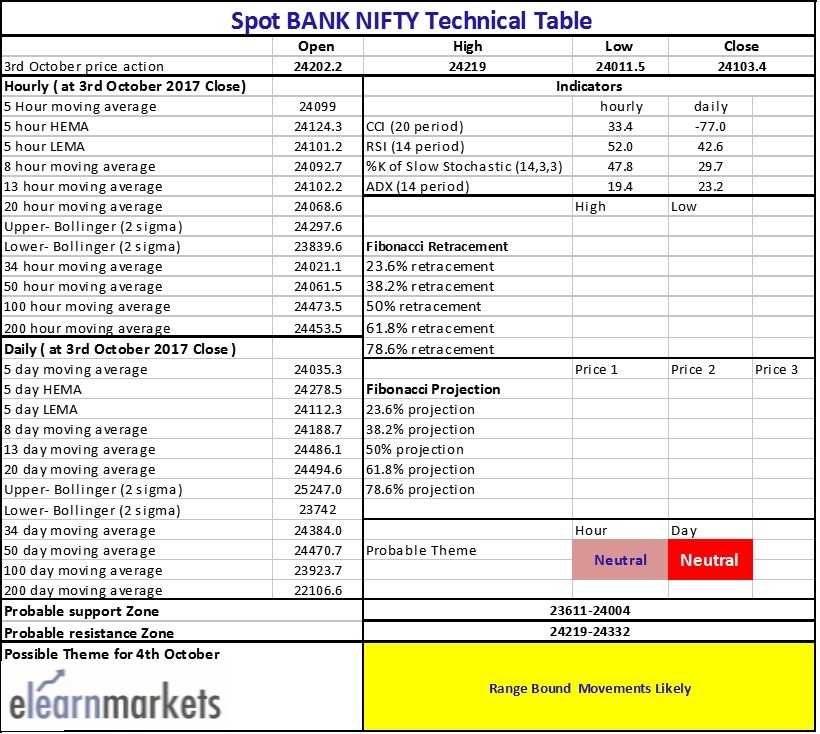

The daily chart indicates that Bank Nifty has closed marginally below its 5 day low EMA(24112 approx). The Index will face the next wave of resistance around the 34 DMA (24384 approx). On the downside however, if Bank Nifty breaks and closes below its Previous Day Low( 24004 approx), it could find support around the lower range of the Bollinger Band ( 23600 approx) area.

The daily RSI indicator has closed midway between the normal range.The CCI has closed below its normal range ADX indicates momentum might be picking up.

Figure: Bank-Nifty Daily

Figure: Bank-Nifty Tech Table