Nifty close : Nifty traded in a mere 50 point range in today’s session and managed to close above 10200 mark. The index has been consolidating since last 4-5 trading session at the top making doji patterns suggesting indecision and tough fight between the bulls and the bear.

Hourly Technical:

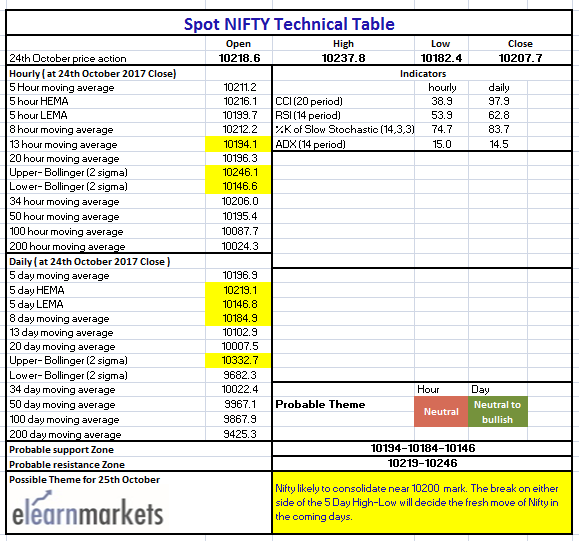

In the hourly chart, Nifty was in a very tight range in today’s session. The probable support in the hourly chart comes at 13 Hour moving average (presently at approx.10194.1) and Lower Bollinger line (presently at approx.10146.6).

On the upside, Nifty may face resistance at Upper Bollinger line (presently at approx.10246.1).

Hourly CCI and RSI are in the normal zone while Stochastic is very close to the upper bound. ADX is downward sloping suggesting loss of momentum. Overall Nifty remains neutral in the Hourly chart.

Figure: Hourly Chart

Daily Technical:

In the daily chart, Nifty closed marginally below 5 Day High EMA (presently at approx. 10219.1 ), close above which will bring the bulls back in the game.

The probable support in the daily chart comes at 8 DMA (presently at approx. 10184.9) and 5 Day Low EMA (presently at approx.10146.8).

On the upside, Nifty may face resistance at 5 day High EMA (presently at approx. 10219).

Daily Stochastic is in the overbought zone while Daily RSI and CCI are trading near its upper bound of their respective range. The ADX is still moving downward suggesting loss of momentum. Overall Nifty remains neutral to bullish in the daily chart.

Figure: Daily Chart

Figure: Tech table