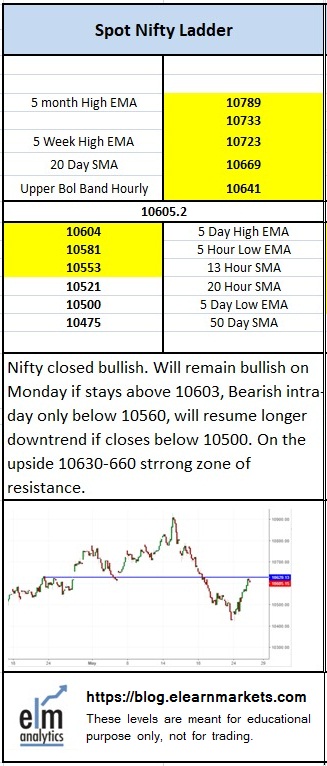

Nifty close 10605.15: Nifty ended the week on a positive note after short covering on the expiry day followed by good buying on Friday’s session. The benchmark index registered a high of 10627 and managed to close above 10600 mark.

Hourly Technical

In the hourly chart, Nifty is trading slightly below 200 Hour moving average (presently at approx.10656.8) which is a strong resistance in the short term; close above which positive short term move can be expected. The probable support in the hourly chart comes at 5 Hour Low EMA (presently at approx. 10581) and 13 Hour SMA (presently at approx. 10553).

On the upside, Nifty may face resistance at upper Bollinger line (presently at approx. 10641) and 200 Hour moving average (presently at approx.10656.8). Hourly Stochastic and CCI are trading in the overbought area while hourly RSI is trading close to the upper bound of its respective range suggesting strength in the hourly time frame. Overall, Nifty appears strong in the Hourly chart.

Hourly Chart

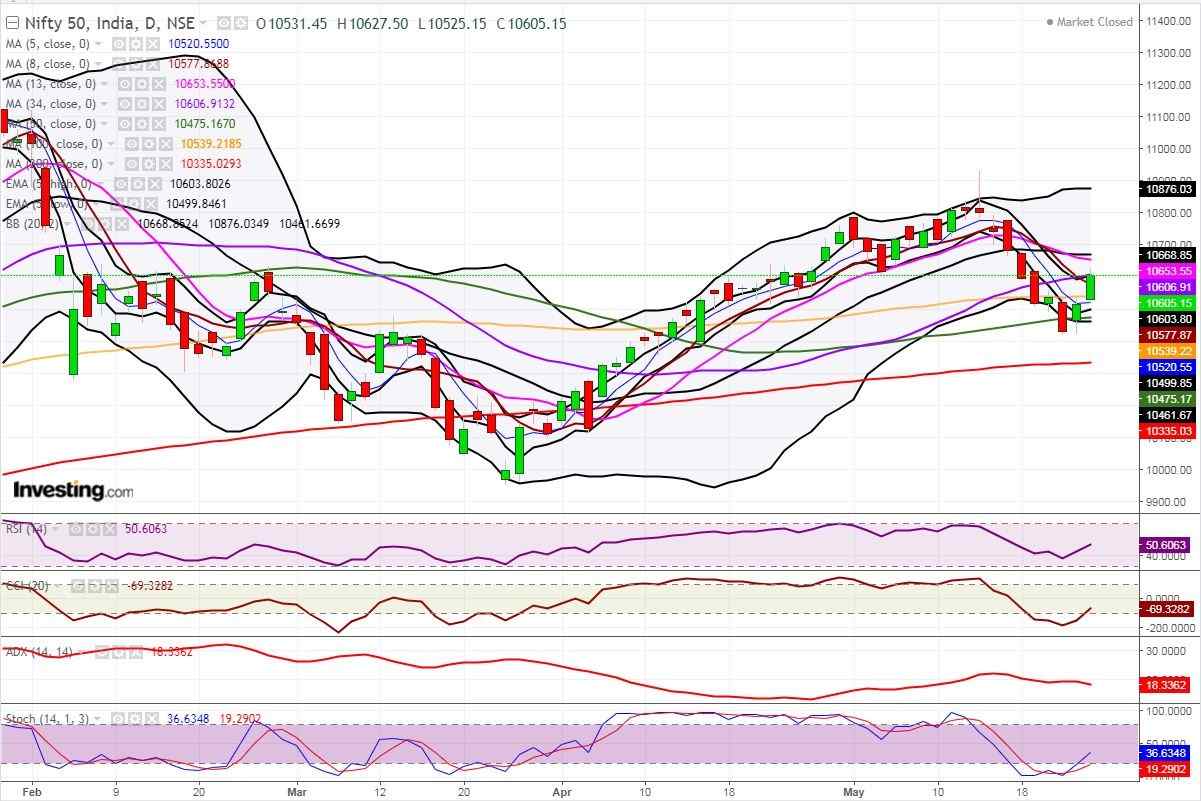

Daily Technical

In the daily chart, Nifty bulls stole the show in last two trading session which led the index to close above 5 day High EMA (presently at approx. 10602.8) but trading below most moving average.

The probable support in the daily chart comes at 8 Day SMA (presently at approx.10577.8) and 100 Day SMA (presently at approx.10539).

On the upside, Nifty may face resistance at 13 Day SMA (presently at approx.10684) and 20 Day SMA (presently at approx.10668.8).

Daily Stochastic and CCI are trading above the lower bound of their respective level and RSI is in the normal zone. Overall, Nifty remained neutral to bearish in the daily chart.

Daily chart

Weekly Technical

Nifty saw good bounce from 34 week SMA (presently at approx.10437) and closed almost at the weekly high making a dragonfly doji. Presently Nifty is trading inside 5 week high low band and any close above 5 week high EMA (presently at approx.10723.2) may possibly take index to higher levels. Weekly CCI, RSI and Stochastic are in the normal zone. Overall, Nifty remained neutral in the weekly chart.

Weekly Chart

ELM Matrix