Nifty close 10331.6: Nifty ended in green for the second consecutive week amidst global trade worries. The boost in investor sentiment after RBI’s announcement that it expects the GDP growth to rise to 7.4 percent and also anticipates inflation level to fall in the coming year; led the market rally more than 2% on Thursday’s session

Hourly Technical

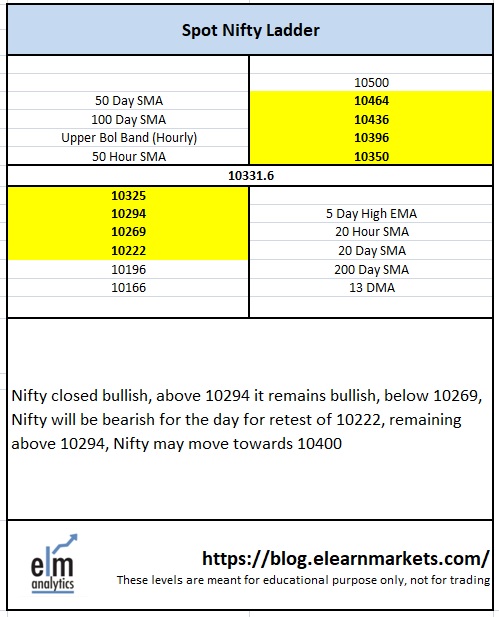

In the hourly chart, Nifty is trading above all short term moving averages. The probable support in the hourly chart comes at 20 Hour moving average (presently at approx. 10269).

On the upside, Nifty may face resistance at 50 Hour moving average (presently at approx. 10350) and Upper Bollinger line (presently at approx. 10396).

Hourly RSI, Stochastic and CCI are trading close to the upper bound of their respective range suggesting strength in the hourly time frame. Moreover ADX is gradually going up further confirming the gain in upside momentum. Overall, Nifty appears very strong in the Hourly chart.

Hourly chart

Daily Technical

In the daily chart, presently Nifty is trading above important 200 DMA and 5 Day High EMA which appears positive in the short term.

The probable support in the daily chart comes at 5 Day high EMA (presently at approx.10294) and 20 Day SMA (presently at approx.10222).

On the upside, Nifty may face resistance at 100 Day SMA (presently at approx.10436) and 50 Day SMA (presently at approx. 10464).

Daily Stochastic and CCI are trading very close to the upper bound of their respective level and stochastic is in the normal zone. Overall, Nifty remained neutral to bullish in the daily chart.

Daily chart

Weekly Technical

Nifty rallied for the second consecutive week after bouncing off the 50 week SMA and presently trading above 34 week SMA. As of now it seems that market has turned on the upside but in case of any further negative sentiment, 9700 may act as a very strong support which is a convergence of uptrend line and support line.

Weekly CCI and Stochastic are in the lower bound of their respective range while RSI is in the normal zone. Overall, Nifty remained neutral in the weekly chart.

Weekly Chart

Nifty ELM Matrix