Nifty (Close approx. 9904.15): Nifty opened in green today but there was a tug of war between the bulls and the bears at the resistance of 200 hour moving average (presently at approx. 9944.5).

As mentioned in the last day’s report that a strong resistance is expected at 200 hour moving average (At approx. 9940.2) and Nifty could not breach that level in today’s session.

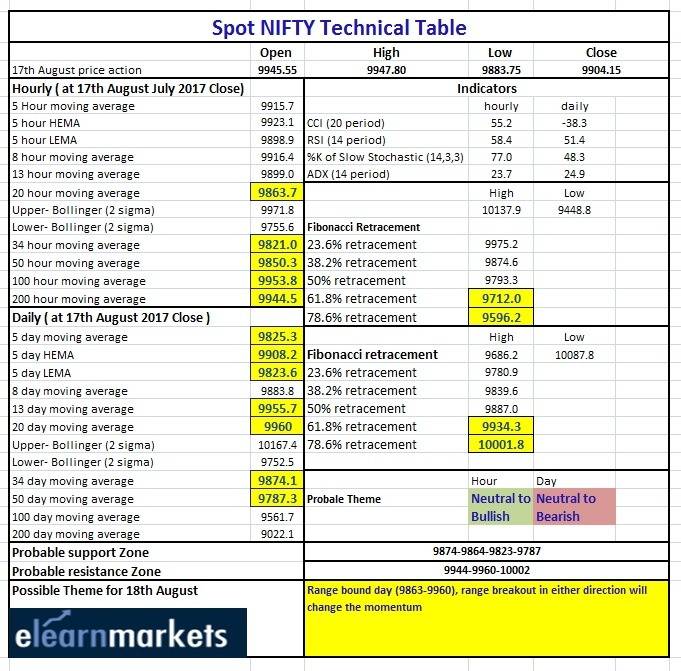

Hourly Technical:

After a positive open above 9900, Nifty was in a very tight 55 points (9940 – 9885 approx.) range.

The probable support in the hourly chart comes at 20 hour moving average (presently at approx. 9863.7) and 34 hour moving average (presently at approx. 9821). The probable resistance in the hourly chart could be seen at 200 hour moving average (presently at approx. 9944.5).

The hourly CCI and RSI are in the neutral zone and hourly stochastic is still in the overbought zone. Moreover, the hourly ADX is trending down. Overall these indicators indicate neutral to bullish view in the hourly time frame.

Figure: Hourly Chart

Daily Technical

After a strong two day rally, market consolidates in today’s session and ended flat. In the daily chart, Nifty took support from the 8 DMA (presently at approx. 9883.8).

The next probable support in the daily chart remains at 34 DMA (presently at approx. 9874.1), 5 Day low EMA (presently at approx. 9823.6) and 50 DMA (presently at approx.9787.3). On the upside, the probable resistance could be 20 DMA (presently at approx. 9960) and 78.6% retracement level of the down move from approx. 10088 to aprrox.9686 (presently at approx. 10001.8).

The Daily CCI, RSI and slow stochastic have turned up from the oversold zone which suggests positive bias and Daily ADX is neutral. Overall Nifty in the daily time frame remains neutral to bearish.

Figure: Daily Chart

Figure: Nifty Tech Table