Here is a morning market glimpse of the important News across several business newspapers: –

Morning Market Glimpse – Economic Times – Business Standard

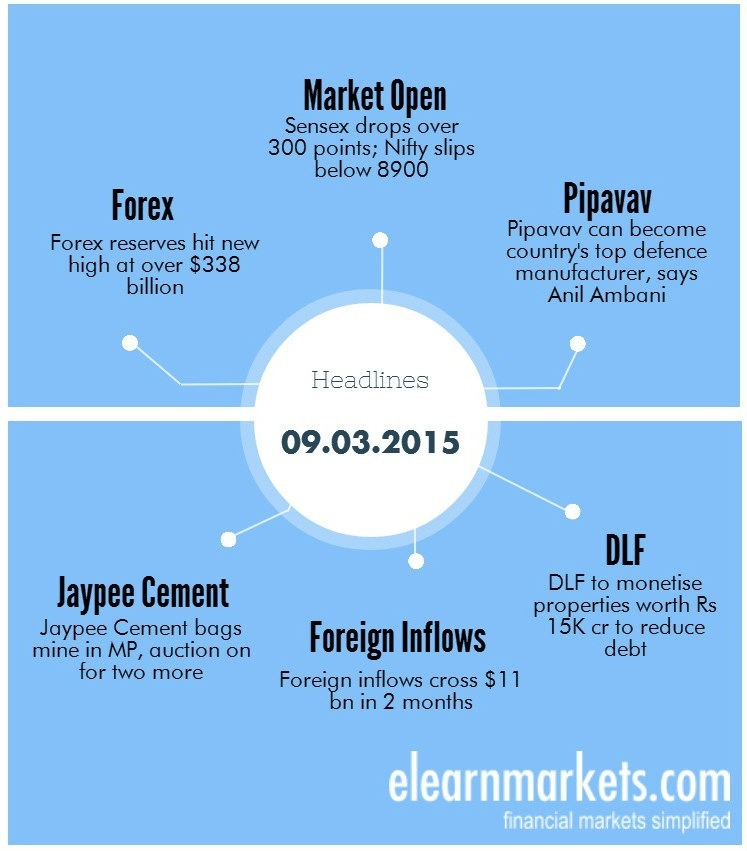

Ø Forex reserves hit new high at over $338 billion

Ø Pipavav can become country’s top defence manufacturer, says Anil Ambani

Ø Tata JLR plans to build first electric car in Austria

Ø Greece warns of referendum ahead of debt meeting

Ø DoD wants subsidy roadmap before ONGC disinvestment

Ø Rel Jio racing to launch 4G services before deadline

Ø Govt mulls panel to resolve exporters’ issues, boost shipments

Ø Foreign inflows cross $11 bn in 2 months

Ø EU seeks Modi intervention to resume FTA talks

Ø DLF to monetise properties worth Rs 15K cr to reduce debt

Ø Green signal for two big-ticket FDI proposals in Railways

Ø Jaypee Cement bags mine in MP, auction on for two more

Morning Market Glimpse – Business Line – Mint

Ø IndianOil, ONGC, Oil India named by US govt for Iran ties

Ø Gulf Oil Lubricants in expansion mode

Ø Kernex Microsystems to sell assets to fund new projects

Ø SEBI to launch media campaigns to safeguard investors

Ø Sumitomo to set up 4,000 MW project in Andhra Pradesh

Ø IL&FS Engineering gets nod for preferential offer

Ø China’s lower GDP growth target negative for steel

Ø New land acquisition bill to be tabled in Parliament today

Ø TCS likely to report muted earnings growth in March quarter

Ø Panel backs spinning off ONGC tech services arm

Ø Rising rubber imports a threat to local growers

Morning Market Glimpse – Financial Express – Financial Chronicle

Ø RBI taking a closer look at rate transmission issue

Ø Coal auction rains revenue bonanza; touches Rs 1.57 lakh cr

Ø IIP, inflation data key for stock markets this week: Experts

Ø FDI in services sector up 44% during April-December

Ø Sun Pharma recalls 5,322 bottles of Ketorolac eye drop in US

Ø IDBI Bank’s NSE stake sale in next fiscal only

Ø Much-awaited verdict in Satyam fraud case likely today

Ø Black money can be smart strategy for inefficient economy

Ø Tax-free bonds a new investment avenue

Ø Govt gets proposals worth over Rs 25,000 crore for electronics manufacturing

Ø All services will not attract Swachh Bharat cess

Morning Market Glimpse – Corporate Snippet

Ø DLF is looking to monetise properties worth about Rs 15,000 crore to boost its cash flow and reduce debt, a senior company official said.DLF had a net debt of Rs 20,336 crore at the end of the December quarter.With property market showing sluggishness,company is looking to raise about Rs 3,000 crore by selling about 50% stake each in four housing projects to private equity firms.( BS )

Ø Top telcos like Airtel, Vodafone andRCOM determined to hold on to 2G spectrum that’s back on sale at the end of licence terms, likely ignoring 3G despite operators having raised a clamour for it before the auction began. Meanwhile, the CDMA band has seen surprising, albeit limited, interest.( ET )

Ø Tata Motors-owned Jaguar Land Rover(JLR) is set to build its first all-electric car in Austria.The luxury car-maker’s Jaguar brand could begin production of the vehicle next year.( BL )

Ø ONGC, IOC and OIL are among the five global companies named by the US administration for having energy ties with Iran, for which they can face sanctions by America.( BS )

Ø Suzlon Energy, the debt-laden wind-turbine manufacturer, is keen to sell its forging and foundry company, in which it invested Rs 1,000 crore, and component units and office complexes worth about Rs 1,000 crore as it exits non-core areas and continues its fund-raising drive.( ET )

Ø Ambuja Cements and Jaypee Cementemerged winners in the ongoing coal block auctions for the ready-to-produce blocks on Sunday.Ambuja Cements won the Gare Palma IV/8 block in Chhattisgarh for Rs. 2,291 a tonne. The block reserved for the non-power sector has extractable reserves of 11.75 million tonnes and was previously owned by Jayaswal Neco Ltd.Meanwhile, Jaypee Cement won the Mandla South, Madhya Pradesh with a bid of Rs. 1,852 a tonne.The ready-to-produce block has extractable reserves of 13.35million tonnes and is for the non-power sector.( BL )

Ø Apollo Hospitals has entered the tier-II town of Andhra Pradesh with the launch of a 200-bedded Apollo Specialty Hospital (ASH) in Nellore.( BL )

Ø Flush with an investment outlay of $ 3 billion a year on networks, telecom majorBharti Airtel plans to double its 4G network by next fiscal as it gears up to take on competition, including the much-awaited foray of Mukesh Ambani-led Reliance Industries group.( BS )

Ø Sun Pharma is voluntarily recalling 5,322 bottles of Ketorolac Tromethamine ophthalmic solution in the US market for failing to meet specifications.( BS )

Ø The Indian pharmaceutical industry is expected to receive a massive boost if a recent attempt by the World Trade Organization (WTO) to amend its TRIPS (Trade-Related Aspects of Intellectual Property Rights) Agreement on the access to essential medicines goes through.If it happens, it will enable India to export generic versions of some costly life-saving drugs made under compulsory licensing to third world countries, especially in Africa, which do not have the production capacity for such medicines.( BS )

Ø Cadila Healthcare: US, India will drive growth.The company’s US business, which accounts for about 40 % of its consolidated revenues and enjoys good margins, continues to grow at a healthy pace. With a robust pipeline of 158 products awaiting US FDA approval, Cadila is well placed to sustain strong growth in this geography.( BL )

Ø IDBI Bank plans to sell its entire 5% stake in leading stock exchange NSE in the next fiscal as part of its capital raising exercise by existing non-core businesses.Value of IDBI Bank’s 5% stake in NSE will be more than Rs 1,000 crore.( BS )

Ø Reliance Entertainment’s film production and distribution business in India will partner boutique production house Phantom Films, founded by Anurag Kashyap, Vikas Bahl, Vikramaditya Motwane and Madhu Mantena – in a 50:50 joint venture.Reliance will own 50% of the combined business, while the remaining will be held among the four promoters of Phantom Films.( BS )

Ø IL&FS Engineering and Construction Company Limited has secured approval for issue of 2,12,74,442 equity shares of Rs. 10 each fully-paid to promoter/promoter group and non-promoter on preferential basis.( BL )

Ø The depreciation in the Australian dollar (AUD) against the US dollar, coupled with falling coal prices, has eroded the net worth of Griffin Coal, an Australian mining company acquired by Lanco Group for AUD 730 million in 2011, a senior official of the Group has said.( ET )

Ø Global private equity fund General Atlantic, which invests $2 billion worldwide every year, is planning to channel as much as a fourth of that into India, said Chief Executive Officer Bill Ford, adding that six sectors have been identified as investment targets — financial services, retail, healthcare, data-driven business process outsourcing, internet advertising and mobile internet.( ET )

Ø State Bank of Travancore (SBT) has pared the base rate by 10 basis points to10.15 per cent effective from March 16.SBT is the first off the block to act in the post-Budget phase that saw the RBI go for a second off-cycle review of the repo rate.( BL )

Ø Low-cost airline SpiceJet is understood to be in talks with some of its key vendors, including aircraft maker Bombardier, to rework their contracts to get better terms.The airline management is also considering a move to offer ESOPs to employees to retain them as well as to lure back pilots.( BL )

Ø Kernex Microsystems India Ltd has informed BSE that a meeting of the board of directors of the company will be held on March 10, 2015 to consider and approve sale of some assets of the company.(BL)

Ø Gulf Oil Lubricants, a Hinduja Group company, aims to be a rising player in the lubricants business. The company has undertaken capacity expansion, that includes capex in a new plant and expansion of current allocation.( BL )

Ø A special court here is slated to pronounce today the much-awaited judgement in the multi-crore accounting fraud in erstwhile Satyam Computer Services Limited (SCSL).( BS )

Ø Japanese major Sumitomo Corporationhas evinced interest in setting up of a 4,000 MW ultra mega power project in Srikakulam district of Andhra Pradesh.( BL )

Ø A top Indian jewellery retailer will invest $ 25 million in Prime Minister Narendra Modi’s ambitious Gujarat International Finance Tec-City projectwhich aims to create the first global financial hub in India.Pure Gold Jewellers, which claims to be the only World Diamond Mark ( WDM) certified company in the Gulf Cooperation Council (GCC) and India will invest in various projects of GIFT City. It has 125 stores across 12 countries.( ET )

Ø Online and mobile classifieds playerQuikr is close to raising around 900 crore, or $150 million, in a new round of funding from new and existing investors, according to three sources familiar with the development. This round will see the entry of Hong Kong-based Steadview Capital, which has emerged as one of the most aggressive hedge funds buying into the India internet story.( ET )

Ø KPMG, one of the big four consultancies globally, has acquired the Indian arm of Spanish boutique advisory firm AF-Mercados for an undisclosed sum. The acquisition is aimed at entering the consultancy vertical in the energy sector and comes at a time when the Big Four -KPMG, Ernst & Young, Deloitte and PricewaterhouseCoopers -are betting big on India, expecting a huge growth in the next decade.( ET )

Morning Market Glimpse – Economic Snippet

Ø Finance Minister Arun Jaitley will address board members of the Reserve Bank here on March 22 to inform them about steps taken in the Budget for 2015-16 to boost economic growth and contain fiscal deficit.( BS )

Ø The Department of Disinvestment (DoD) wants the government to lay out a roadmap for fuel subsidy sharing before the Rs 14,000 crore stake sale in Oil and Natural Gas Corp (ONGC), a top official said.ONGC and other oil producers have to bear a part of the losses that fuel retailers incur on selling LPG and kerosene at government-controlled rates.( BS )

Ø Indian companies have raised over $ 4 billion (Rs 27,000 crore) from Qualified Institutional Placements. (QIPs)

BOTTOMLINE

Visit blog.elearnmarkets.com to read more blogs.

You can use Stockedge to get cutting edge over others in both short-term trading and investing.

whoah this blog is great i really like reading your posts. Keep up the great paintings! You already know, a lot of persons are looking round for this info, you can help them greatly.