Nifty has been taking resistance at the level of 7730, about which we have been talking a lot since a long time. The recent advance in Nifty came on poor volumes which was an early indicator of today’s correction. However, in my opinion, the RSI momentum indication is quite positive as it managed to hold itself above the level of 60, and in this rally it has maintained itself above 60 since a long time . In the recent past of approximately 1 year we have rarely seen Nifty maintaining the level of 60+ on the Daily charts. In my opinion it sure looks like we are in a bull trend. And in this correction, i see the support at 7550, which was incidentally our previous resistance, now this is the Principle of Polarity.

On the intraday chart of the index, today’s move comes out as a one sided slide, where, a bit of support came in the last 30 mins of trading at the level of 7590-7600.

The winners of the day do not show much significant data. The winner amongst the top 100 Nifty stocks is Godrej consumers, which was up nearly 2%, following are a bank stock, an exception today, which is Kotak Mahindra, +1.71%, Bosch ltd and some cement stocks like Ambuja cements and ACC, along with BPCL were seen posting a green closing for the day.

On the losers end, we have the major heavy industry stocks like VEDL, tatasteel, Hindalco, SAIL, which have lost around 4-9% today with Vedanta being the worst hit. The banks also performed pretty bad, like Federal bank, canara bank, SBIN, and among the pharmaceuticals, we have sun pharma which traded lower.

Among the indices we have NSE Realty index which got a bad beating in the market and closed more than 4% lower, wheres the NSE Infra index was 1.57% down, followed by the Midcap index, and the Banknifty (-1.37%

)

The international picture does not look very bright either, especially due to the Fed words due to come in this week, wherein rate hikes are expected to be announced. The DJIA and NASDAQ futures are trading flatr, whereas CRUDE is better off trading .77% high and gold under mild pressure. Friday was a holiday for the US markets, and today will be no different, the European markets were also closed today, however on the previous trading session they were pretty beaten up with losses varying between 1-2% among the indices. The Asian Indices for the day seem grim as the Hangseng index closed in red, losing more than 1% and the Shanghai composite index closed some .77% lower. Sensex has also breached the level of 25000 again on the downside.

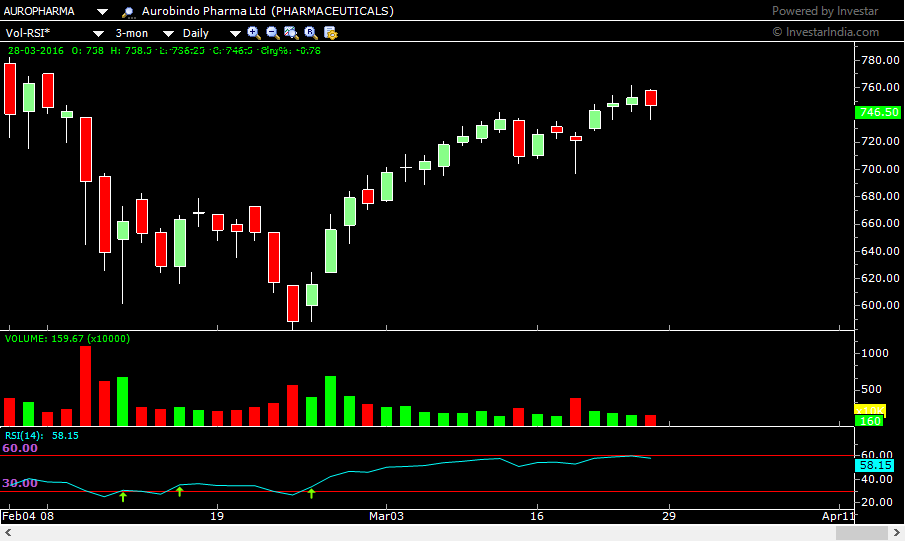

CHART OF THE DAY

Aurobindo pharma has been investor’s favorite since a long time however the past one year has not been very good for the stock as it has been under correction. The recent rally also come about on poor volumes, which is a cause of worry. The RSI momentum indicator also had held the level of 60 rather adamantly intact. These elements do not hint towards much promises coming in this stock. And we can expect some more correction to follow.

________________________________________________________________________________________________________________________________________

Read more articles here:

https://blog.elearnmarkets.com/market/nifty-chart/