What would you do if your finances were taken care of? Imagine for a moment that you are in a situation where money isn’t an issue any more. Then you could pursue anything you want, think of doing things that you generally don’t do because on a priority basis we have to earn a living.We could explore possibilities, take risks.Financial Planning can help you achieve this reality.

That is what I would like to call as “Financial Independence”. Very few people in this world get to experience this. But, the number of such people have been rising steadily.

While this sort of mentality wouldn’t make any sense 50 years ago. Most part of the world was coming out of two world wars and the economies were destroyed in one sense.

But gradually the world has moved towards prosperous territory. Most countries have been more or less stable for the last 50 years. This has provided the opportunity to flourish.

Nowadays, the struggle is different. While some portion of the population has achieved true wealth some barely survive. The inequality divide is a lot in countries like ours (India). We all desire financial independence but I’ll admit that it’s really difficult to achieve financial independence.

There is a way out.

The answer is proper financial planning and trying to execute our plans. But it’s easier said than done. One of the cardinal rules: Compounding effect will help you amass a significant amount of wealth. However, there is a catch in using compounding effect to create wealth.

The catch is: TIME.

So, how can we make “Time” work for us rather than it working against us. One solution that comes to mind is– “Start Early”.

This article aims at this generation of young adults to teach their next generation— how they can form good money habits

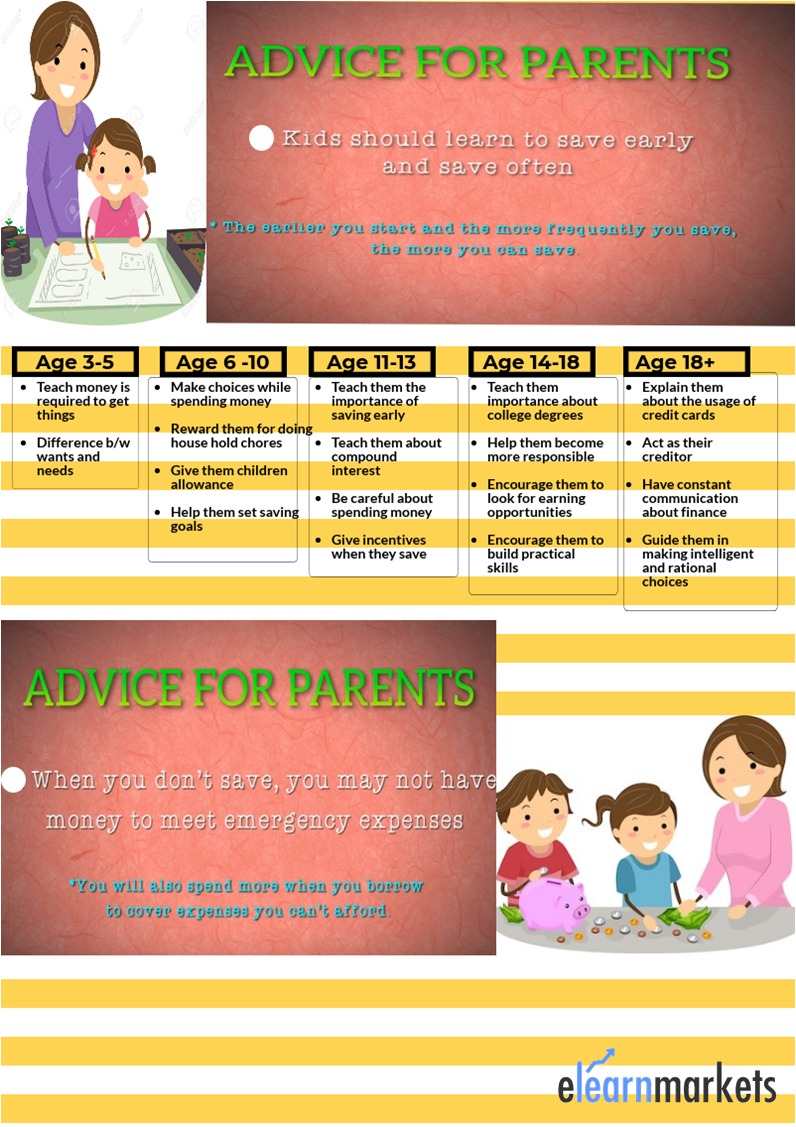

Age 3-5

Teach them basics of money and difference between wants and needs

Well at this age, the kids can identify and attach meaning to most of the common objects around us. Like he or she knows a glass is used for drinking water or ball is used for playing.

Parents can teach them the very basics of money like, money is needed to get the things you want. Teach them that to get a chocolate, you have to actually pay the shopkeeper in coins or notes. Teach them that money has value to purchase things.

You can teach them easy to understand things like prioritizing, the difference between things that they need and things they want.

For example: You can teach that articles like a book, pencil, food, clothes, shoes are absolutely necessary while ice-cream, chocolates or toys although attractive are not essentials.

I’m in no way trying to say that don’t give them these things (ice-cream and chocolates). Just make them understand the difference between absolutely essential and not so essential so that they understand the concept of giving priority to needs over wants.

Patience and planning are the key to achieve anything you want

Making them realize that we actually have to work to get something we want—this can be a huge lesson not just for saving but for life in general.

Patience and planning to achieve something you want. And slowly but steadily working towards a goal.

Suppose they want a fairly expensive toy or a bike. Help them make a financial target and teach them to save for it from their allowance and you also contribute as a reward to their savings.

Age 6-10

Spending choices and work to earn

By this age, they know that money is required to get things they want. So, at this stage teach them that they should be careful while spending money. They should spend on essentials and save rest for future use.

They are very young to work somewhere else so they could help you in doing household chores like cleaning or something else and you could pay them in return. In this way they will be able to learn that they need to work to earn money.

Use children allowances and gifts carefully

All parents give children some allowance from time to time. Just guide them on how they should use the allowance.

Kids also receives money as gift on special occasions such as on their birthdays and festivals.

Teach them to set saving goals

Children have demands for a lot of things. You can pick some of those things and help them set an amount-target for that article. Then help them to save some from their allowance and as a reward add some money from your side to help them reach the target.

Give them places to save

Get them a piggy bank where they can put their money. When the piggy bank is full, open a savings account for them. In this way they will know where to save and can keep track of how their money is growing.

Age 11-13

Importance of starting early and working for own money

Teach them the important concept of starting early. The more time you give for money to grow, the better returns you’ll get.

If early on they can work somewhere in their own capacity and make some money, that will encourage them to value money, save and invest it.

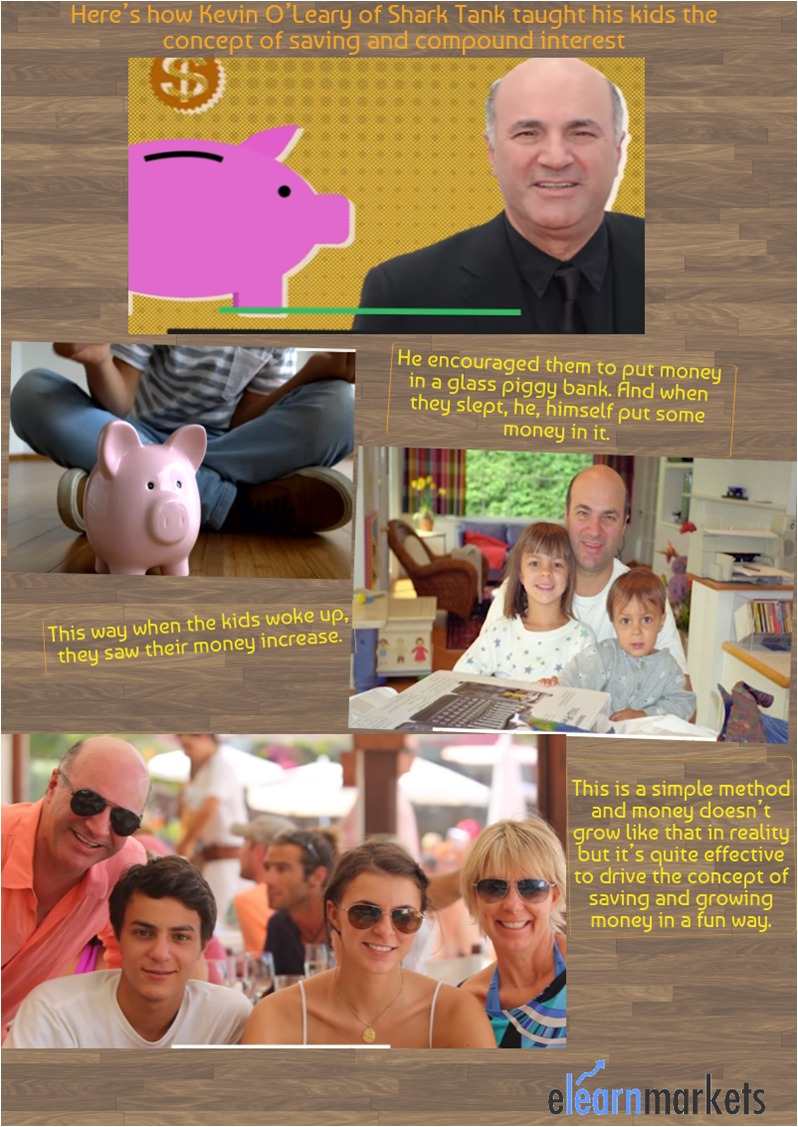

Teach them about the power of compound interest

When you keep saving and investing early on, you benefit from compounding i.e. earn interest on interest. Teach them that in this way money grows faster. If some needs come up suddenly, they will be able to afford that bythemselves.

Spending carefully and becoming self-dependent

You can teach them to be mindful of what they are spending their allowance on. Encourage them not to spend on things that theydon’t actually need.

However, on special occasions, you can give them some leeway. Saving will enable them to afford things that they may require in future.

Eg: They can save to buy some stuff for a school project.

Encourage good habits through rewards

Reward them with something on reaching a certain saving goal. This will encourage them to carry on with this good habit.

Age 14-18

Teach them importance and consequences of pursuing the right things

At this stage, they will graduate out of school and probably start college. Teach them how important it is to get into a good college and pursue a career-oriented goal. College graduates on an average earn much more than people with no college degrees.

Help them become more responsible, accountable and rational

Help them become more responsible and accountable by letting them calculate and estimate how much their college degrees would cost.

Encourage them to build practical skills along with their degrees and apply for relevant internship or part-time jobs while in high school or college.

Age 18+

Understand the ill-effects of borrowing and using credit card

By this stage, they will have a bank account and a credit card. Help them to know the nuances of using a credit card. Such as a credit card should be used if only, they are sure of paying off the balances. Encourage them to use debit card rather than credit card.

Become their strict financial guardian

If they need to buy something expensive, don’t just give away money. Pretend to be a creditor and tell them to pay back the money by earningand saving diligently.

Keep communicating about finances

If they are in some sort of financial distress, help them come out of it by advising solutions. Make them realize the importance of planning beforehand and working towards a goal.

Bottomline

All this effort of teaching kids about money and saving is aimed at making their lives comfortable and make them financially independent at an early age.

They then will be able to pursue their passion when they grow up rather than sacrifice dreams and be forced to take up any job to support themselves financially.

In this way we can create a generation of prosperous young people motivated enough to work in their respective field and aim for glory.