A bank is a financial institution which is involved in borrowing and lending activity. Banks take customer deposits and in return pay customers an annual interest payment. People keep their money in the banks because it is a safe and secure way to store the money. Banks and NBFCs then uses majority of these deposits to lend to other customers for a variety of loans. The difference between the two interest rates is the profit margin for banks.

| Table of Contents |

|---|

| Services Offered by Banks & NBFCs |

| Parameters for evaluating Banking & NBFCs Stocks |

| Bottomline |

Services Offered by Banks & NBFCs

Banks and NBFCs also earn money by offering a variety of products and services like distributing mutual fund and insurance products, offering wealth management services, commission exchange and brokerage etc for which they charge a fee. They also make money by buying and selling debt securities (treasury operations).

The money they earn by this activity is reflected in their profit and loss statement under ‘other income’. Banks are a very important part of our economy and play an important role in the economy. Banks also play an important role in offering/providing finance to businesses who wish to invest and expand.

Suggested Read: 22 Important Banking Terms you need to know

These loans and business investment increase company production and distribution activity which help in enabling economic growth.

Parameters for evaluating Banking & NBFCs Stocks:

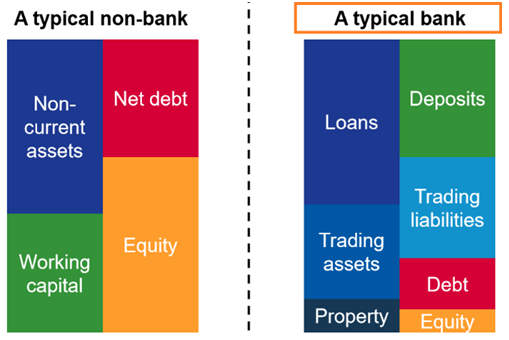

The analysis of banking stocks is very different because Bank’s business model is different from that of a Manufacturing company. For evaluating the banking stocks, there are certain key parameters which we can use to know the profitability of banks.

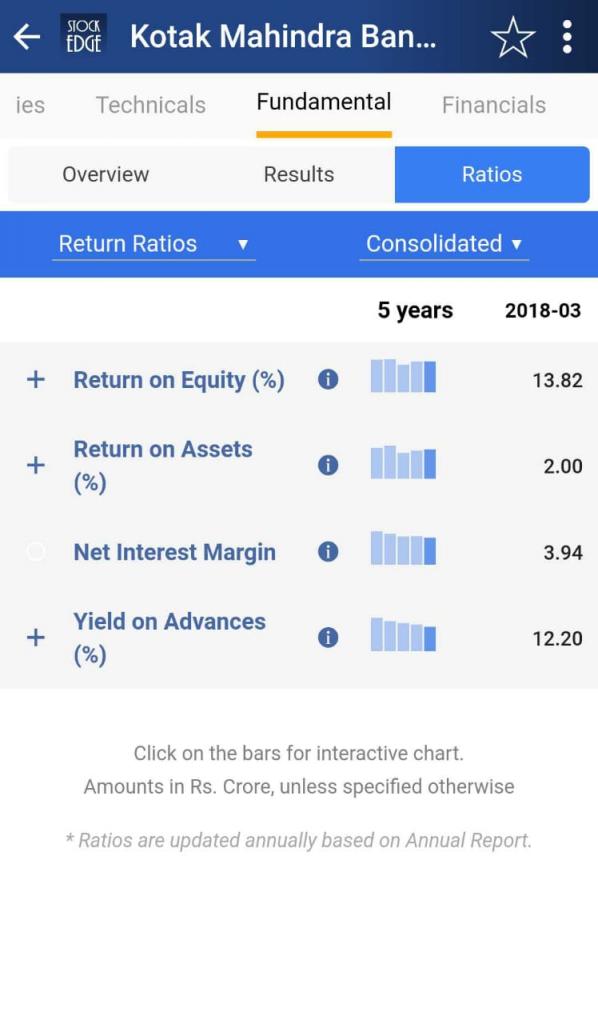

Source: StockEdge

NET INTEREST MARGIN (NIM)

Net interest Margin (NIM) is the difference between the interest income generated by banks and the amount of interest paid out to their lenders (for example, deposits).

Net interest Margin is calculated as: Investment Return- Interest expense /Average Earning Assets

Example: A bank’s average loan to customers was 100.00 in a year while it earned interest income of 9.00 and paid interest of 6.00. The NIM is computed as 9.00 – 6.00 / 100.00 = 3%.

All Banks are keenly interested in their net interest margins because they lend at one rate and pay depositors at another. Higher the NIM, the more profit a bank earn from a given pool of funds. A negative value shows that interest expenses were greater than the amount of returns generated by investments.

NON PERFORMING ASSETS (NPA)

A non performing asset is a loan or advance for which the interest payment or principal remained overdue for a period of 90 days. NPAs reflect the healthiness of a bank’s loan portfolio book. The higher the amount of NPA (bad loan), the weaker is the bank.

Banks are required to classify NPAs into Substandard, Doubtful and Loss assets.

Learn in 2 hours : How to Trade Bank Nifty Options on Expiry Day

1. Substandard assets: Assets that has remained NPA for a period less than or equal to 12 months.

2. Doubtful assets: An asset would be classified as doubtful assets if it has remained in the substandard category for a period of 12 months.

3. Loss assets: An asset where loss has been identified by the bank, internal or external auditors or the RBI inspection but the amount has not been written off wholly.

NET PROFIT MARGIN

A net profit margin ratio is a profitability ratio that measures the amount of net income earned with each rupee of sales generated.

NPM is calculated as: Net profit / Sales.

Net profit margin is an indication of how effective a company is at cost control. The higher the net profit margin is, the more effective it is at converting sales into actual profit.

RETURN ON ASSETS (ROA)

Return on asset (ROA) is an important performance indicator for measuring the performance of the bank.

ROA is calculated as: Net profit /average total assets

It shows how profitable a bank is relative to its total assets. Return on asset also gives an idea of how efficiently management is using its assets to generate earnings.

The higher is the ROA, the better and it is good to compare ROA between banks.

RETURN ON EQUITY (ROE)

Return on equity (ROE) ratio essentially measures the rate of return that the owners of the stocks of a company receive on its shareholding.

ROE is calculated as: Net profit / shareholder’s Equity

It helps investor to understand, how well the shareholders fund are used by bank to generate profit. The higher is the ROE, means shareholders are benefitting more.

Bottomline

The whole logic is to understand the basic fundamentals of banks and then invest into it. Thus be it any banking instrument Banks or NBFCs these are the various given parameters which one should keep in mind for evaluating and then investing. Thus when you do your homework well then you can rest assured that your investments will give you best returns.