Bank Nifty opened above its 5 Low DEMA (24170.6 approx) today the 30th of August. The Index traded in a narrow range of 127 points throughout the day and closed marginally below the 5 Day High EMA of (24357 approx)

Hourly Technicals:

In the Hourly Chart, Bank Nifty has closed at 224309, below its 5 Hour High EMA of (24331.2 approx).The Index is likely to face immediate resistance around the 5 Hour High EMA (24331.2 approx) mark. Bank Nifty has to close convincingly above 24379 for the Bulls take over.

Hourly RSI and CCI are close to the higher end of their normal range. The hourly ADX is indicating that Bank Nifty is likely to remain flattish.

Figure: Bank Nifty Hourly Chart

Daily Technicals:

The daily chart indicates that Bank Nifty has closed marginally below the 5 Day High EMA of (24357 approx). If the Index breaks above the 34 DMA (24370 approx) mark, the next resistance will be 24496. On the downside however, if Bank Nifty breaks and closes below its 13DMA (24183.5 approx), it could find support at the 50DMA area (24078 approx).

While the daily RSI is marginally above its normal range, the CCI indicator has closed slightly below its normal range. The ADX has closed around its normal range as well.

While the daily RSI is marginally above its normal range, the CCI indicator has closed slightly below its normal range. The ADX indicates a below normal range as well.

Figure: Bank Nifty Hourly Chart

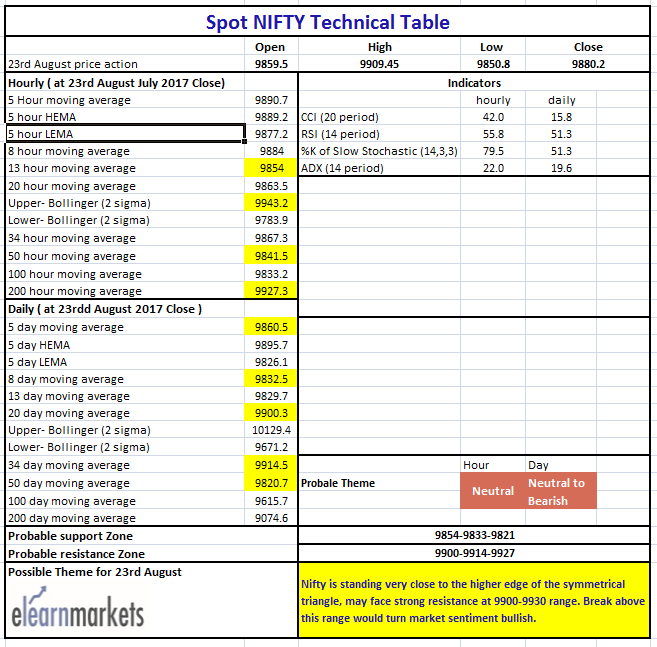

Figure: Bank Nifty Tech Table