Elliott Wave Pattern- Do you know that these patterns can help you in understanding market behaviour? Yes! It’s absolutely true! But before driving into patterns lets us actually understand what is the Elliott wave principle:

The Elliott wave principle is a form of technical analysis that helps traders in analyzing financial market cycles. With the help of this Elliott wave theory, traders can forecast market trends by identifying extremes in prices and investor psychology.

Elliott Wave Theory suggests that movements of the market follow a sequence of crowd psychology cycles. The Elliott Wave Patterns are formed according to the ongoing market sentiment, which alternates between bullish and bearish cycles.

However, the Elliott Wave should not be considered as a technical indicator but a theory that helps in predicting the behaviour of the market. In this blog we will discuss the 5 main types of Elliott Wave Pattern which will help the traders in predicting the market behaviour:

What is Elliott Wave Theory?

The Elliott Wave Theory suggests that the stock prices move continuously up and down in the same pattern known as waves that are formed by the traders’ psychology.

The theory holds as these are recurring patterns, the movements of the stock prices can be easily predicted. Investors can get an insight into ongoing trend dynamics when observing these waves and also helps in deeply analyzing the price movements.

But traders should take note that interpretation of the Elliot wave is subjective as investors interpret it in different ways.

Before discussing the patterns, let us discuss Motives and Corrective Waves:

What are Motives and Corrective Waves?

The Elliott Wave can be categorized into Motives and Corrective Waves:

1. Motive Waves

Motive waves move in the direction of the main trend and consist of 5 waves that are labelled as Wave 1, Wave 2, Wave 3, Wave 4 and Wave 5.

Wave 1, 2 and 3 move in the direction of the main direction whereas Wave 2 and 4 move in the opposite direction.

There are usually two types of Motive Waves- Impulse and Diagonal Waves.

2. Corrective Waves

Waves that counter the main trend are known as the corrective waves.

Corrective waves are more complex and time-consuming than motive waves. Correction patterns are made up of three waves and are labelled as A, B and C.

The three main types of corrective waves are Zig-Zag, Diagonal and Triangle Waves.

Now let us come to Elliott Wave Patterns:

Below are the 5 main types of Elliott Wave Patterns

1. Impulse

Impulse is the most common motive wave and also easiest to spot in a market.

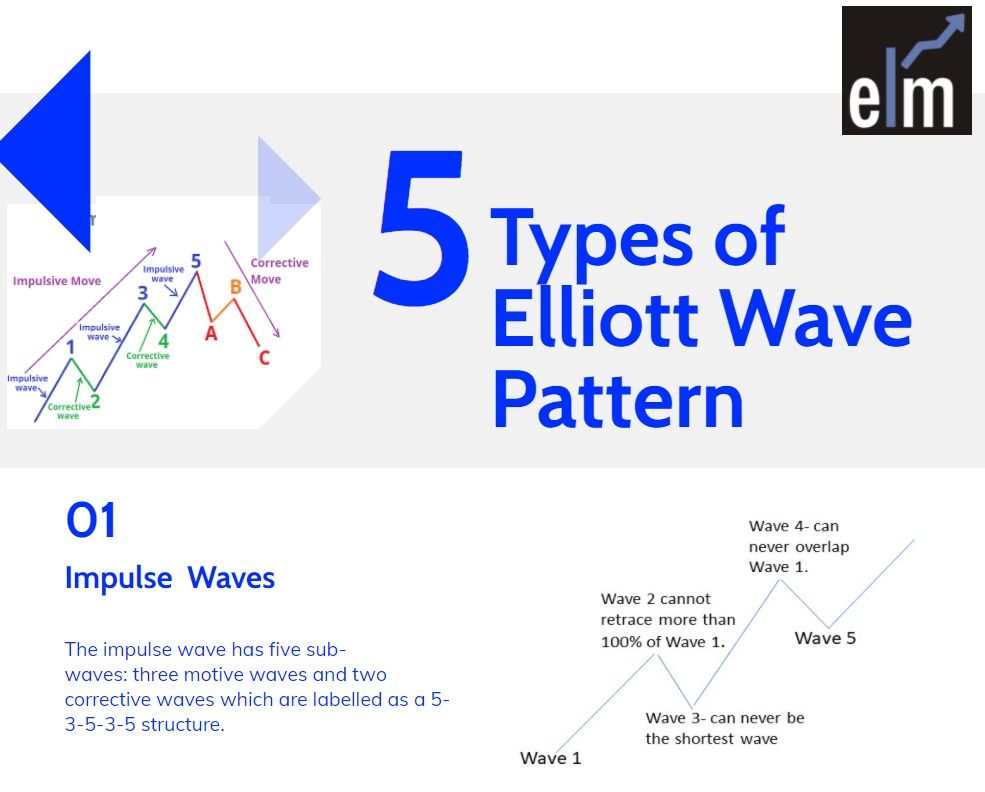

Like all motive waves, the impulse wave has five sub-waves: three motive waves and two corrective waves which are labelled as a 5-3-5-3-5 structure.

However, the formation of the wave is based on a set of rules.

If any of these rules are violated, then the impulse wave is not formed and we have to re-label the suspected impulse wave.

The three rules for impulse wave formation are:

- Wave 2 cannot retrace more than 100% of Wave 1.

- Wave 3 can never be the shortest of waves 1, 3, and 5.

- Wave 4 can never overlap Wave 1.

The main goal of a motive wave is to move the market and impulse waves are the best at accomplishing this.

2. Diagonal

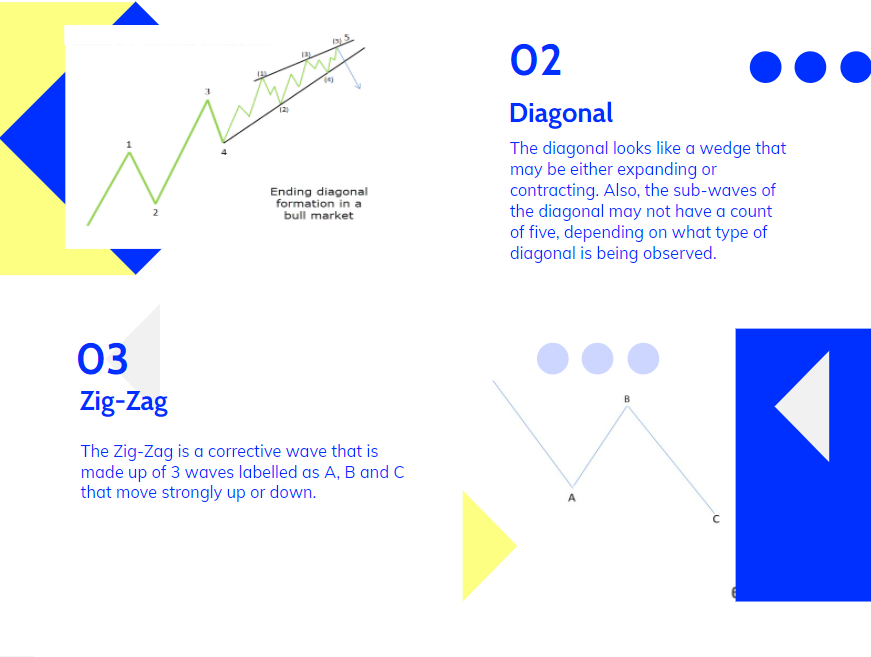

Another type of motive wave is the diagonal wave which, like all motive waves, consists of five sub-waves and moves in the direction of the trend.

The diagonal looks like a wedge that may be either expanding or contracting. Also, the sub-waves of the diagonal may not have a count of five, depending on what type of diagonal is being observed.

Like other motive waves, each sub-wave of the diagonal wave does not fully retrace the previous sub-wave. Also, sub-wave 3 of the diagonal is not the shortest wave.

Diagonals can be further divided into the ending and leading diagonals.

The ending diagonal usually occurs in Wave 5 of an impulse wave or the last wave of corrective waves whereas the leading diagonal is found in either the Wave 1 of an impulse wave or the Wave A position of a zigzag correction.

3. Zig-Zag

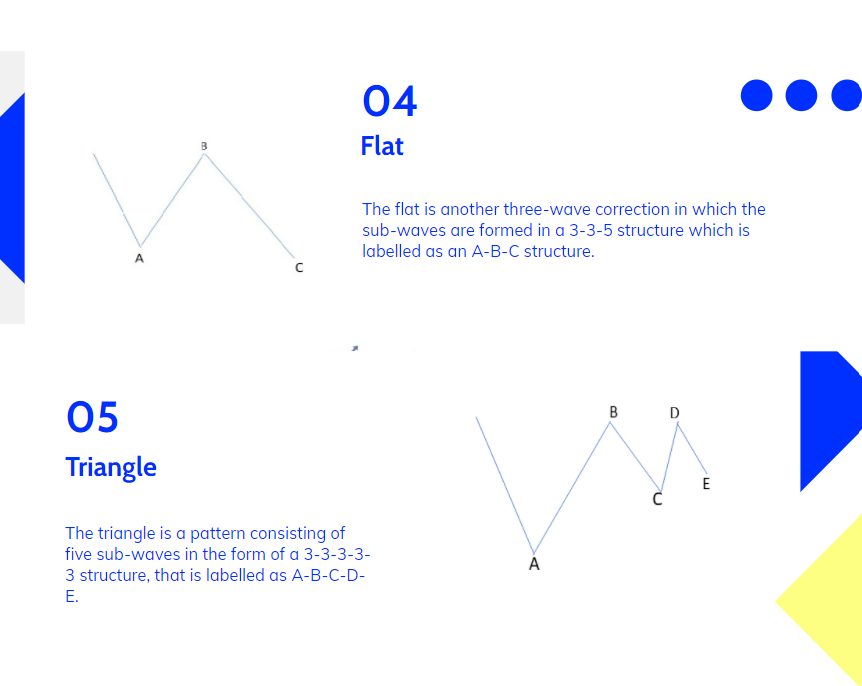

The Zig-Zag is a corrective wave that is made up of 3 waves labelled as A, B and C that move strongly up or down.

The A and C waves are motive waves whereas the B wave is corrective (often with 3 sub-waves).

Zigzag patterns are sharp declines in a bull rally or advances in a bear rally that substantially correct the price level of the previous Impulse patterns.

Zigzags may also be formed in a combination which is known as the double or triple zigzag, where two or three zigzags are connected by another corrective wave between them.

4. Flat

The flat is another three-wave correction in which the sub-waves are formed in a 3-3-5 structure which is labelled as an A-B-C structure.

In the flat structure, both Waves A and B are corrective and Wave C is motive having 5 sub-waves.

This pattern is known as the flat as it moves sideways. Generally, within an impulse wave, the fourth wave has a flat whereas the second wave rarely does.

On the technical charts, most flats usually don’t look clear as there are variations on this structure.

A flat may have wave B terminate beyond the beginning of the A wave and the C wave may terminate beyond the start of the B wave. This type of flat is known as the expanded flat.

The expanded flat is more common in markets as compared to the normal flats as discussed above.

You can also join our course on MASTERCLASS TO ELLIOT WAVE

5. Triangle

The triangle is a pattern consisting of five sub-waves in the form of a 3-3-3-3-3 structure, that is labelled as A-B-C-D-E. This corrective pattern shows a balance of forces and it travels sideways.

The triangle can either be expanding, in which each of the following sub-waves gets bigger or contracting, that is in the form of a wedge.

The triangles can also be categorized as symmetrical, descending or ascending, based on whether they are pointing sideways, up with a flat top or down with a flat bottom.

The sub-waves can be formed in complex combinations. It may theoretically look easy for spotting a triangle, it may take a little practice for identifying them in the market.

You can watch our video on Elliott Wave Theory:

Bottomline

As we have discussed above Elliott wave theory is open to interpretations in different ways by different traders, so are their patterns. Thus, traders should ensure that when they identify the patterns. You can understand in detail about Elliot waves through our Elliot wave course in India.

Get more Market Insights through StockEdge

Very nice for beginners

Hi,

We really appreciated that you liked our blog!

Thank you for Reading!

Keep Reading!