Although trading can be profitable and exciting, it can also be mentally and emotionally challenging. Many traders, especially novice traders, find it difficult for controlling their emotions and keeping a focused mindset, which results in bad choices and loss in the stock market.

Understanding and controlling your emotions, biases, and mindset can make all the difference in your ability to trade successfully. This is where trading psychology comes in.

In this blog, we’ll examine the essential components of trading psychology and offer techniques for cultivating a winning attitude.

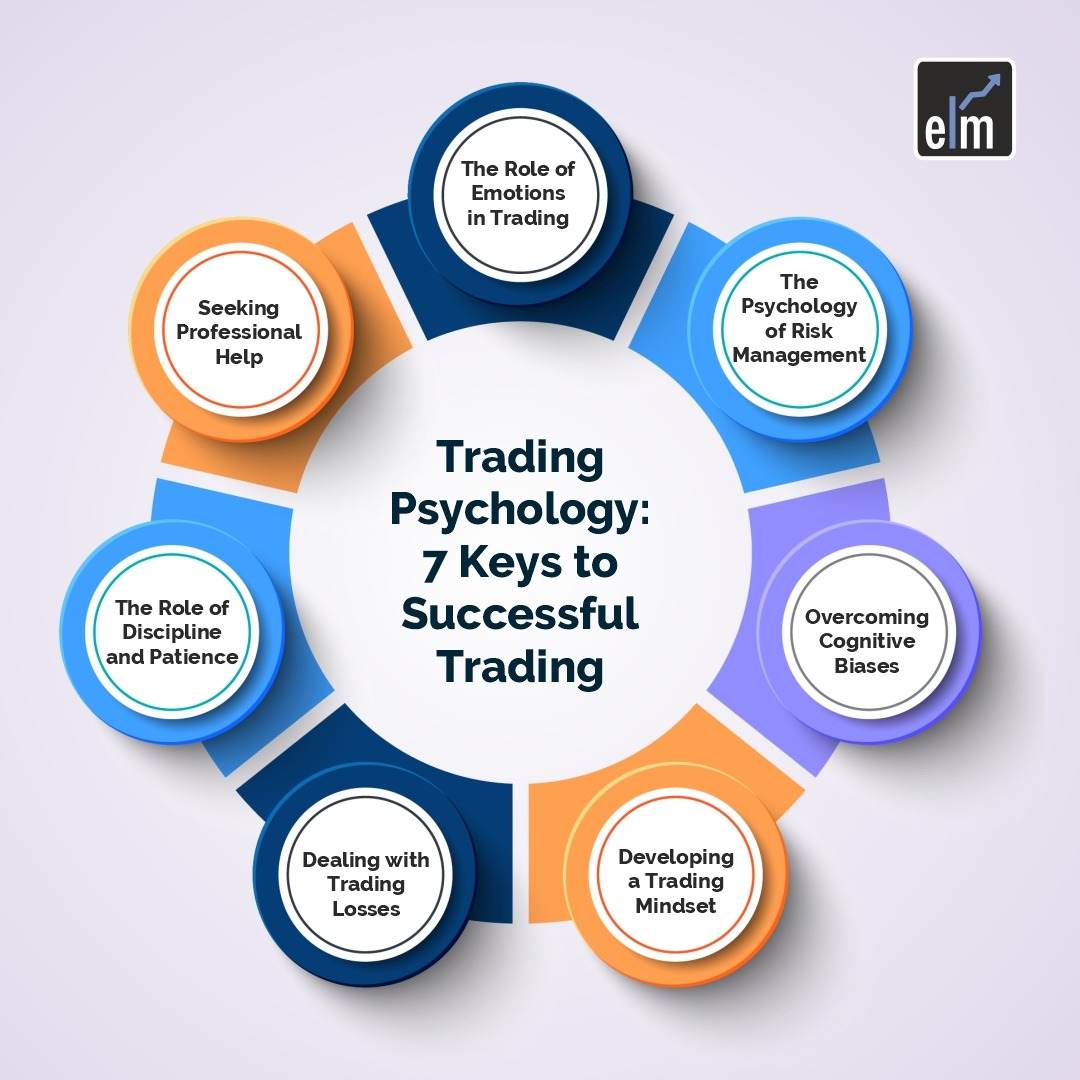

Trading Psychology: 7 Keys to Successful Trading

1. The Role of Emotions in Trading

Trading in the stock market is an emotional rollercoaster where you experience moments of elation and confidence along with moments of anxiety and uncertainty. Fear, greed, hope, and frustration are common feelings for traders. These feelings have the potential to impair judgement and affect irrational decisions, such as holding onto a failing business for an extended period of time or risking an excessive amount of money in the pursuit of gains.

Recognising your emotions and understanding how they impact your trading behaviour should be the first step for any trader.

One should keep a trading journal in which you track your emotions before, during, and after each trade is useful strategy. By monitoring your emotions, you can start to identify trends and situations that influence your decisions.

You can begin to create coping mechanisms for your emotional triggers once you’ve identified them. For instance, you can use deep breathing exercises or visualisation techniques to boost your confidence if you discover that fear is preventing you from making a trade. After a winning streak, you can also remind yourself to maintain discipline and refrain from unnecessary risk-taking if you have a tendency to become overconfident.

2. The Psychology of Risk Management

An important component of trading psychology is risk management. Understanding risk and its psychological effects, including how risk tolerance affects trading behaviour, is crucial.

Setting appropriate stop-loss levels and position sizing based on your risk appetite and trading strategy are essential components of effective risk management.

One should focus on the process rather than the result is one of the best methods to manage risk in the stock market.

Focus on following your trading plan with discipline and consistency rather than becoming fixated on the potential gains or losses of a trade. You can lower your risk of emotional reactions and enhance your trading performance by keeping a long-term perspective and avoiding rash choices.

3. Overcoming Cognitive Biases

Another common issue in trading psychology is cognitive biases These mental shortcuts help our minds make difficult decisions easier, but they can also lead to irrational thinking and bad judgement.

Some examples of cognitive biases in trading include confirmation bias refers to seeking information that confirms your beliefs. Loss aversion refers to being more sensitive to losses than gains and hindsight bias means thinking you could have predicted an event after it has happened.

It’s important for remaining conscious of cognitive biases and purposefully challenge your presumptions in order to overcome them.

One effective technique is to seek out diverse perspectives and alternative viewpoints to counteract confirmation bias.

Additionally, focusing on data-driven analysis rather than gut instincts can help reduce the influence of emotions and biases on your trading decisions.

4. Developing a Trading Mindset

Self-reflection and self-awareness are among the best ways that help in creating a trading mindset. You can start recognising limited beliefs and damaging self-talk by taking a close look at your thoughts and feelings.

Long-term trading success requires adopting a winning mindset. This helps in developing mental toughness, staying committed to your goals and also keeping a positive outlook.

5. Dealing with Trading Losses

Trading will result in some losses, and how you react to them will have a big impact on your trading psychology.

It’s critical to comprehend and accept that losses are a necessary component of trading. Consider losses as chances for growth and learning rather than dwelling on them.

When faced with a loss, one should take the time to analyse what went wrong and also identify any lessons you can learn from the experience.

By learning about losses as valuable feedback, you can turn them into improvement. It’s also important to practice self-compassion and avoid self-blame. Remember that trading is a journey, and setbacks are natural.

6. The Role of Discipline and Patience

Discipline and patience are the cornerstones of successful trading. It’s essential to stick to your trading plan, follow your rules, and avoid impulsive decisions driven by fear or greed. Discipline also involves being patient and waiting for high-probability trade setups instead of chasing every opportunity.

To maintain discipline and patience, it can be helpful to establish a routine and create a trading plan that includes specific entry and exit criteria.

By having a well-defined plan, you can reduce the influence of emotions and make more objective trading decisions. Regularly reviewing and updating your plan can also help you adapt to changing market conditions and avoid complacency.

You can also watch our webinar on Trading for Living: Learn Trading Psychology

7. Seeking Professional Help

While developing your trading psychology skills is crucial, there may be times when seeking professional help is beneficial.

Trading coaches, mentors, and therapists who specialize in trading psychology can provide valuable guidance and support. They can assist you in locating and removing ingrained psychological obstacles that might be impeding your trading performance.

One should never be afraid of reaching out to superheros in the stock markets if you feel stuck or overburdened so they can give you the trading strategies and methods which you will need to get past your obstacles.

There are many resources available, such as trading books, online classes, and trading communities where you can meet and interact with others who share your interests and learn from more seasoned traders.

Conclusion

By understanding and managing their emotions, traders can overcome their cognitive biases, develop a winning mindset, and practising discipline and patience; they can enhance your trading .

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Happy Investing!

To get the latest updates about Financial Markets, visit StockEdge