There are hundreds of trading journal books available, each promoting a unique approach to trading and how to find the best trading opportunities. But there is one thing on which all traders agree: you must keep a trading journal to become a profitable trader.

Just think about it:

Do you remember your last 10 or 20 trades?

Do you recall what went wrong and what you should have done instead?

What did you do particularly well, and what do you need to do more?

Which errors do you keep making, and when do you make them? I could go on and on, but I’m sure you get the idea.

Of course, no one can recall all of their previous trades off the top of their heads. But how can you expect to improve as a trader if you don’t know where to start or how to improve?

Finally, trading is similar to running a business. And no business can thrive if the owner does not understand the numbers. Of course, you can’t run a successful business if you don’t know your revenue, costs, profits, best-selling product, and how much tax you owe. That is something we can all agree on. It works the same way in trading.

So, in today’s blog, let us discuss how to create a trade journal book:

What is a Trading Journal?

A trading journal is where you keep track of your day’s trading progress. Entries typically include information about your trades (or notes on why you didn’t trade), what you did, and your overall results.

There are several methods for tracking your trading data. Others use Excel or Google Docs, while some traders use a note-taking app. Some people use a trading-related program.

A trading journal is where you keep track of your day’s trading progress. Trading journal entries typically include information about your trades (or notes on why you didn’t trade), what you did, and your overall results. Some traders use a note-taking app, while others prefer Excel or Google Docs as their trading journal.

Benefits of Maintaining a Trading Journal

Let us discuss some benefits of creating a trading journal:

1. Help You Develop Your Strategies

Paper trading, experimenting with different strategies, and keeping a trading journal of your progress can all assist you in determining which strategies work best for you. That is how you can work to improve over time.

2. Help You Develop Your Discipline in Trading

Keeping a journal forces you to confront the truth about what you’re doing right — and wrong. When you’re honest about where you could improve, it can help you focus your study time. It can also help to improve discipline by instilling a sense of responsibility.

3. Help You Master Your Emotions

It would be fantastic if you could trade without feeling. Unfortunately, this is not an option.

That much is obvious. Consider all the obstinate short-sellers and their poor decisions when caught in one of the recent insane short squeezes.

Tracking your trades can assist you in analyzing your behavior patterns and determining what factors influence your personal trading psychology.

4. Improve Your Risk Management

Risk management is taking into account all of the variables associated with risk and determining the level of risk you are willing to accept.

When you trade, you are taking a risk. That is unchangeable. However, you can improve how you manage risk.

Are you, like so many newcomers, taking massive positions on trades in the hope of winning big? Begin keeping track of your trades. You may notice that you have the wrong money mindset, causing you to lose a lot of money. Tracking everything can help you adjust your risk to a more prudent level.

It’s all about small victories that add up over time!

Now, let us discuss how you can create your trading journal:

How to create your Trading Journal?

Here’s what you’ll need to document both during and after the trade:

Relevant metrics

The relevant metrics for your trading journal are:

- Date – Date you entered your trade

- Time Frame – The time frame you entered on

- Setup – Trading setup that triggers your entry

- Market – Markets you’re trading

- Lot size – Size of your position

- Long/Short – Direction of your trade

- Price in – Price you entered

- Price out – Price you exited

- Stop loss – Price where you’ll exit when you’re wrong

- Profit & Loss in Rs. – Profit or loss from this trade

- Karma- Whether you are satisfied with the trade or not. If satisfied, we will add +1 in the Karma column; if not, then -1.

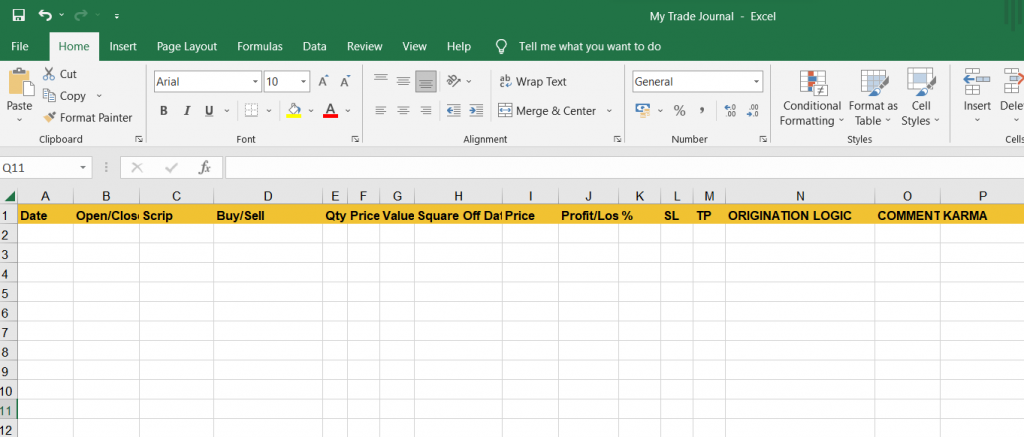

Below is an example of Trading Journal that we have prepared in the excel sheet with the above metrics-

Example

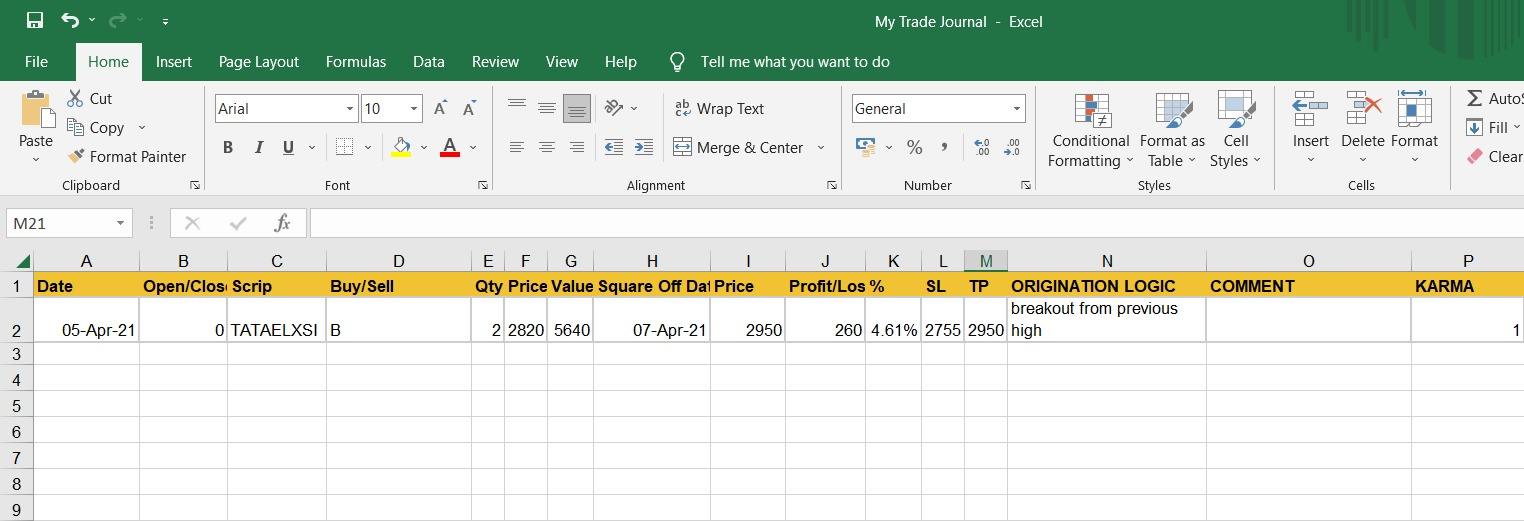

Chart of entry timeframe– This is your trading setup’s chart. You should specify your setup, as well as your entry level and stop loss. For example, you took a trade in the stock Tata Elxsi Ltd. The stock price broke out from the previous high, and we entered the trade at Rs. 2820 with the stop-loss of Rs. 2755.

Chart after the trade is completed– This is the chart after the trade has been completed. You want to state the trade’s final result with gained/loss amount and also the Karma value when the targeted price is reached, as shown below-

How to review your Trading Journal?

If you kept a trading journal and kept it up to date, you can now go over it and improve your trading results.

This is the chart after the trade has been completed. You want to state the trade’s final result with the R multiple gained/loss.

1. Identify patterns that lead to your losses

There may be some trading setups that are consistently causing you to lose money. So, go through your trading journal and find the worst-performing setup — and then stop trading it.

This simple change will reduce your losses and, in the end, increase your net profits.

2. Identify patterns that lead to your winners

Following that, you should identify your best trading setups. These are the ones who consistently bring in money.

So, go through your trading journal and find the best-performing setup — and concentrate on it. If you want to find more trading opportunities, trade in more markets, trade in a different timeframe, or do both.

3. Find ways to minimize your losses

Let’s take things a step further now.

Even after you’ve identified your best trading setups, you’ll have losers. So, examine the losers from your best trading setups and ask yourself-

“How can I reduce my losses?”

Maybe you can cut your losses sooner. Maybe you can use a filter to reduce your losses. Maybe you can avoid trading at certain times of the day (or week).

4. Find ways to maximize your gains

Do you want to step up your trading game? Then you must figure out how to maximize your profits.

Examine your best trading setups and ask yourself- “How can I make the most money from these trades?”

You can by-

- Scale back a portion of your trade and let the rest run.

- Identify and follow the patterns that lead to monster winners.

- Think for yourself and come up with a solution that works for you.

You can also do our course on TRADING MENTORSHIP PROGRAM

You can watch our video on How to create your Trading Journal by Mr. Vivek Bajaj

Bottomline

If you want to take your trading to the next level and are tired of not seeing any results, it may be time to take things more seriously and begin a trading journal.

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Happy Investing!