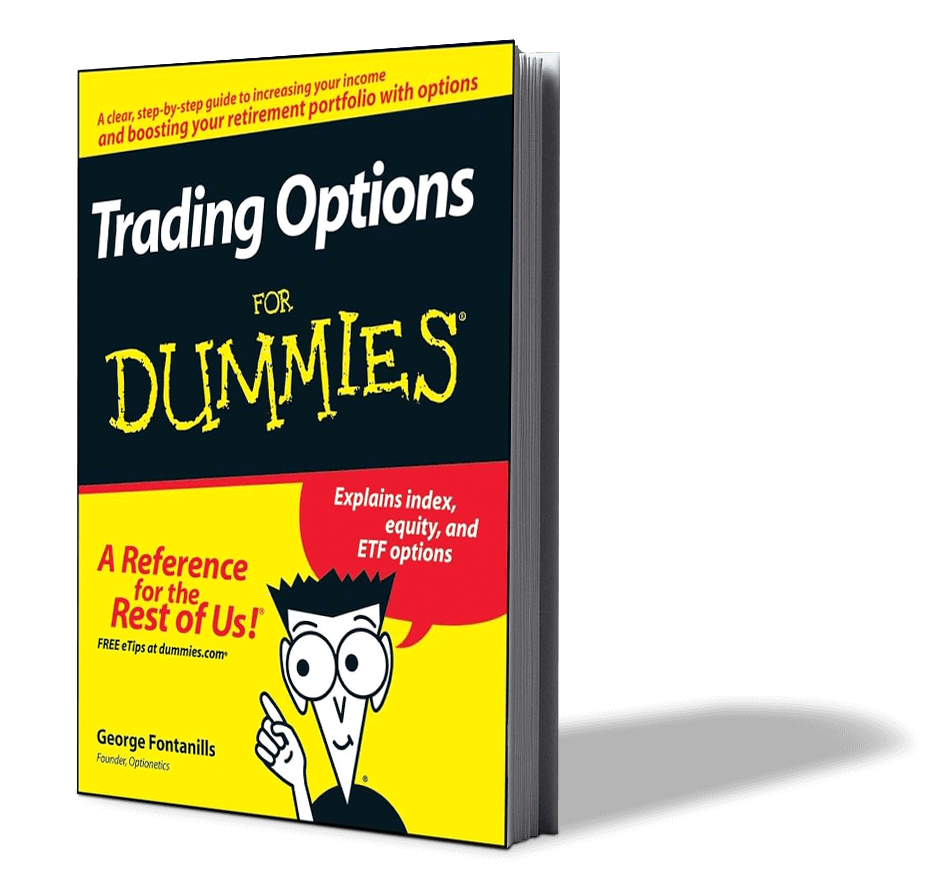

Options trading sounds complicated, right? For many beginners, it feels like stepping into a high-stakes casino.

But this is not the truth!

In reality, options trading helps you hedge risks, amplify profits, and even make money when the market is moving sideways.

The key? Understanding how it works before actually trading in options.

That’s where books come in! A good options trading book can simplify difficult topics and help you build a strong foundation before you risk your hard-earned money.

So, if you’re just starting out, these five options trading books will guide you through the steps of options trading.

Options Made Easy – Guy Cohen

“If you can’t explain it simply, you don’t understand it well enough.” – Albert Einstein.

If you’re a beginner, this options trading book is a perfect starting point. Guy Cohen explains complex concepts in a simpler way than studying a textbook. This book is for beginners who want to learn about options step-by-step without getting lost in difficult technical jargon.

What You’ll Learn?

- The basics of calls and puts

- How option pricing works

- When to use simple option strategies

- How to avoid common beginner mistakes

The Options Playbook – Brian Overby

This options trading book can be considered a guide to options strategies. It lays out 40+ trading strategies with clear instructions on when and how to use them. This option trading book is best suited for beginners who want to explore different strategies and find what suits them best.

What You’ll Learn?

- How to use spreads, straddles, and iron condors

- When to use different strategies based on market conditions

- How to manage risk and maximize rewards

This book can be kept as a reference guide—you’ll come back to it often as you experiment with new strategies.

Trading Options for Dummies – George Fontanills

This options trading book is a comprehensive guide that helps beginners understand options trading and is easy for beginners.

It explains important options trading concepts like calls, puts, strike prices, and expiration dates simply.

The book also covers important strategies such as covered calls, straddles, and spreads, helping options traders learn how to trade in different market conditions.

What You’ll Learn?

- The basics of buying and selling options

- How to use technical analysis to improve trade timing

- The importance of risk management in options trading

Options as a Strategic Investment – Lawrence McMillan

This book is a must read for serious traders who want to make a career in options trading. This book covers major topics from basic to advanced options strategies. Thus, helping traders to understand how to use options for hedging, speculation, and income generation.

In this option trading book, McMillan explains strategies like covered calls, spreads, straddles, and volatility-based trading. He also describes how to manage risk and maximize returns in different market conditions.

What You’ll Learn?

- Advanced strategies for hedging and speculation

- The impact of market trends and volatility on options

- How to use options for portfolio hedging

Option Volatility & Pricing – Sheldon Natenberg

The book focuses on how volatility impacts option prices and teaches traders how to use it to their advantage.

It covers key topics like implied and historical volatility, pricing models, Greeks (Delta, Gamma, Theta, Vega), and advanced trading strategies like spreads and straddles.

Natenberg explains how professional traders think and manage risk, making it a great resource for those who want to trade options more effectively.

What You’ll Learn?

- The role of volatility in option pricing

- The importance of the Greeks (Delta, Gamma, Theta, Vega)

- How market movements affect option prices

Conclusion

Choosing the right book depends on where you are in your options trading journey, i.e., whether you are a beginner or a professional. If you’re a complete beginner, Options Made Easy or Trading Options for Dummies will help you understand the basics. If you’re ready to explore different strategies, you should opt for The Options Playbook.

For those who are looking for a deep dive into advanced strategies, Options as a Strategic Investment offers in-depth knowledge. If you enjoy technical details and want to master volatility and pricing, opt for Option Volatility & Pricing. One should remember that reading is just the first step—practice on a demo account and test different trading strategies.

You can visit StockEdge to explore detailed market insights.