Have you been in the stock market for quite a few years and now you are considering buying or selling options?

If yes, then selecting the strike price is the most important decision to make.

When you pick your options strike price, it depends on a number of key decisions, likes:

What are you expecting the move in the underlying stock over a specific period and also what price are you willing to pay for buying an options contract?

| Table of Contents |

|---|

| What is the Strike Price? |

| How to analyze the options strike price? |

So let us first discuss what is the strike price and then we will discuss how to select the strike price for your option contract:

What is Strike Price?

The options strike price refers to the price at which a call or a put option can be exercised.

The strike price is also known as the exercise price.

For call options, the strike price refers to the price at which an underlying stock can be bought.

Similarly, for put options, the strike price refers to the price at which underlying stock can be sold.

Selecting the strike price is one of the main decisions that an investor or trader should make when selecting a specific option.

How your option trade will play out mainly depends on selecting the right options strike price.

How to analyze Options strike price?

Having understood what the strike price is, let us now discuss how to analyze the same.

Example:

For example, if the buyer wants to buy ITC Limited’s Call Option of Rs.165 (165 being the strike price) then this indicates that the buyer wants to pay a premium today for buying the rights of ‘buying ITC at Rs.165 on expiry’.

Needless to say, he will buy ITC at Rs.165, if ITC is trading above Rs.165.

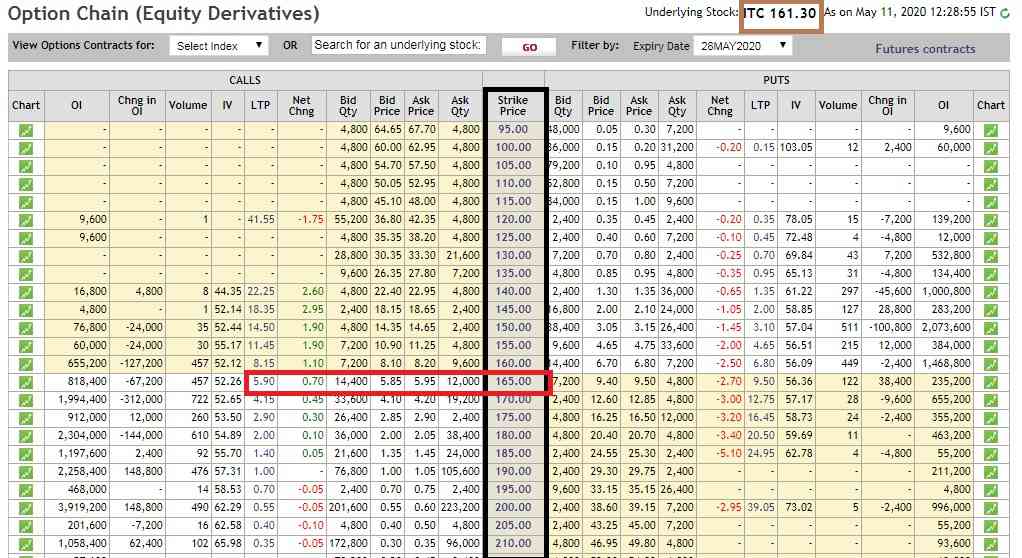

Below is a snapshot from NSE’s website where different strike prices of ITC and the associated premium can be seen:

Start learning from Market Experts:

The above table is known as the ‘Option Chain’, which shows all the different strike prices available for the options contract with the premium for the same.

The above option chain table also includes a lot more trading information like Open Interest, volume, bid-ask quantity, etc.

Now let us discuss in detail the highlighted information:

The highlight in maroon shows the price of the underlying stock in the spot that is according to our example; ITC is trading at Rs.161.30 per share.

- The highlight in black shows us all the different available strike prices. As we can see starting from Rs.95 with Rs.5 interval to strike prices up to Rs.210

- One should also remember that each strike price is independent of the other.

- One can enter into a 165 call options by paying a premium of Rs.5.90 that is highlighted in red.

- This means that the buyer is entitled to buy ITC shares at the end of the expiry at Rs.165. One should know that under which circumstance it makes sense to buy ITC at 165 at the end of expiry.

Picking up the strike price is one of the main decisions for an options trader as it has a very important impact on the profitability of an option position.

Traders should do their homework for selecting the optimum strike price, as it is a necessary step for improving your chances of success in options trading.

You can also use option scans to filter out stocks for trading the next day by using StockEdge App, now also available in the web version.

You can also practice options strategies on Elearnoptions.

Key Takeaways:

- The strike price of any option contract is the price at which a call option or a put option can be exercised.

- A conservative investor should opt for a call option whose strike price is at or below the stock price.

- Similarly, a put option should opt for that strike price at or above the stock price as it is safer than a strike price below the stock price.

- Picking up the wrong strike price can result in losses, and this risk increases when the strike price is set away out of the money

Having understood how to analyze the strike price as shown above, why don’t you start analyzing the strike price as shown above? Tell us by commenting below:

Happy Learning!