A bear call spread strategy is a two-part options strategy that includes selling a call option and receiving an upfront option premium, then buying a second call option with the same expiration date but a higher strike price. One of the four fundamental vertical option spreads is the bear call spread.

The amount of option premium is smaller because the strike of the call sold (i.e. the short call leg) is lower than the strike of the call purchased (i.e. the long call leg).

So, in today’s blog, let us discuss the Bear Call Spread Strategy:

What is Bear Call Spread Strategy?

Buying a Call Option and selling a Call Option with a lower strike price on the same underlying asset and expiry date is referred to as a Bear Call Spread Strategy.

When you sell a Call Option, you get paid a premium; when you buy a Call Option, you pay a premium. As a result, your investment cost is substantially lower. In addition, because the return is limited to the difference between the premium received and paid, the technique is less risky.

This approach is applied when a trader feels the underlying asset price will fall moderately. Because a net credit is received upon joining the trade, this method is known as the bear call credit spread.

The strategy’s risk and profit are both limited.

How does Bear Call Spread Strategy work?

Let us take the stock example so that we can understand this strategy better-

Index Example- Nifty50 – 13.6.2022

1. Outlook

We were bearish on the Nifty 50 index due to global factors such as US Inflation and the rising dollar. Also, the Nifty 50 opened gapped down due to global factors. Below is the chart of the Nifty 50:

2. Strategy

To implement the bear call spread –

- Buy 1 OTM Call option (leg 1)

- Sell 1 ITM Call option (leg 2)

One should ensure that-

- All strikes belong to the same underlying

- Belong to the same expiry series

- Each leg involves the same number of options

- Let us take up an example to understand this better –

Outlook – Moderately bearish

Nifty Spot – 15800

Bear Call Spread, trade set up –

- Buy 15900 CE by paying Rs.239.05 – as a premium; do note this is an OTM option. This is a debit transaction since money is going out of my account.

- Sell 15700 CE and receive Rs.343.95- as a premium, do note this is an ITM option. Since I receive money, this is a credit transaction.

Suppose the stock price is at or below the short call’s strike price (lower strike) at expiration and both options expire worthlessly. In that case, the potential profit is restricted to the net premium collected less commissions.

3. Maximum loss\risk

The maximum risk is the difference between the strike prices minus the net credit received, including commissions. In the example above, the difference between the strike prices is 200 (15900 – 15700 = 200), and the net credit is 104.9 (343.95 – 239.05 = 104.9).

Therefore, the maximum risk is 95.1(200-104.9) per share less commissions. This maximum risk is realized if the stock price is at or above the long call’s strike price at expiration.

Short calls are generally assigned at expiration when the stock price is above the strike price.

5. Breakeven stock price at expiration

The strike price of short call (lower strike) plus net premium received.

In this example: 15700+ 104.9 = 15804.9

6. Payoff Diagram

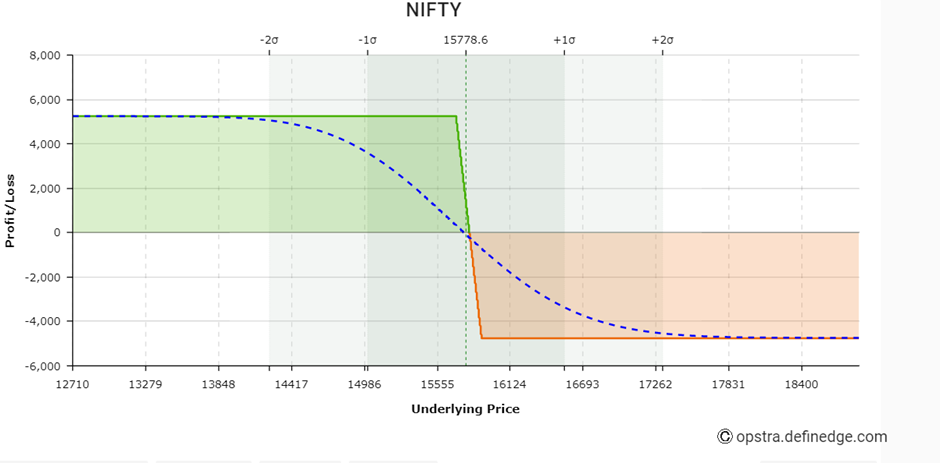

Below is the Payoff diagram of the above strategy:

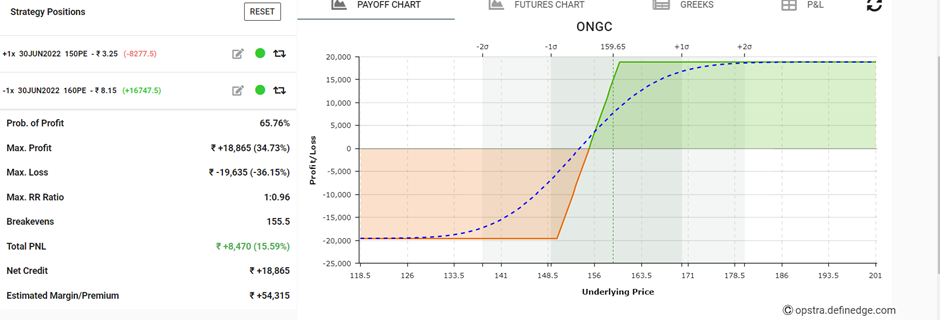

Before we conclude, we would like to show you how our last strategy- Bull Put Spread Strategy did that we implemented on Oil and National Gas Corporation Ltd.:

Bottomline

Finally, traders can profit from mild falls or neutral price movements in the underlying asset by using the Bear Call Spread technique. Traders restrict potential losses while creating a net credit by selling a call option with a lower strike price and simultaneously purchasing a call option with a higher strike price. The technique has little risk, but its maximum reward is capped at the original credit obtained. Setting suitable exit points, controlling risk, and comprehending market conditions are essential for a successful implementation. The Bear Call Spread strategy offers traders looking to generate revenue in particular market conditions a methodical way to go.

Frequently Asked Questions (FAQs)

What is a Bear Call Spread?

An options trading method used by investors who predict a drop in a security’s price is known as a bear call spread. It is the act of simultaneously purchasing a call option with a higher strike price and selling a call option with a lower strike price, both of which have the same expiration date.

How does a Bear Call Spread work?

When the underlying security’s price stays below the sold call option’s strike price until it expires, the strategy makes money. In the event that the value of the underlying asset unexpectedly increases, the acquired call option reduces possible losses.

What is the maximum profit and loss potential of a Bear Call Spread?

The net premium collected from selling the call option less the premium spent to purchase it sets the maximum profit. The difference between the strike prices less the net premium obtained is the maximum loss that can occur.

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.