Are you aware that you have an estate?

No!

Almost every one of us does have.

The term “estate” might seem to be a very complicated term, but in simple words, it comprises of everything you own- right from your home, car, bank accounts, life insurance, investments and any personal possessions.

Irrespective of how big or small estate you have, you’re not going to take it with you after you die.

Hence, estate planning is a very important decision.

To make sure that everything is done according to your wish, you need to document everything legally stating that whom you want something of yours to receive after your death, what and when exactly you want them to receive.

Moreover, you’ll also want the entire procedure to happen with the very nominal amount paid as taxes and legal charges.

Learn Estate Planning by enrolling in NSE Academy Certified Financial Planning & Wealth Management course on Elearnamrkets.

Estate planning

It is a process which involves few people including your family, other individuals and in some cases, charitable institution of person’s choice.

It involves deciding upon the title holder of your assets in case of your disability or death.

Moreover, it also addresses the future needs if you’re not able to take proper care of yours.

In very simple words, estate planning refers to making a pre-plan and naming the people whom you want the things to receive after your death.

An advocate or a lawyer may help you in planning your estate and also advise on issues like asset title, taxes, and the estate management.

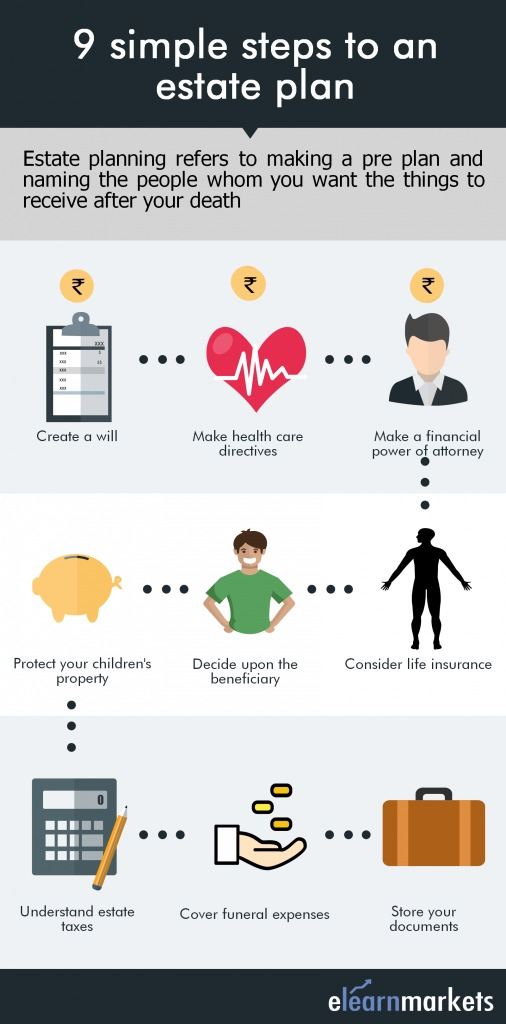

Estate Planning Checklist

1. Create a will– A will is a traditional legal document where you name a person who you want to inherit your property or specify a guardian to take care of your kids in case something happens to you or your partner.

2. Giving directives for your healthcare– It’s better to write down your wishes for health care which can be a savior when you are not able to make decisions for yourself.

Moreover, you should also specify a power of attorney for your health care which make sure someone has the power to make decisions when you can’t.

Know More: How To Choose A Best Health Insurance Plan?

3. Decide upon a financial power of attorney– It’s a very important decision where you can give authority to a trusted person to take care of your assets and finances in case you are not capable to handle it.

4. Children’s property should be protected– Do mention the name of an adult in order to manage the property and money inherited by your minor children.

5. Decide upon the beneficiary– When you name a beneficiary for your bank accounts or any retirement plans, it by default becomes payable on death to the beneficiary and it help the funds to avoid the probate process.

Read More: Why is Retirement Planning Important?

6. Life insurance should be considered– Life insurance becomes a good idea when you own a house or have young children, or owe large amount of debts or estate tax.

Learn More: Know the Future of Life Insurance? Also Cover its Benefits

7. Estate taxes need to be understood-You must have an idea about the estate tax calculation or consult a lawyer to deal with such matters.

8. Cover your funeral expenses– Instead of going for a funeral prepayment plan; you may opt for a payable on death account at the bank and submit funds to cover funeral and related expenses.

9. Properly store your documents– Your lawyer may require access to the various documents so you must store them properly.

10. Make final arrangements– If you have any wishes for donation of any organ or any other wish, so make it known.

Estate Planning Myth

Most people have a misconception that estate planning is for the retired people.

This is wrong since nobody can predict that how long will they survive as accidents and illness happens to people of all ages.

Another myth which people face is that estate planning is for the wealthy people but actually good estate planning is more important to families with modest assets as they can’t afford to lose it.

Most people don’t plan

Individuals have a tendency to neglect estate planning.

Everyone has a different reason but some of the most common excuses are as follows:-

1. People believe that they don’t own enough assets

2. They have plenty of time

3. They are not old enough to think of the same

4. People seem to be very busy

5. They are very confused and don’t know from whom to ask for help, etc.

Due to such neglect the family of the person often suffers as when something happens to the individual, the family has to connect the pieces together.

Know more about Estate Planning by watching the video below:

Consequences in the absence of an estate planning- “you may not like it”

The rules and regulations of estate planning differ from state to state.

Let’s understand what happens during disability and at the time of the death of the individual.

a. At disability- Say if you are the title holder of the assets and you are unable to conduct business due to any physical or mental incapacity, then only a court appointee can sign on your behalf.

Your family will lose control over the assets and rather the court will give directions as to how your assets will be used to care for you through guardianship or conservatorship.

This is an extremely time consuming and an expensive affair.

Moreover, even if you recover, it will be very difficult to end.

b. During your death- In case of your death without a proper estate planning, your assets will be distributed as per the law prevailing in the state.

In most states, say if you are a married person and have kids, your spouse and children will each receive a share.

It means that your wife will receive only a portion of your estate and it may not be enough for her to survive.

The court will control the inheritance if you have minor children and in case of death of both parents, a guardian will be appointed without knowing whom you would have chosen.

If you have a choice, will you not prefer to solve this matter privately by your own family rather than going to court?

Wouldn’t you prefer to have a control over who receives what and when?

Wouldn’t you prefer to decide as to who will take care of your kids if you can’t?

Estate planning may not be expensive

If you’re unable to afford a complex estate planning at present, it’s better to start with what is there in your budget.

For a young and a small family, it may start by creating a simple will, power of attorney of your assets, healthcare decisions and taking up a term life insurance.

With the improvement of your financial situation and as per your changing needs, develop and expand your planning accordingly.

Seek the help of an experienced lawyer as he may provide critical guidance and don’t try to do it yourself just to save some money.

Bottomline

When you have done estate planning and you have a proper plan to protect your family which is as per your guidelines, it will give you a peace of mind.

It is one of the most precious gift you can give yourself and to your loved ones.

Happy learning!!

Really helpfull and quite fantastic! Good work on this article. It’s worth reading.

Hi,

Thank you for reading our blogs!

Keep Reading!