In an interesting session as a part of the highly popular Face2Face series, conducted by Elearnmarkets, Mr Vivek Bajaj, Co-founder of Elearnmarkets, invited Mr Bharat Jhunjhunwala, a successful stock market investor with many years of experience, to decode A Unique Way of Using Relative Strength Index (RSI) Indicator.

Mr Bharat Jhunjunwala have done extensive research and study in the stocks and have degrees in CMT & CFT. He has created his technical indicator and also completed his master’s. He will talk about how he developed a passion for the markets in 2008 and made profits during a crash.

This blog will discuss everything about the Relative Strength Index, aka the RSI. The speaker will talk about a strategy which he thinks will benefit many retail investors. Combining price action with the RSI indicator, Mr Bharat says how practising this indicator will enable traders to identify upcoming changes in the market.

Relative Strength Index (RSI) – A Momentum Indicator

First of all, if anything is derived from price, then it will be able to explain anything only after the closing of the price.

So, if you want any confirmation or any price action, you first need to understand the price and then confirm it using RSI.

After reading many books on Momentum by Martin Pring, an expert in momentum, Mr Bharat concluded from his books that momentum is such an indicator that it gives you hints way before about an ongoing trend, whether it is getting weaker or stronger.

So, as we say, in X-ray vision that it gives us momentum. So if we can’t see that on a daily chart, then it might be possible that we could see it on a small-time frame chart.

We also call it fractal or fractal nature. You get a solid and powerful trading system if you mix the fractal nature of price action with momentum.

You can use it at your convenience because it’s too flexible, and there is no such set of stringent rules.

RSI Strategy

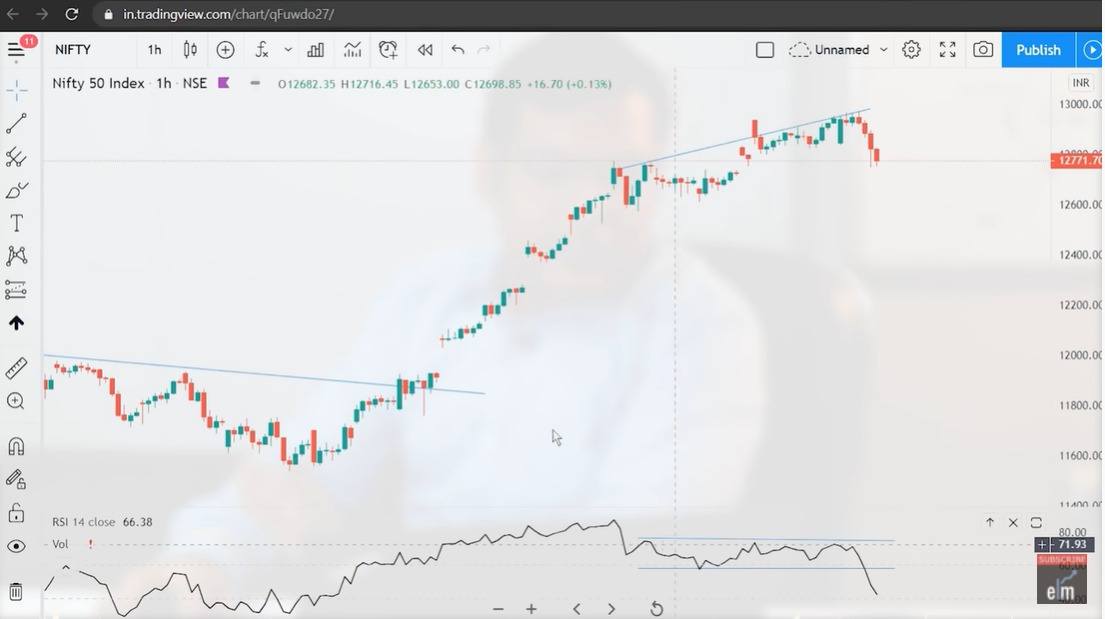

Mr Bharat Jhunjhunwala explains his RSI strategy with the help of the Nifty chart as shown below:

He tells us to look at the candle of 3rd November; that was when the market got better. So, after 3rd November, this candle got closed, and on 4th November, it broke the red line here, and the prices are making higher highs and are getting closed at higher highs.

And if you see there, the colours of candles are changing, and markets are explaining a different story.

Now, try to understand the price action or “try to understand the tempo of the market or the market’s speed”.

See, there were only green candles which clearly shows that only buying is happening and here comes the first red candle, which is our first hint that someone has started a little bit of selling.

It’s not in our hands to change the colours of the candles, which shows that someone has started selling. And here, one green candle and after those two consecutive red candles show more people are selling now.

Though the price is going up, he got the hint that something somewhere is being sold because if you see the candles only, then there are continuous green candles and suddenly the colours of candles start getting changed, which means the market is getting slowed down or somewhere someone is selling.

Now he took us to the small-time frame in hourly charts. As he said, the market is slowing down, which is clearly shown here through divergence.

Also, divergence is a misunderstood concept because people get excited and think that the market closes at divergence, which is just a myth. Divergence generally slows down the ongoing trend like detours.

Here comes the divergence, and after this, if you read the market correctly, you can benefit from it.

He explains that like this is a divergence, and if we talk about range rules, you might have heard about 60-40, but nothing is fixed in the market. Like your habits are different, and your traits are different.

So, it’s unnecessary that if 60-40 is getting followed at Nifty, it will also be followed at Bank Nifty because both have different characters.

Likewise, it’s not necessary that if 60-40 is being followed in HDFC, it will also be followed at DLF similarly.

As the name suggests, Relative Strength Index, so nothing is absolute, and we cannot make it absolute.

Mr Bharat tells us that Nifty created its RSI range, not 60-40. It’s almost between 75 and 55and almost for the last three days, it’s been trading between 75 and 55, and we also got an additional divergence.

So, it explains two things. First, the divergence indicates that the trend might not change, but the market may slow down in the upcoming days.

Next, RSI is struck here, also known as RSI compression, and this is a very powerful signal.

You can also do our course on RSI Made Easy

This compression is so powerful that you can catch the tops if you can read them. See, if this compression is the top of Nifty, then this compression will let me know in the upcoming one or two days that Nifty might have created a small top, major top etc.

Further, he explains the range rule on a short-term chart. Though you can use range rules on every kind of chart, whether you are a short-term trader or scalper or long term trader or an investor, you can use these range rules on every time frame chart using the same method.

More Webinars by Mr Bharat Jhunjhunwala

1. The Super Performance Trading Pattern – Achieving Superperformance with Limited Capital

The presentation intends to guide on how anyone can achieve above-average returns in trading even with small capital. This is not a capital extensive strategy. This strategy does not involve your full-time attention on the screen.

2. Strength Zones on RSI & Signals to trade at those zones

This Webinar is all about understanding the beautiful relationship between price and momentum. This session will discuss the details of the RSI indicator and understand the importance of momentum in the world of trading.

Get to know the simple yet versatile nature of the RSI indicator. Learn how to use RSI for successful trading. With RSI, you will be able to keep your trading simple yet effective.

3. Identifying Mutlibaggers using RSI Range Rules

RSI is one of the most versatile and important indicators in the field of Technical analysis. In this webinar, we take a deeper dive into RSI and discuss strategies for using it. You will learn to combine RSI range rules and simple price patterns to pick out very high probability stocks which may give super normal returns.

Range Rule was introduced by Mr Andrew Cardwell but is often used incorrectly by traders. In this webinar, we will focus on the correct use of the range rules and pull out multi-baggers.

You can watch the entire video here

Bottomline

We hope you found this blog informative and use it to its maximum potential in the practical world.

Interested in similar topics, then checkout our technical analysis course and explore the world of technicals even deeper.

Also, show some love by sharing this blog with your family and friends and helping us in our mission of spreading financial literacy.

Happy Investing!

You can also visit web.stockedge.com, a unique platform that is 100% focused on research and analytics.