Nifty close 10767.65: Nifty Ends in Green. Thursday’s gap up opening and a green candle helped Nifty to end in a positive note. Week started with red which drives nifty to touch its 100 MA line (which is at approx. 10552). Nifty takes a pull back from that points, this week’s RBI news and correction in oil price helped nifty to cover up its previous down move.

Hourly Technical

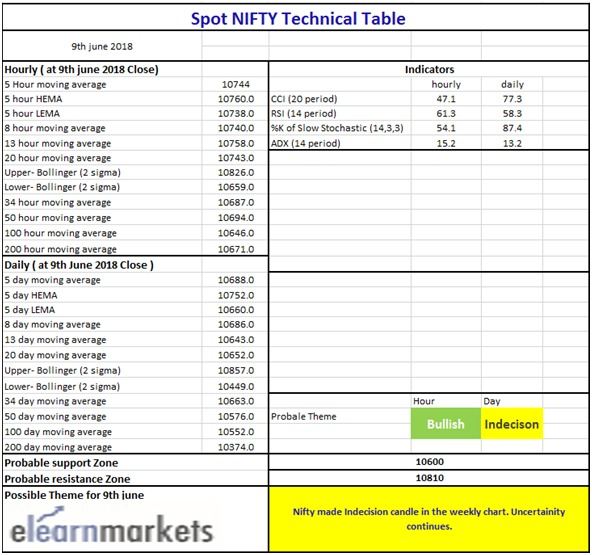

From the hourly chart it is visible that the Nifty is about to begin a new trend. Moving average lines are below the price and they will might as short term support for the price in case of a downfall.

Indicator RSI (Which is at approx. 61) suggesting the price is in a good support of momentum, slow stochastic also above level 50. In case of ADX it is at level 15 and trading flat, indicator CCI is just below 50.

Overall from the chart and from the indicator’s position, we can derive the up move may continue if Nifty breaks the 10800 level with good momentum. Only the upper Bollinger line (presently at 10826) could be a possible Resistance for the price.(Hourly Chart)

Daily Technical

In the daily chart, nifty presently trading at a Resistance level. This level has been tested by the index more than 4 times. Above this level Nifty is bullish. In the Thursday’s trading session nifty tried to give a breakout but it failed, and closed below 10800 level.

The good thing is moving average lines are below the price, they will support the index in case of a short dip. So there is less chance for Nifty to go down without any pause.

Let’s talk about the indicators. Momentum indicator RSI is below 60, Strength indicator ADX is trading flat, slow stochastic %k has already crossed it 70 marks and entered into the overbought level and CCI is turning back from 90 level.

Overall the indicator reaction is not positive as well as not negative. If Nifty breaks this 10800 zone, further up move may be possible.

(Daily chart)

Weekly Technical

In the weekly chart Nifty has made a Doji candle. Which shows indecision in the market.

This is the 3rd time Nifty making big spikes in the weekly chart, one positive thing to note that the price is above all moving averages line and the spike in the weekly chart also shows that buyers are still present in the market to push the market higher.

Let’s discuss the indicators,

RSI is just below 60, slow stochastic has entered into its overbought level, CCI is below 70 and the indicator ADX is at level 15.

Overall there is no significant movement visible from the indicators but from the candlestick, we can decipher that the indecision is taking the lead.

We have seen MA 34 line has been a good support for the index so until the index holds this level and stay above 10500 there will be always a good chance for the up move.

(Weekly chart)

You can use stockedge app to get cutting edge over others in both short term trading and investing. Here you not only get data at one particular place but can also create your own combination scans based on your own technical and fundamental parameter. See the video below to know about various features in Stockedge app.

Thanks for the article post.Really thank you! Great.

Welcome