Nifty close 10772.65:Trade war making the market highly unpredictable and volatile. This week Nifty made higher highs and higher lows in the daily chart but ultimately it ended in the same zone (10600-10800). In the weekly chart this is the 6th time index tries to cross the level.

However, we can expect a major movement for the next trading week because Nifty is standing at a very important level. Break in the up side may define a new trend for the index otherwise we may witnessmore spike or shadows in the chart.

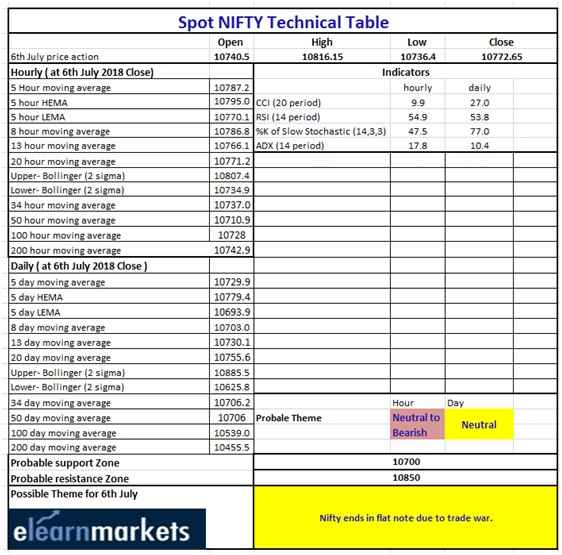

Hourly Technical

In the hourly chart we can see a short term uptrend is taking shape. The upper Bollinger band (presently at approx. 10807) act as a resistance here. This could be the one of the reason for the last hour sell off.

Let’s discuss the technical parameters. RSI is below 60, ADX is below 20 and facing downward, Stochastic and CCI in its normal zone. So from the indicator there is no such certain signal. Momentum is flat as well as the strength.

Overall, from the hourly chart we can expect that the short term uptrend may be continued if The index able to break the 10800 level and close above it. Unless there is a chance of short term downfall.

(Hourly chart)

Daily Technical

From the hourly chart we can see that the index is trading at a crucial resistance level. In the last trading day, it crossed the 10800 mark but unable to close above it. Breaking this level will create a new direction for the index.

Indicators are also trading quite flat. RSI is below 60, ADX is just above level 10, CCI is in its normal zone and Stochastic is about to cross its overbought level (presently at approx. 76.96).

One good factor for the index is that most of the moving average lines are below the price and in case of a short term downfall they might act as support (possible support area approx. at 10700 level). In case of a up move there is only one major level which will act as a strong resistance (Upper Bollinger line presently at approx. 10885)

(Daily chart)

Weekly Technical:

Nifty is still in the range bound zone in the weekly chart. This has been 6th attempt made by the index to cross and close above 10800 level. As we can we can see from the chart most of the candles are Doji which suggesting indecision in the market. However, from the lower shadow we can decipher that the buyers are still present in the market.

Momentum Indicator RSI is about to cross level 60 (presently at approx. 58.28), Stochastic has went up above 80 level, ADX is below 15 and facing downward and CCI is in its normal zone.

Overall there is no mentionable movements visible from the indicators. But price is above most of MA lines which is a good sign. Just like the daily chart, Upper Bollinger band will also act as a resistance in case of anup move (presently at 11022.89 level) in case of a short term down fall support is visible at 10700 level.

(Weekly chart)

You can use stockedge app to get cutting edge over others in both short term trading and investing. Here you not only get data at one particular place but can also create your own combination scans based on your own technical and fundamental parameter. See the video below to know about various features in Stockedge app.

https://www.youtube.com/watch?v=uqz4PVw0blw