Nifty close …..:Nifty opened flat and continued its upward journey in today’s session to close at record high. After a long time, there was a heavy buying seen by the FII’s yesterday which could also be seen as a positive trigger for the market.

Hourly Technical:

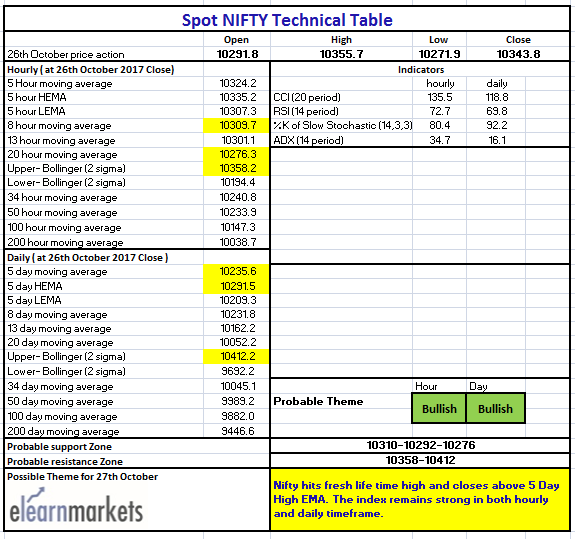

In the hourly chart, Nifty closed above most short term moving average which indicates the strong control of the bulls over bears.

The probable support in the hourly chart comes at 8 hour moving average (presently at approx. 10309.7) and 20 hour moving average (presently at approx. 10276.3).

On the upside, Nifty may face resistance at upper Bollinger line (presently at approx. 10358.2).

Hourly Stochastic, CCI and RSI are in the overbought zone and ADX is again inching higher suggesting gain of momentum. Overall Nifty remains higher in the Hourly chart.

Figure: Hourly Chart

Daily Technical:

In the daily chart, Nifty continues to stay above the 5 Day High EMA and also above most short term moving averages signalling a positive bias.

The probable support in the daily chart comes at 5 Day High EMA (presently at approx.10291.5) and 5 DMA (presently at approx.10235.6).

On the upside, Nifty may face resistance at upper Bollinger line (presently at approx.10412.2).

Stochastic, CCI are in the overbought zone while RSI is marginally below its upper bound. Overall Nifty remains very bullish in the daily chart.

Figure: Daily Chart

Figure: Tech Table