Each one of us has an inspiration in their lives, for me, it is my mother.

I have seen her managing everything with such balance. I always wanted to become like her, so well-organized and well-balanced in all facets of life.

And indeed she has taught me a lot of it.

Now one of the very special qualities of her, which inspires me the most is, whatever she used to do, she used to do it with 100% dedication

So be it planning groceries, arranging cupboards, planning a short trip or financial planning management for all of us.

I staunchly believed in her and the financial lessons she gave me, which gave a huge kick-start to my savings habit in my early 20s.

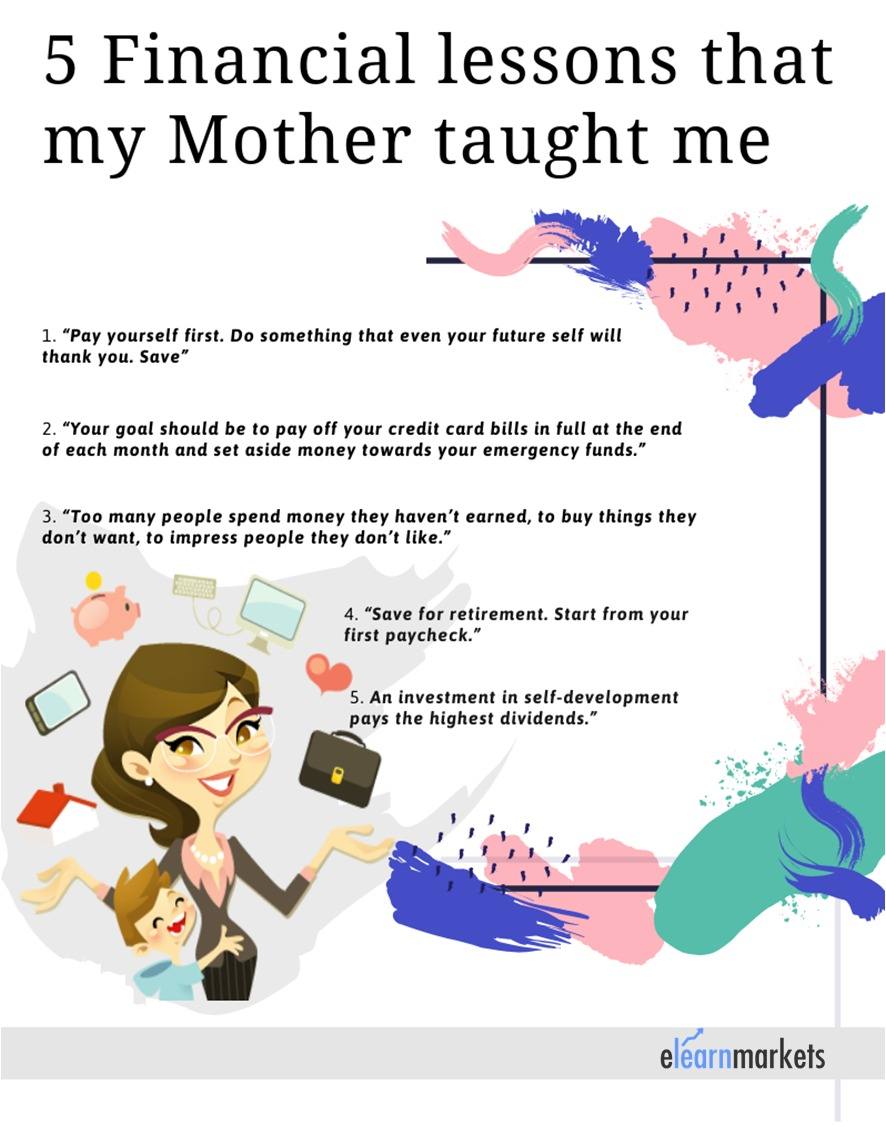

Let me share the 5 super hit one’s here:

1. Magic of 25%

“Pay yourself first. Do something that even your future self will thank you. Save”

This means whatever you may earn, keep a part of yourself as “Savings”. Her formula to save was: Expenses = Income – Savings

Now in this process, she taught me to keep 25% (I don’t know why this percentage was suggested by her, but I followed and it worked) of income as savings.

So suppose you earn Rs 20,000/- a month. Save Rs 5000/- of it and the remaining amount can be expended based on your priorities.

You can save more, obviously, I did not want to save at that age more than Rs 5000/-.

2. Invest this magical 25%

Now after I started saving this Rs 5000/-, most of the months I expended it around 2 months.

I don’t know how but I always ran short of money to rely either on my saved cash or go out for credit (credit lessons was her third gyan, discussed after this point).

So now she asked me to invest this Rs 5000/- in a Systematic Investment Plan (SIP) (I did not know what SIP was at that time, but I did a bit of research, understanding it to be an interest-earning option. So I came across a blog on 2 Steps Checklist on starting(SIP) and went ahead.

this Rs 5000/- in a Systematic Investment Plan (SIP) (I did not know what SIP was at that time, but I did a bit of research, understanding it to be an interest-earning option. So I came across a blog on 2 Steps Checklist on starting(SIP) and went ahead.

So every month I invested my saving of Rs. 5000 in a SIP that gave me an interest of around 12% p.a.

Now seriously this proved magic to me when I thought of a solo trip after 5 years ( I was 22 years old at that time). To my surprise, a whopping Rs 2.15 lacs approx (You can calculate this figure yourself, with the help of this SIP calculator) was shinning in my account.

Trust me, it was a dream come true.

You know it is quite practical and too much relevant. All you need to do is listen to your mother (which is a bit difficult at times) and START at the earliest.

3. Bad credits and good credits

“Your goal should be to pay off your credit card bills in full at the end of each month and set aside money towards your emergency funds.”

Now, let us come back from the solo trip and all and talk about the 3rd financial lesson from my mother.

Credit card – BOOM

My first mistake here was I started postponing bills to next month matching my credit card cycles.

Even though I had enough cash in hand to pay for the monthly expenditures and bills. I started using cards to pay for it. Actually I failed to understand that the benefit of credit cards was to meet emergency expenses, which cannot be postponed.

I also started spending a lot on online shopping, even if i was using entire time lot of coupons taken from dontpayfull.com.

So this carried on for a couple of months, when my saviour, my mom, asked me to get a scissor and cut the credit card right in front of her.

Well! That was a sigh of relief, though I had to give up all my savings for the pending payments and interests accumulated.

Never mind, better late than never, I guess.

4. Think and Spend

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people they don’t like”

Now even the money which remains in your hand after savings and meeting expenses needs to be expended well.

You need to differentiate between a necessity and a luxury (which has been already taught in much details in our economics class)

My mother had taught me the value of money and also to distinguish between the wants and needs.

She had taught me to exercise patience when thinking about big purchases.

She had taught us the difference between saving for a house (need) and saving for Iphone (want).

We need to take tactical steps and break the action into manageable pieces if we want to achieve our long term goals.

5. Future Security

“Save for retirement. Start from your first paycheck.”

After completing 3 years of work life, when I switched to a promoted level and my salary was Rs 50000/-, my mother told me that the trial period is over. (By trail period she meant, she has already inculcated core financial planning habits in me)

So by this time, I had learnt to save, invests, understood between good and bad credit, started thinking before expending.

Financial security was her last and the most important lesson. Though I saved, I expended in my trips and all.

So with the increased salary, she asked me to reduce the number of vacations and keep a major part for future financial security. You can invest in a retirement plan, take an insurance policy or anything that helps to your secure future.

No, I did not start saving for my retirement from my first paycheck because I had a different mindset at that time. Probably, you can and may start even earlier than me.

I can never thank her enough for all that she has done for us. But yes, I dedicate this post to her for giving me life and the right way to live this life.

Thank you mom, my hero!

To all the Mothers in this World:

You deserve the very best!

Happy Mother’s Day!