Nifty close 11278.90: After making a Doji in the weekly chart on the last week, today Nifty is down almost 380 points. Technically the sign was given by the index as it was breaching below the low of that Doji. But what are the factors which impacted so much in the Index?

The first one as we all know the uncertainty of Lok- Sabha election. Second, the rising tension of US-China trade war. Third, the volatility index (India Vix) crossed last three years high on Monday’s trading session. So these are the possible scenarios which are creating an impact in the market.

Now the Big question for Nifty is – will the correction continue?

Lets find out.

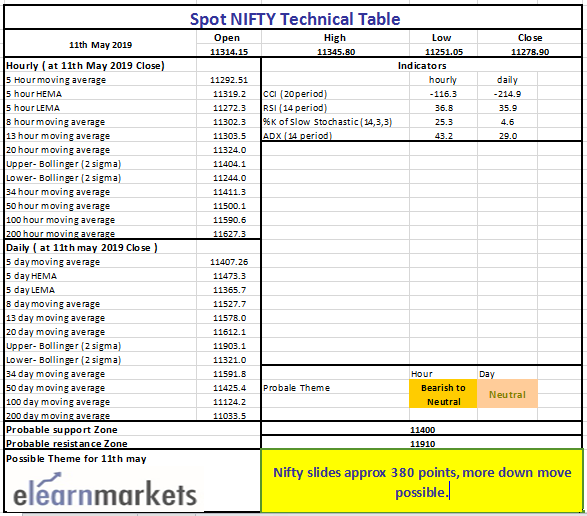

Hourly Technical: Market was very choppy on Friday’s trading session. Though, it had a negative close. So as of now, 11100 would be the possible support level for the Index and the 11350 is the possible short term resistance level.

Technical indicators side, RSI is showing tripple divergence and it is trading above 35 level, Stochastic is below its 30 level, ADX is trading above 40 and CCI is below -100 level.

So overall, sentiment is weak but the momentum is lacking. In case price breaches below the 11250 level, further down move likely to take place. But if price start moving upward, 11350and 11420 would be the possible resistance level.

Daily Technical: On the daily chart Nifty is consolidating for last two days. Once it breaks either side there will be quick move.

As per the price action and indicators, if the move happens on the downside then it will be fierce.

On the indicators side, RSI is below 50, Stochastic is below 10, ADX is below 30 and the CCI is below -200 level.

So there is weakness in the market.If the price goes down 11100 would be the possible support (100 MA is at 11124.20). In case it goes up, 11425.39 (50 MA line) is the possible resistance level.

Weekly Technical: It is big red candles in the weekly chart and as per the price action suggest the move is fierce and further downside is likely to take place. Two possible support level would be there if price slides below this week low, one at 11000 level and the seconds one is at 10650.

Indicators are also suggesting weakness ahead, RSI below 55 level, Stochastic is also trading below the 55level, ADX is below 20 and the CCI is below 50 level.

So overall there is more room for correction at this moment. But if any pull back happens ,11500 would be the possible resistance level.

BOTTOMLINE

Visit Elearnmarkets to get access to NSE and MCX certified courses and standout from others in the Financial Markets.

You can use StockEdge app to get cutting edge over others in both short term trading and investing. Here you not only get data at one particular place but can also create your own combination scans based on your own technical and fundamental parameter. See the video below to know about various features in StockEdge app.