The Indian Stock Market has been surging recently, and if you haven’t made any investments, you may be experiencing “investor FOMO” (Fear Of Missing Out).

However, before you act hastily, take a moment to compose yourself, and remember that timing the market is practically impossible.

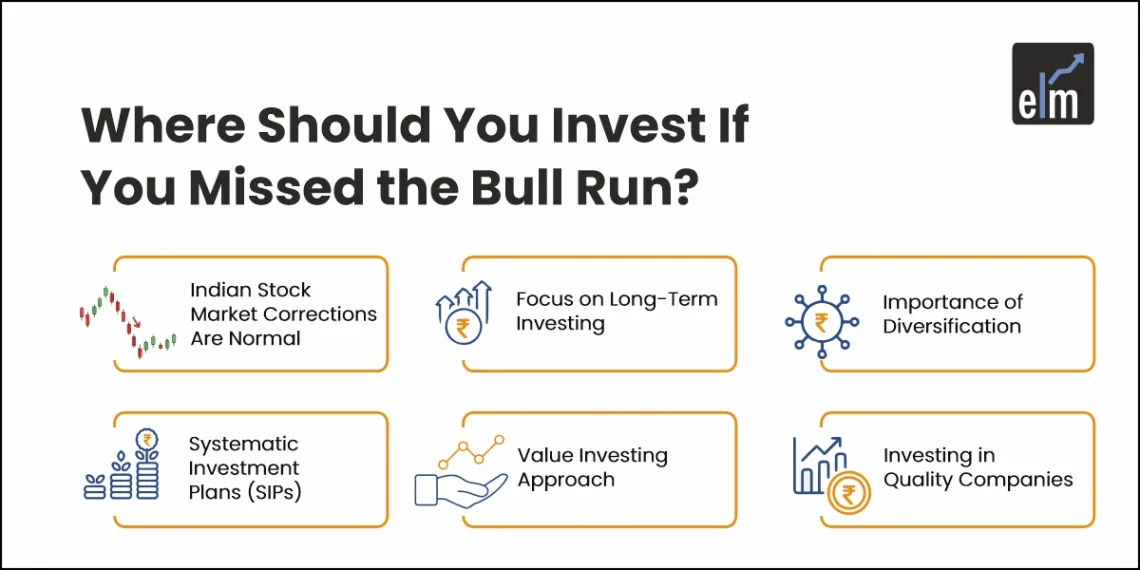

Many investors wonder where to invest if they missed the bull run. Even though the future is beyond our control, there are astute tactics we may investigate that surpass market timing and concentrate on long-term wealth accumulation.

In today’s blog, let us discuss some investment strategies if you have missed the bull run in the Indian Stock Markets.

Indian Stock Market Corrections Are Normal

A normal aspect of the stock market cycle is market corrections. They usually follow bull runs or protracted periods of market exuberance and happen after periods of notable expansion. Investors need to realize that these corrections are typical and beneficial to the market as a whole.

Bull runs are defined as extended times of high investor confidence and persistent optimism, during which stock values climb. But it’s important to understand that bull markets have a fixed lifespan. A correction eventually results from changes in investor attitude, economic considerations, or market conditions.

Prices can become overpriced during bull runs when investors bid up stock prices in anticipation of future growth. As a result, assets may become overpriced relative to their fundamental value, increasing the likelihood of a downturn.

Although investors may find market corrections unnerving, they also offer special possibilities. When stock prices correct, they rise to more realistic levels, which attracts investors who want to enter the market or expand their current holdings.

Focus on Long-Term Investing

Corrections can be beneficial for long-term investors since they make high-quality equities more affordable. The renowned advice given by Warren Buffett to investors was to “be fearful when others are greedy and greedy when others are fearful,” emphasizing the significance of profiting from market declines.

During market corrections, investors must resist the urge to act impulsively based on short-term swings and instead maintain a long-term perspective. As long as they maintain discipline and concentrate on fundamentals, investors can increase their wealth over time by taking advantage of market corrections.

Diversification is Key

A key component of investing strategy is diversification, which aims to minimize risk and maximize profits over the long run. Investments must be dispersed among various asset types, including debt instruments, stocks, and commodities like gold, and diversified across multiple industries within each asset class.

Diversification is a key tactic for controlling investment risk and optimizing long-term returns. By diversifying their assets across multiple asset classes and industries, investors can reduce their exposure to particular risks and take advantage of opportunities in a range of market conditions. It is important to remember that diversification is a sensible strategy for creating a strong investment portfolio, but it does not ensure profits or totally remove risk.

Investment Strategies for Missed Opportunities

Here are some investment strategies if you have missed the bull run in the stock market:

1. Systematic Investment Plans (SIPs)

SIPs entail making monthly, fixed-amount investments regardless of market conditions. This approach uses rupee-cost averaging to profit from market volatility. The fixed investment purchases more units during bear markets and fewer units during bull markets. This lessens the effect of market swings and averages out the cost of assets over time.

SIPs encourage consistent investing regardless of market emotion, which instils discipline. By using this strategy, investors can avoid the famously tough task of trying to time the market. Moreover, SIPs support the development of long-term investment and saving habits that can result in a sizable accumulation of wealth.

2. Consider Value Investing

Purchasing equities that are cheap in relation to their underlying value and have room to expand over the long run is known as value investing. Investors search for companies whose market inefficiencies, short-term setbacks, or a lack of interest from investors have caused the stock prices to undervalue the company.

Investors can use fundamental analysis techniques to find cheap stocks. This involves examining elements such as the business’s financial accounts, competitive advantages, managerial caliber, and growth forecasts. Investment newsletters, financial websites, and screening tools can also offer information on cheap stocks.

3. Focus on Quality Companies

Strong foundations, such as steady income streams, sound balance sheets, long-term competitive advantages, and capable management teams, are characteristics of quality businesses. By investigating these businesses, investors can reduce their exposure to negative risk and find chances for long-term wealth building.

Investors can evaluate a company’s quality using a range of measures and standards. This entails examining financial measures (such as the debt-to-equity and price-to-earnings ratios), analyzing past performance, studying industry dynamics and competitive positioning, and estimating future growth prospects. Furthermore, the identification of quality organizations is heavily reliant on qualitative variables like corporate governance standards, innovation skills, and brand strength.

Conclusion

It’s critical to concentrate on investing techniques that match your risk tolerance and financial goals if you miss the bull run. Even if historical market performance could be alluring, wise investment entails putting long-term value development ahead of short-term trends. Investors can manage market swings and gradually create a robust investment portfolio by adopting disciplined investing strategies, including value investing, SIPs, and concentrating on quality firms. Recall that the secret to investing for wealth creation and financial security is patience and a long-term outlook.

For more Market Updates, Visit StockEdge