Today we will discuss a very powerful candlestick formation known as Inside Bar pattern which is basically two-bar price action strategy. Here we will discuss the structure of the inside bar setup, the psychology behind it and some inside bar trading strategies when to enter or avoid the trade.

| Table of Contents |

|---|

| What is an Inside Bar? |

| Psychology behind the Inside Bar |

| When to enter the trade and when to avoid the trade? |

| 5 important characteristics of Inside Bar that matters |

| How to trade? |

What is an Inside Bar?

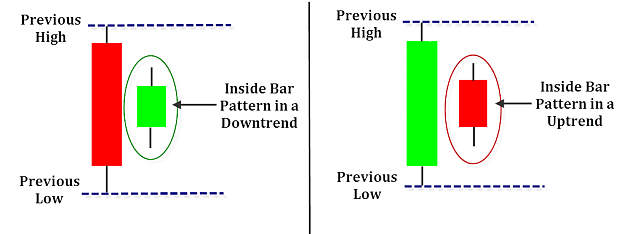

An Inside Bar pattern is a two-bar price action trading strategy where the inside bar is smaller and within the high-low range of the previous bar (popularly known as mother bar).

The relative position of the inside bar can be present at the bottom, middle or top of the inside bar.

Psychology behind the Inside Bar

Inside Bar pattern basically shows a period of indecision or consolidation in the market.

This is usually formed following a strong move in the market as it pauses to consolidate before making its next move.

However, they can also form at a market turning points and acts as a reversal signal from key support or resistance.

These are actually low volatility ranges and the subsequent course of action will be highly volatile which creates a good swing trading opportunity.

So the high and low of the mother bar basically acts as a short-term support or resistance.

Keep Inside Bar’s opposite direction to be the stop loss.

When to enter the trade and when to avoid the trade?

When you notice an Inside Candle on the price chart, you should mark the high and low of the Inside Bar consolidation range.

Both the levels are used as a trigger of a potential trade as there is a high possibility of continuation outside the range in the direction the breakout.

Though prior to the actual move, there is no clarity of the direction of the breakout.

In simple words, you should go long if the price breaks on the upside while you should go short if the breakout is on the downside.

Learn from Experts: Identify Trend Reversal with Candlesticks

Taking position based on inside candle is ideal in case of breakout or the market is trending.

In case of a consolidation or a choppy phase, you should avoid taking a position.

5 important characteristics of Inside Bar that matters

a. The time frame is important

The time frame is a key in case you trade based on inside bar.

You should not enter into a trade based on this strategy with anything less than the daily time frame.

The reason being that there will be high chances of false signals as lower time frame trades are more influenced by noise.

b. Works beautifully in trending market

If you are planning to trade based on inside candle, then you should always look for a trend.

Also Read: A complete overview on trend and theory of retracement

This strategy does not work in a choppy market as you will be easily stopped out.

c. Look for a breakout

The best inside bar setups takes place just after a break from a consolidation phase where the preceding trend is set to resume.

d. Give priority to the risk-reward ratio

A favourable risk to reward ratio is a key to the success of any trading setup.

The best thing about Inside Bar trading strategy is that risk is very limited as compared to the subsequent movement.

e. Size of inside bar

The size of the inside bar vis-a-vis mother bar is extremely important.

The smaller the inside bar relative to the mother bar, the higher the chance of experiencing a profitable trade setup.

Also Read: Trade RSI using the Andrew Cardwell way

The formation of inside bar from within the upper or lower half of the mother bar is an ideal situation.

How to trade?

1. Market breaks out of consolidation

You should avoid trading inside candle when the particular stock is range bound.

The best time to trade is when the stock comes out of the choppy phase as it is expected that the previous trend is set to resume.

The traders who are unable to devote much time in analysing charts of various securities may benefit from scan section in StockEdge mobile app.

To know how to effectively use the scan of StockEdge mobile app you can watch the video below:

2. Price is respecting 10 periods moving average

The simple technique to filter the trade is by plotting 10 Day Simple Moving Average on the price chart. In case of an up move, you should take a position until the price stays above the 10 Day SMA and vice versa.

Also Read: How to trade using moving average on different timeframes?

3. Inside Bar Breakout with Narrow Range (IB NR4) strategy

The inside bar with narrow range is an inside candle which also has the smallest day range among the last four days.

It indicates that the range is shrinking and anytime there will be a volatility expansion.

Conclusion

Even in a trending market, you will find Inside Bar strategy failing.

There is a candlestick pattern called Hikkake candle pattern which shows the failure of inside bar.

When the inside bar pattern fails and goes back to break the opposite level of the range, within 2-3 bars, we confirm a Hikkake pattern.

Here you can take your position in the opposite direction to the initial Inside Bar trade entry, placing your stop loss on the opposite level of the inside range.

what is the difference between the harami pattern and inside bar pattern?

Hi Anand,

The difference between an inside bar and harami is that with an inside bar, the highs and lows are considered while the real body is ignored.

Thank you for Reading!

Keep Reading!

Hi there! I simply wish to give a huge thumbs up for the good data you might have right here on this post. I can be coming back to your blog for more soon.