‘Yeh Laal Rang Kab Mujhe Chorega’

Considering the condition of the stock market today, this Late Rajesh Khanna’s song play in my ears,. It was a very bad for the stock markets all over. Nifty breached the ever important 7000 level today, taking the index some 23% down from its high of 9150 which had formed in March last year, that was right after the Union Budget.

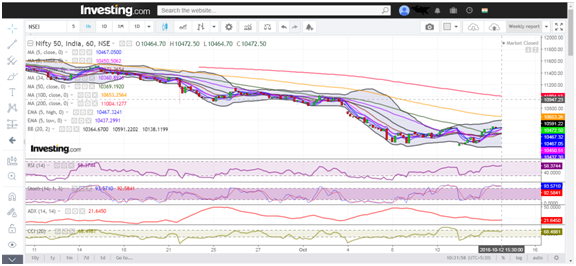

On the daily chart of Nifty we can see that the downward sloping channel which we have been following since a very long time has finally seen a breakout on the downside near the level of 7000 and even closed lower. The volumes were also very high and very supportive of this breakout.

On the weekly chart there are some observations which I have been saving for a day like this:

Amidst the steep fall that we are witnessing the support levels are a crucial subject. Since the carnage has violated some 4-5 important supports today itself let’s look at the levels available on the weekly chart.

The nearest support is coming from the 61.80% Fibonacci retracement of the advance which started from August 2013, which is the 6800 level roughly, and the next is the support from the level of past two peaks around 6300-6400.

A similar clustering of evidences can witnessed on the BankNifty charts also as it has come very close to the 61.80% golden retracement zone, which is also the support from way- way back in time.

Now looking at the closer picture, the major losers were the infrastructure stock GMR infra, down 12.50%, Oriental bank down 12%, wockhardt down 10.7%..

All the sectors have closed in a Deep red today may it be the PSU banks, the private banks, the auto sector, the Power stocks, only the pharmaceuticals were slightly less negative except for wockhardt.

If we look the winners chart, there is barely any stock atall which closer more than a percent higher. The sell off touched all the sectors and all the stocks irrespective of how attractive their valuations are and how good the stock specific news were.

On the international front a similar bloodbath can be witness as heave sell off rip the indices of some 3-4% . The Chinese Markets remain close, and though there was much expectation that some relief will come about from the holidays, no such thing can be witnessed for real.

Today we don’t have the usual separate segment on Chart of the Day as the Index Nifty has overshadowed all other stocks.

—————————————————————————————————————————————–

Read more articles here:

https://blog.elearnmarkets.com/market/nifty-chart/