Candlestick charts are a very useful tool for analyzing trader’s psychology and undercurrents in price momentum.

Every aspect of a candlestick plays a role, may it be the color of the body, the length of the wick/tail, and size of the body.

A candle-stick maybe studied individually or in a cluster, depending on factors such as the momentum preceding the candlestick pattern, which also contributes to the effectiveness of the pattern.

Also Read: All you need to know about the Japanese Candlestick

In this post, we will talk about two types of Inside Day Candle-Stick Patterns: the Bearish Harami and the Bullish Harami.

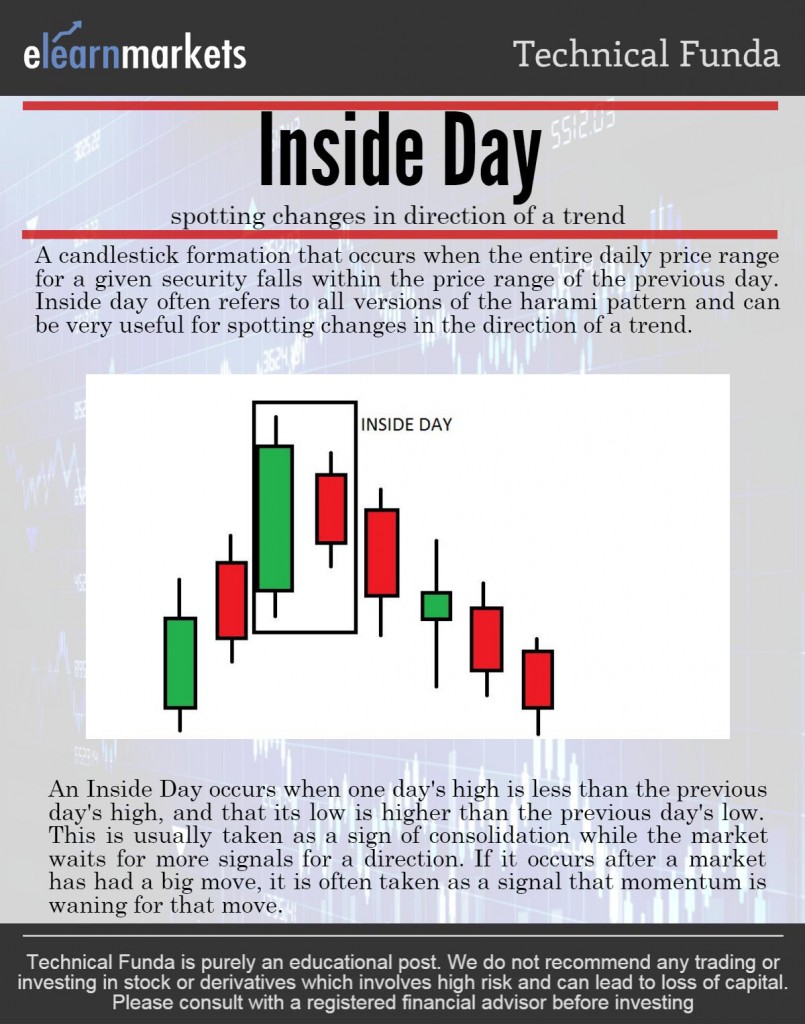

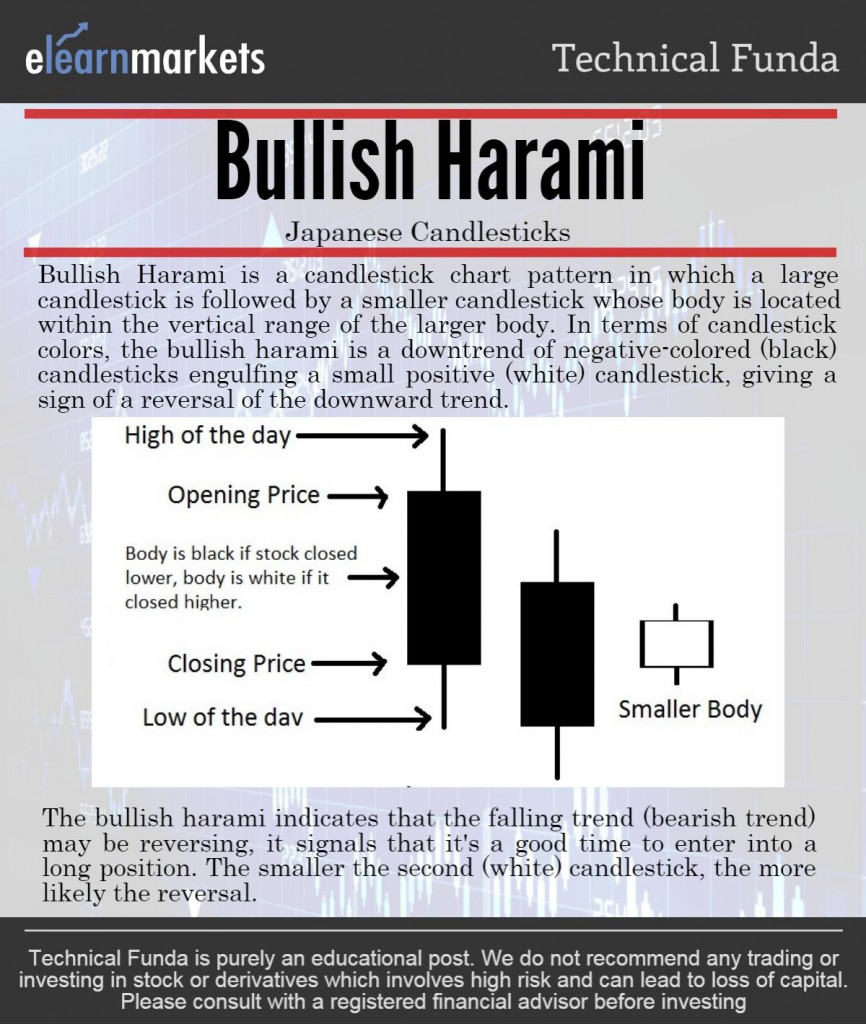

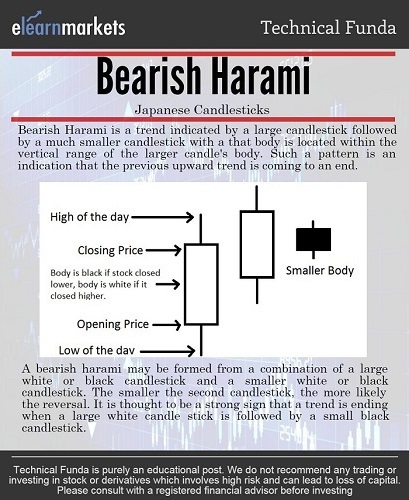

The Inside day is that candle-stick when the day’s range, that is the high and low, were within the range of the previous day. So, it looks like a long-bodied candlestick, followed by a small bodied-candlestick. In Japanese candle-stick term, this two-period formation is called a ‘Harami’ pattern. Harami in Japanese means ‘pregnant woman’, which is so called because of the look of the pattern. Now, whether the pattern is bullish or bearish depends upon the following criteria:

- The trend preceding the formation of the pattern.

- The color of the inside day.

- The confirmation within next three trading periods.

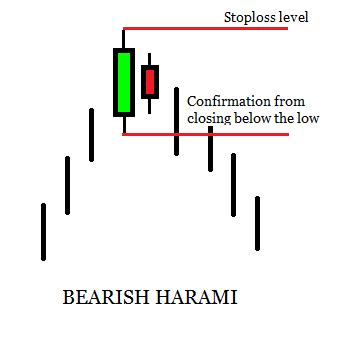

In an uptrend, the occurrence of the Harami pattern, with a red Inside Day, is an indication that the trend is losing momentum and the buying streak is cooling off. A closing below the low of the first candle of the Harami pattern is a confirmation of the pattern and serves as the sell signal with high of the pattern as stop-loss.

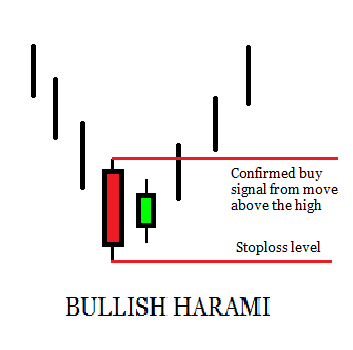

Similarly, in a downtrend, the occurrence of a Harami with a green Inside Day is an indication that the selling pressure is subsiding and a move above the high of the first candle is a confirmation of the Harami buy with the low as stop-loss.

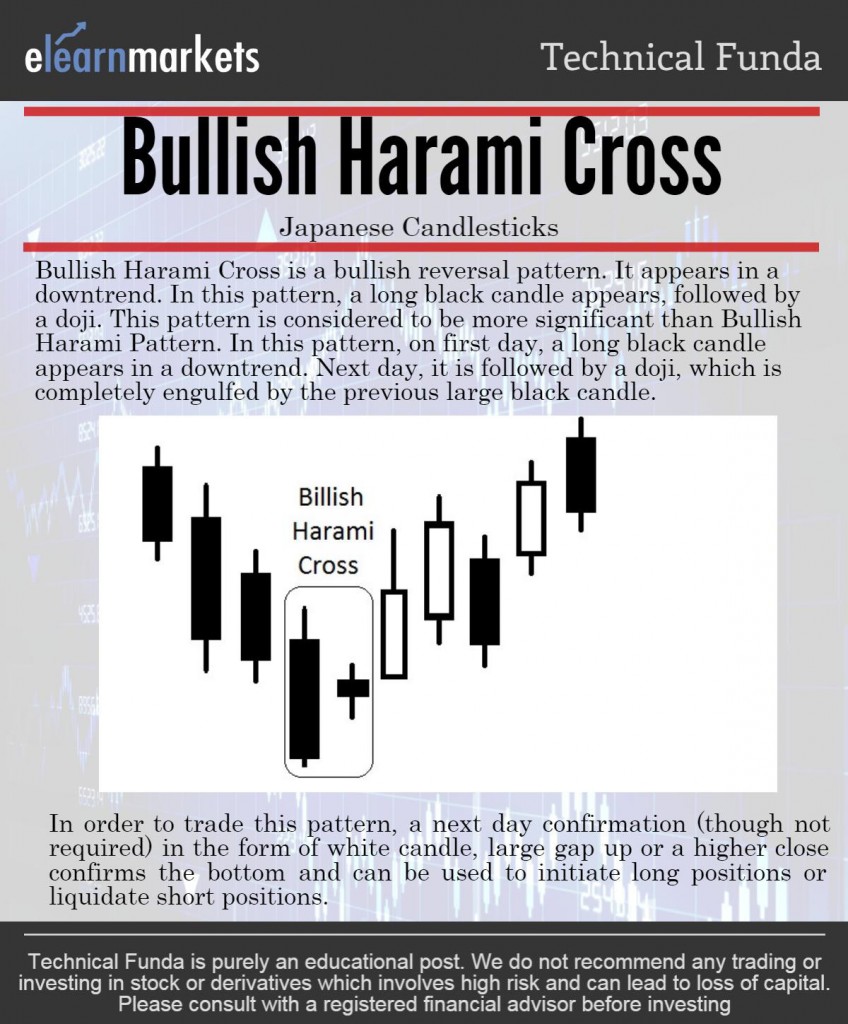

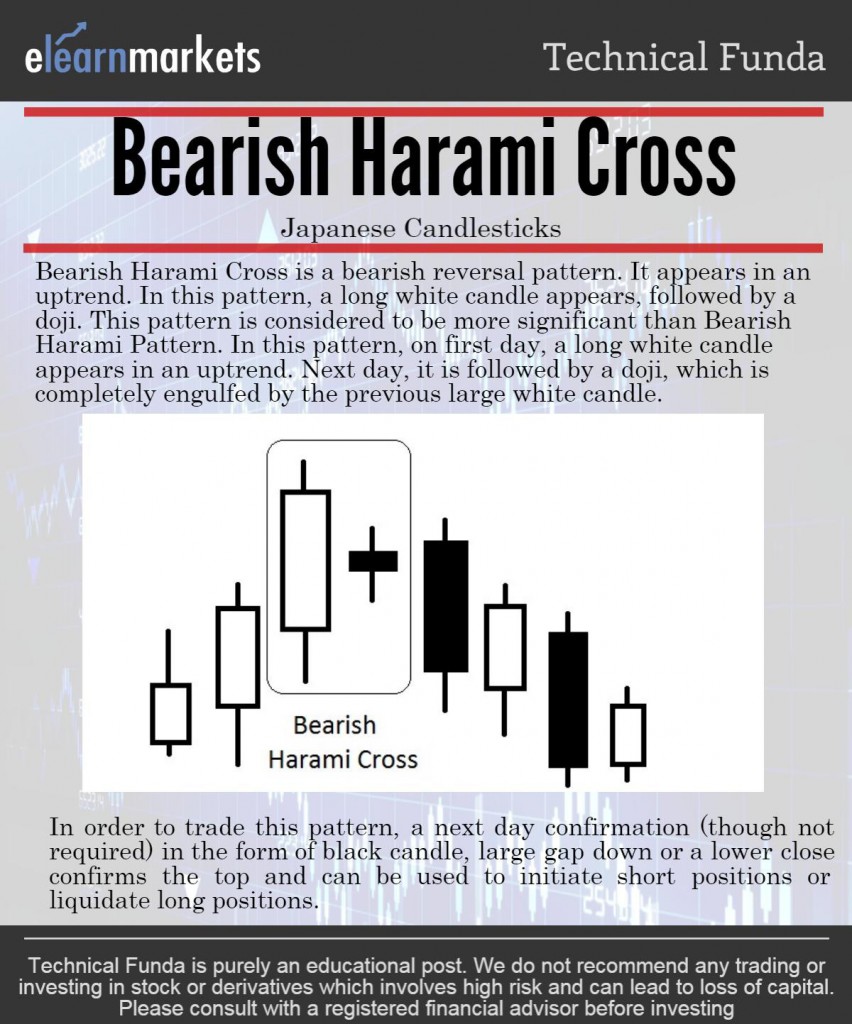

Other variations of the Harami is ‘Harami Cross’ wherein the Inside day is a small Doji candle with nearly the same open and close, in which the color is not available, and is a weak pattern as neither the bulls nor the bears could make a stand before the Inside Day closed. Refer to the gallery below for variants on HARAMI patterns.

As an example of the Harami pattern, let’s look at the Daily chart of GAIL. We saw a Bearish Harami reversal after the uptrend lost steam in a series of small-bodied candles. The Trend not just reversed, It leads to very steep fall in prices.

Learn the technical analysis of stocks, the analysis of financial charts, trading strategies and more in our NSE Academy Certified Technical Analysis course.

In order to get the latest updates about Financial Markets visit StockEdge.com

Hello to all, because I am really keen of reading this blog’s post to be updated regularly.

It contains good material.

I am truly glad to glance at this webpage posts which includes plenty of valuable data, thanks for

providing such data.

Pretty! This was an incredibly wonderful article. Thank you for

supplying these details.

Hi, this weekend is pleasant for me, as this

time i am reading this impressive informative paragraph here at my residence.

What’s up it’s me, I am also visiting this site

regularly, this web site is truly fastidious and the users are in fact sharing nice thoughts.