The Force index measures the strength of the price move based on three important parameters which include volume, direction, and extent.

It was invented by Alexander Elder and this oscillator actually fluctuates around the zero line.

Read More: Triple screen trading system: the Alexander Elder way of trading

When the indicator goes from positive to negative, the uptrend possibly comes to an end and it marks the starting of the downtrend.

Similarly, when the indicator goes from negative to positive, it signals the beginning of an uptrend.

Calculation

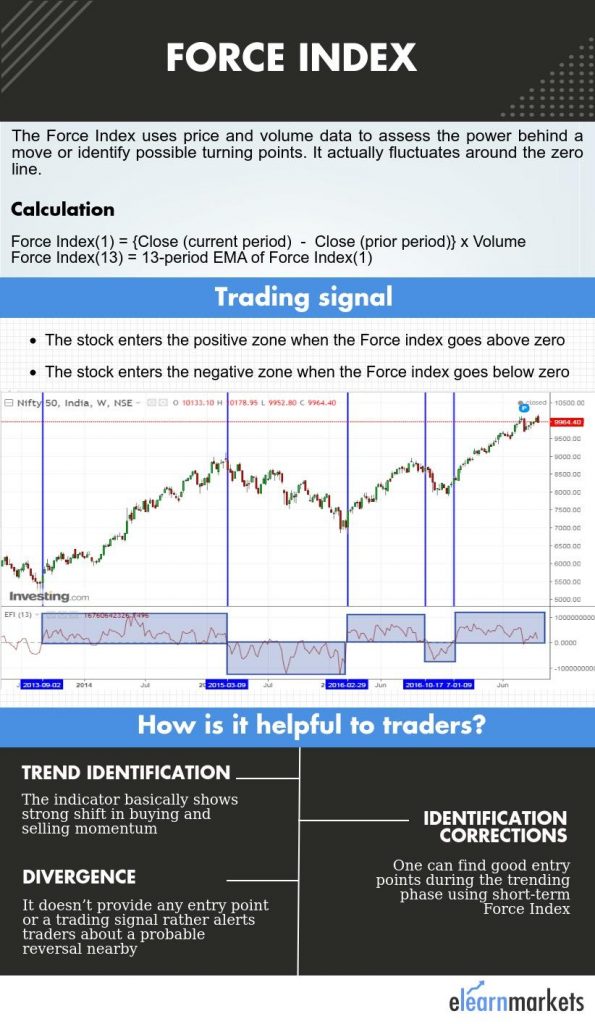

It is calculated as the difference between the current and the previous closing price multiplied by current trading volume.

The default period is taken as 13 periods and the 13-period Force Index is computed by taking 13 periods EMA of above calculated Force Index.

Force Index(1) = {Close (current period) – Close (prior period)} x Volume

Force Index(13) = 13-period EMA of Force Index(1)

How is it helpful to traders?

The Force Index primarily has three main uses which include identifying corrections within the trend, trend confirmation and locating divergences.

Let’s understand each of these uses in detail-

Trend Identification/Confirmation

The indicator basically shows a strong shift in buying and selling momentum.

The traders want to be on the sidelines when the force index clings close to the zero line as it indicates weak momentum.

When the Force index stays above the zero line, it signals an uptrend.

Also Read: How to identify trend and correction using Force Index?

When it goes above the zero line forcefully, it shows strong buying pressure.

You may do NSE Academy Technical Analysis course to enhance your understanding of Technical analysis and various strategies.

Similarly, when it stays below the zero line, it signals a downtrend.

When it goes below the zero line forcefully, it shows strong selling pressure.

The above is the weekly chart of Nifty 50.

It is clearly evident that whenever the Force index is above the zero line, Nifty has been in a positive territory and has given a good up move.

Similarly, when it is below the zero line, Nifty has given a good correction.

The farther it is away from the zero line, stronger is the trend.

Identifying Corrections

With the help of trend confirmation or identification and short-term Force Index (say 2-period), one can find good entry points during the trending phase.

This is actually a very active strategy but if you want to decrease the number of trading signals, you may increase the time period on the Force Index.

During an uptrend, when the 2-period Force index goes below the zero line and then rallies back above zero, a buy signal is generated.

Similarly, during a downtrend, when the 2-period Force index goes above the zero line and then rallies back below zero, a sell signal is generated.

Divergence

Divergence takes place when both the price and the indicator are not moving in the same direction.

Suppose the price is making higher highs but the indicator is making a lower high and vice versa.

Divergence basically shows weakness in the existing trend and signals either the magnitude of price or the volume is weakening.

It doesn’t provide any entry point or a trading signal rather alerts traders about a probable reversal in the coming period.

However, the reversal could take a long time to happen or it may not come at all.

Bottomline

The Force Index is a versatile indicator which actually combines both price action as well as volume to quantify a valuable metric.

It should be used in conjunction with price patterns and other indicators in order to filter out the divergence and also to trade the divergence in a better way.