Hindi: आप इस लेख को हिंदी में भी पढ़ सकते है|

Bengali: এই ব্লগটি এখানে বাংলায় পড়ুন।

Most of the people look forward to retirement goals. This is a period of life in which you can step away from slogging and follow your dreams. In a perfect world, everyone would be able to retire without any worries or regret.

Unfortunately, many people fail to prepare their future financial stability. So, it is better to figure out how much money will one need for retirement.

If you’re someone looking to spend a quality retired life, then retirement planning should be on your priority list.

With a little planning and a solid foundation of financial wellness, working forever doesn’t have to be your retirement reality!

To start planning for you retirement, you can take help of Kredent Money App

Here are some actions you can take today to make the process of reaching those retirement goals a little more achievable:

1. Set your Retirement Goals:

- What do you wish to do post-retirement?

- Take up some social cause?

- Get back to your home-town and relax?

- Start your dream project? Or

- Spend time with your family.

Manage your Retirement Goals with Personal Financial Planning Course from Market Experts

Whatever your dream is, you need to plan for it now.

2. Determine your Retirement Age:

The most common retirement age is 60 years, but it may vary from person to person.

One of the important factors while deciding your retirement age is the life expectancy rate.

In other words, the estimated number of years you are expected to live based on the age, medical condition, family history and other demographic factors.

3. Why do you need to plan for your Retirement Goals?

- To cover daily living expenses:

- To cover medical expenses:

- To fight inflation: inflation simply means price rise.

- To deal with uncertainties

- To meet your retirement goals

4. Determine your expected income after Retirement

The next step is that one should be aware of their total income from all the sources, be it pension from the company, pension from EPFO, income from any insurance plan or pension policy, thus include all such incomes in the calculation for retirement corpus.

Similarly, include income from property if any that you expect to continue in your retirement.

5. Start Early to retire peacefully

It’s better to start your retirement planning as early as possible as it will provide an edge with several years in hand and also one will have the power of compounding in hand.

Delay in retirement planning might lead to a compromise on your goals.

Hence, start early, start now.

6. Determine your Retirement Corpus

Retirement corpus is the amount you require post-retirement to meet your expenses and continue with the same lifestyle and maybe pursue your other personal goals.

Also, one should consider a very important factor related to post-retirement that is the inflation factor, that is how much your present expenses will amount to at the time of retirement.

This is referred to as the future value of money.

This is the amount you will need every year to meet your post-retirement expenses.

7. Calculate the future value of your current savings

Savings play an important role while building your retirement corpus, savings is the amount of money left after deducting all your expenses from the net income.

After determining savings, one needs to determine its future value.

8. Plan and Create Ideal Portfolio

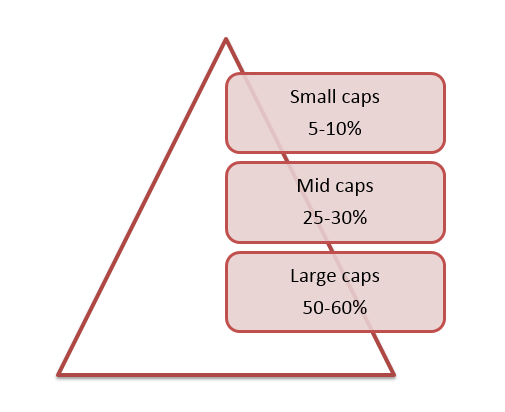

At an early age, we tend to take more risks as compared to when we are in old age. So, depending on your current age and amount of risks that you can afford to take, accordingly the portfolio allocation should be done.

More risk takers will have aggressive portfolio, while the other category will have conservative portfolio

It’s important to have a diversified investment portfolio across different asset classes.

Some assets like equities have the ability to offer you a better inflation-adjusted return (also known as the real rate of return) than fixed income instrument which can only provide safety.

Gold can be a store of value and act as insurance in your portfolio.

9. Track and review your plan regularly

Your retirement plan needs to be monitored at regular intervals (at least once a year) to make sure you are on target to meet your objectives.

Any changes in the income, expenses, retirement age, etc. need to be incorporated in the retirement plan.

Also, make sure the retirement plan meets your investment objectives in the changing market scenario.

Know about the key benefits of Retirement Planning

Key Takeaways:

- Overall, a well-diversified portfolio is your best bet for the consistent long-term growth of your investments.

- Diversification protects your assets from the risks of large declines and structural changes in the economy over time.

- It’s important to monitor the diversification of your portfolio, making adjustments when necessary, and you will greatly increase your chances of creating long-term financial success.

- It’s important to have a diversified portfolio across different asset classes.

- Delay in retirement planning might lead to a compromise on your goals.

My spouse and I stumbldd over here from a different web address

and thought I should check thinggs out. I like what I see so now i’m following you.

Look forward to going over your web page yet again.

Way cool! Some extremely valid points! I

appreciate you writing this post and also the rest of the site

is extremely good.

Very nice post. I just stumbled upon your blog

and wished to say that I’ve really enjoyed browsing

your blog posts. In any case I will be subscribing to your rss feed and I hope you write again very soon!