Since yesterday Indians were counting on notes and Americans on votes.

It has been a really volatile day, not only in Indian economy but also throughout the whole world

. It’s really a matter of luck to get a chance to witness the live screen in days of high volatility.

With the passage of time markets around the world discounted the factor that Hillary is going to grab the topmost job in America.

Instead of looking at it, if we look through it, then we will be able to identify that Clinton was the most wanted candidate mostly among the Financial Community.

According to some analysts, the initiative taken by NaMo is the boldest step taken post-independence to curb black money, of course, which are in the form of hard cold cash.

It will push up the demand for gold and dollars as safe stores of wealth and furthermore will give a big push to e-wallets and credit cards.

Also Read : Gold Demystified!

Undoubtedly it’s a tremendous step towards increased transparency in the Real estate sector.

The effects will be far-reaching and immediate and shake up the sector in no certain way.

Let me share the mind-boggling figures.

According to the RBI press conference, there are 16.5 billion “500-rupee” notes and 6.7 billion “1000-rupee” notes in circulation right now.

Definitely, it would take some time to bridge the gap in money flow.

I am sure that for the coming few weeks the gap between the rich and the poor will reduce (at least by the standard of living).

Jokes apart…

Dejavu of the Brexit moment…

Pre Result

Today the SGX India Nifty futures contract fell 1.7 percent in early trade in Singapore, indicating losses for Indian stock markets after a surprise move by our Prime Minister to abolish larger denomination banknotes.

Of course, the presidential election was an added trigger (it was too early to predict the outcome of the Presidential election to the precision).

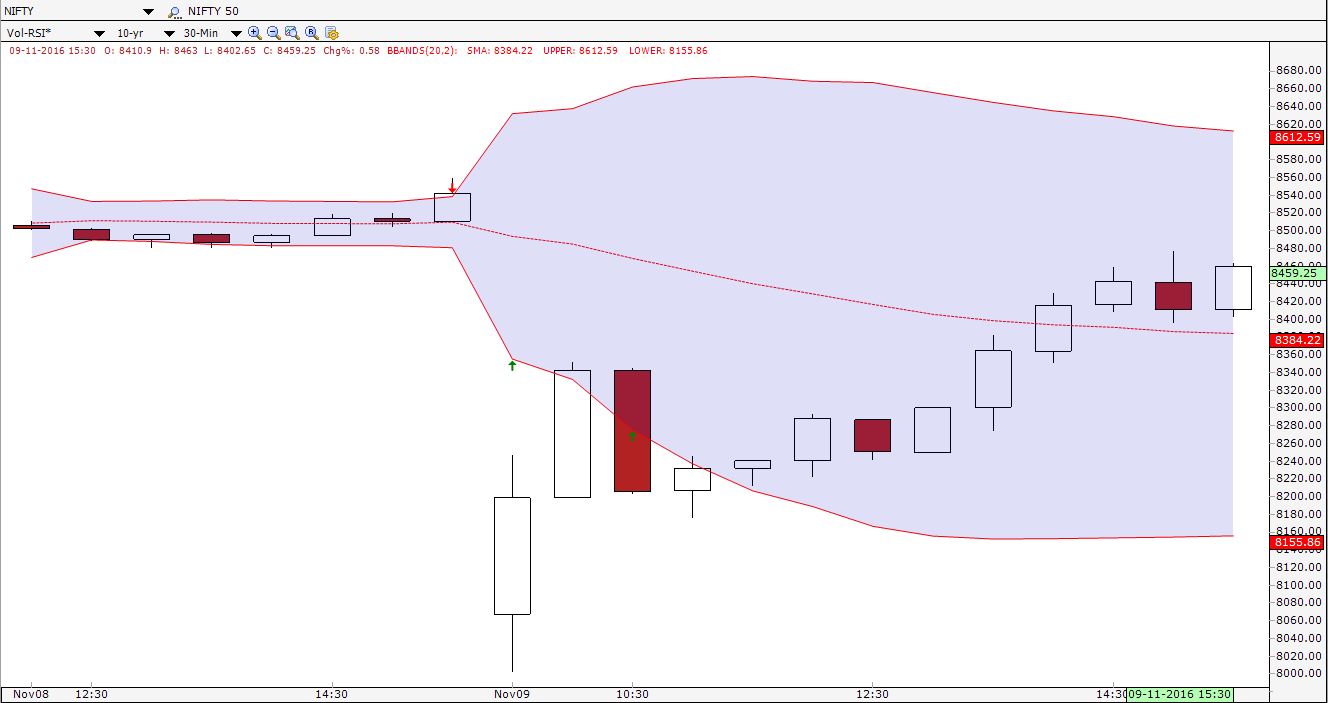

The spark created by uncertainty dragged the Indian stocks and in 15 minutes swiped away 6-7 lakh crore! Nifty 50 tanked over 400 points

It opened with a big gap down and almost touched the crucial support at 8000 and managed to bounce back.

It was mainly due to losses in realty, power, oil & gas, metal, consumer durable, and banking stocks, supported by India VIX, which rose to more than 11%.

The outlier being realty stocks which were bleeding since the early hours with DLF Ltd, India’s biggest property developer, down 17.3 %.

World markets rattled in wild trading today by the increased possibility of a shocking win of Donald Trump.

S&P Futures were down by almost 5%. Mexican Peso also slumped 13% against the dollar. It collapsed and plunged to life low.

Gold jumped nearly 5% to its strongest in 6 weeks as investors snapped up safe havens

It marked gold’s biggest single-day gain since June 24 when it rose as much as 8% when Britain decided to leave the European Union.

It closed up 4.8 % that day.

Moreover, based on Reuters data U.S. rates futures imply traders see only a 36 % chance of the Federal Reserve raising interest rates next month, which should support further gains in gold.

Moreover, oil prices also tumbled. International Brent crude futures LCOc1 were down 3.3 % at $44.51 a barrel.

Post Result

The jaw-dropping moment

Republican Donald Trump stunned the world by defeating heavily favored Hillary Clinton in the presidential election, ending eight years of Democratic rule and sending the United States on a new, uncertain path.

The benchmark index recovered on Trump win, tracking recovery in global markets after Republican Party candidate became the 45th President of US.

The market saw a sell-off, then gained later in the day.

Learn about financial markets from scratch by enrolling in Online NSE Academy Certificate in Research, Trading & Advisory course.

Under sectoral indices, the worst performer is Nifty Realty followed by Nifty IT, as tighter rules could impact Indian IT services firms supporting companies in the US. Banking stocks and pharma closed in green.

The rupee turned positive as the country’s move to withdraw larger banknotes from circulation was seen as a positive for the economy.

The partially convertible rupee was at 66.48 per dollar versus its previous close of 66.6150/6250 in late afternoon trading after hitting 66.40, it’s highest since Oct. 4.

Bonds held on to its gains, with the benchmark 10-year bond yield down 13 basis points at 6.67 percent.

Benchmark yields touched a session low of 6.64 percent, its lowest level since June 9, 2009.

Possible outcomes

In the shorter time frame equities will react negatively to this bold step taken by NaMo.

But considering the stability in growth rate and macro fundamentals, it’s a great long-term structural positive initiative.

According to some economists, there will be longer-term gains including transparency, higher tax revenues, and lower inflation.

The swing factor will be how much of unaccounted money comes into the system from the demonetization.

Post Trump win, there is a possibility of kneejerk reaction in the market as seen today. But it will not definitely destroy the long-term impact on the Indian market.

A high volatility can’t be ruled out in the currency market. Indian fundamentals are still strong enough to attract money and do not see emerging market funds selling big time.

Hence, it will be quite interesting to see how the events unfold going forward.

Wait and watch. There will be many windows of opportunity, which are really blessing in disguise.