You need to master trading psychology if you want to become a better trader.

Emotions are the fastest thing that can ruin your trades. Fear, greed, hope, and regret can all have a disastrous effect on your trading.

You already know that if you’ve spent any time in the markets. How will you handle it, though? Trading psychology examines the psychological and emotional states of traders. It all comes down to how your actions and outlook affect your trading. Your self-control and risk-taking are also mentioned.

Your capacity for long-term trading success greatly depends on your mind. Understanding your trading philosophy can be just as crucial as honing your stock market skills.

Let’s examine two significant feelings in trading:

Greed can cause a trader to hold onto a position for too long in an effort to squeeze every last dollar out of it. Greed can lead traders to adopt speculative and risky positions. It most frequently occurs when speculation runs rampant at the conclusion of bull markets.

It’s the opposite of fear. People sell early because of this to limit losses and prevent taking on additional risks. Bear markets are often accompanied by fear. Some traders may make irrational market exits as a result.

In today’s blog, let us discuss how you can master your mind for trading in the stock market and Trading Psychology

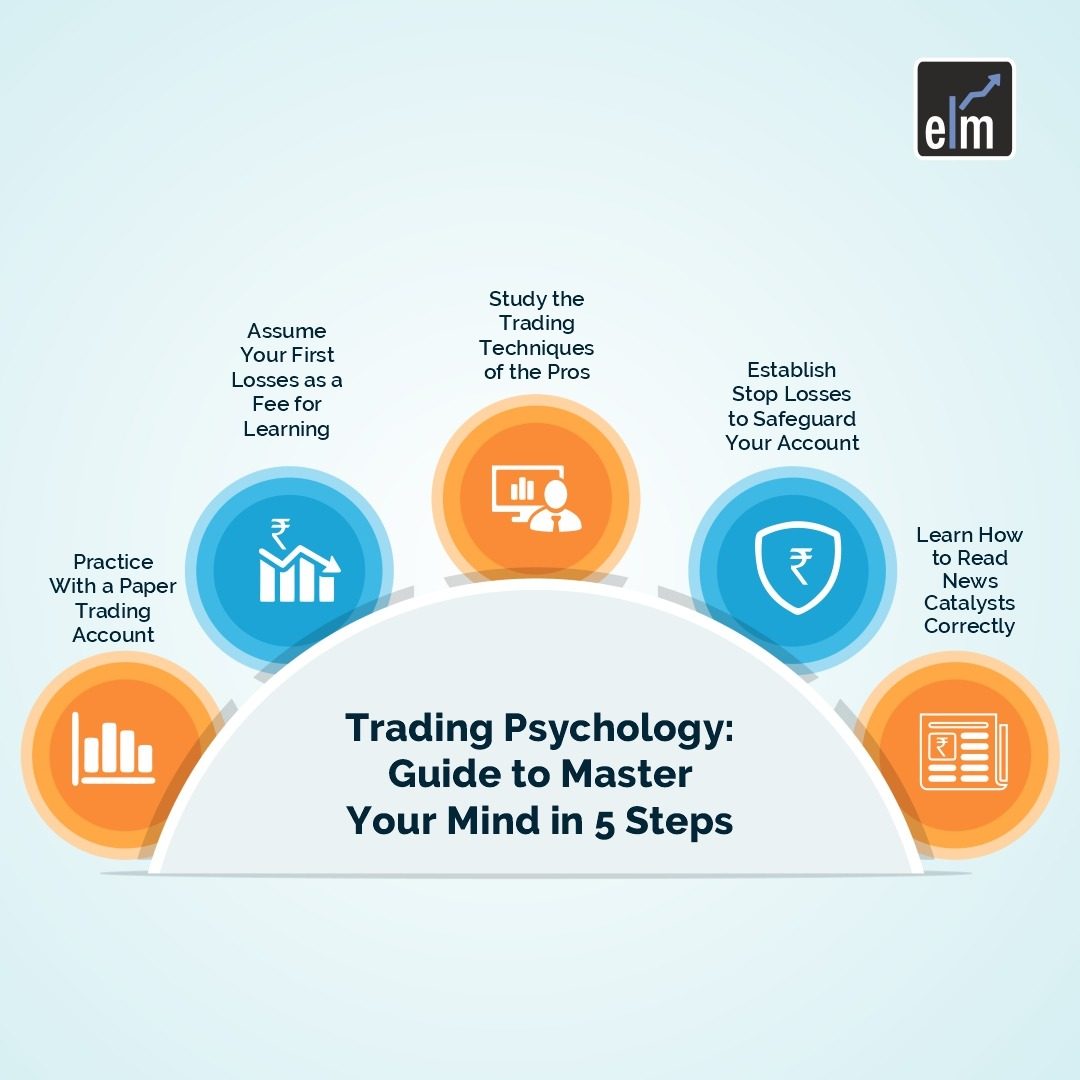

Trading Psychology: Guide to Master Your Mind in 5 Steps

1. Practice With a Paper Trading Account

Learning day trading requires both skill and knowledge as well as experience and practice.

Maybe you’re not quite ready to invest your hard-earned money yet. Create a trading account for paper. Without all the anxiety and emotion that comes with dealing with real money, you can practise real-time trading.

Gaining confidence can be aided by paper trading.

A paper trading account can assist you in learning the trading platform and the procedure for analysing and carrying out trades if you are a novice trader. Use it to practise using stop losses and limit orders. Learn risk management techniques.

Spend a few weeks or months honing your paper trading skills. Maintain thorough records of your trading activity over time. There are additional considerations that you must make. Are you experiencing a bull or bear market? Your plans might not be effective in the future if and when the market changes.

Paper trading is not just for newcomers, by the way. It’s a useful resource to refer to as your abilities develop and change Trading Psychology. Make use of it to test out a riskier trade or a strategy that you aren’t yet ready to wager real money on.

2. Assume Your First Losses as a Fee for Learning

Even with months of practice, nothing compares to entering a live account. There is no actual money at stake. After all, a stock simulator is only capable of so much.

Your trading emotions may become volatile if you use real money! When one of your holdings starts to decline, you might become anxious and exit a position too soon. When it returns to your original goal a few hours later, you’ll then kick yourself.

Or, out of greed, you might cling to a position for too long, hoping to get a little more. And you’ll disregard all warning signs. They all go through it.

Consider your initial losses to be the cost of doing business. All of it contributes to your trading education.

3. Study the Trading Techniques of the Pros

No need to create something entirely new. Instead, take advice from the tens of thousands of profitable traders who came before you.

Learning from seasoned traders is now simpler than ever. On Elearnmarkets, you can find some of the best. Many of our resources are free or cost nothing like the Elearnmarkets blog, ELM School and also our YouTube channel.

Top traders devote time to learning the fundamentals. Then they put forth the effort to continue learning and conducting research. They keep expanding and daily scan stocks.

They, most importantly, set objectives. They examine their methodology, trading psychology, and advancement. Yes, but they grow from them and get better.

Proactive traders perform better than reactive ones. Instead of concentrating on the result, such as how much money they might make, they concentrate on the process of identifying excellent market opportunities.

4. Establish Stop Losses to Safeguard Your Account

No way could it get any worse, right?

Keep those words in mind as you observe the point-by-point decline of your favourite stock. You’ll cling to hope despite all odds, multiple levels of support, and various levels of support.

When the time comes to sell a stock, you may find it difficult to do so if you have become overly emotionally invested in it.

Stop loss orders must be made in advance. No justifications.

You can’t force the market to go your way. It can and frequently will perform actions that you wouldn’t anticipate. It might appear to defy logic and all that you’ve learned. Accept that the market is a random place.

5. Learn How to Read News Catalysts Correctly

Even with the best technical analysis, if news catalysts aren’t taken into consideration, you could still lose money.

When most people read a news article, they assume that it will act as a catalyst. But by the time you read that news, every other trader has already done so. They have already taken action on it.

The alternative is a better strategy. Check out stocks first using a stock screener. Next, search for a news story that can be used to explain a stock’s performance.

The same catalyst may cause several stocks in the same industry to rise. But perhaps there is one that is still lagging that you can get on.

Bottomline

We hope you found this blog informative and use the information to its maximum potential in the practical world. Also, show some love by sharing this blog with your family and friends and helping us spread financial literacy.

Happy Investing!

To get the latest updates about Financial Markets, visit StockEdge