Having a demat account is the first step towards trading or investing. To understand the features and functions of this account properly, we have to fully understand the differences between a savings account, a trading and demat account.

There’s an uncle in my neighbourhood who is an intraday trader. We often discuss market ideas and other related stuff on a weekly basis.

While we were discussing the market scenario and volatility in the global market this week, his son (a newbie to the share market) asked us that where should he open his demat account? On clarifying his doubt, he came up with a next question where he enquired about the differences between these accounts

The uncle started answering the doubt but in the meanwhile, I was surprised to hear that he himself doesn’t know the difference between demat and trading account. This problem is common to most market participants.

This led me to come up with this write-up. So, today we’ll talk about the distinction between the three popular accounts

These three accounts combined together are widely known as the 3-in-1 account. Anyone who’s willing to buy or sell shares in the stock market got to have a demat and a trading account.

Let’s understand that how does demat account differ from the trading account?

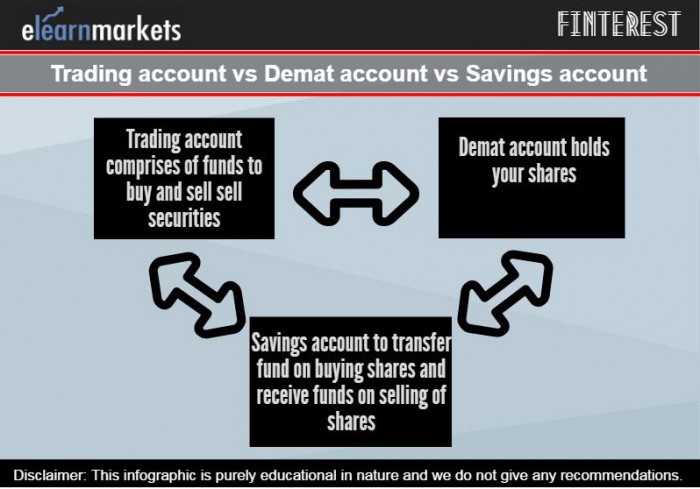

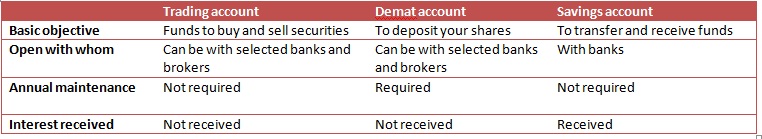

In the demat account, we only keep the shares while in the trading account, you keep the fund needed to buy and sell securities. You should have both the accounts to trade in the share market.

Also Read: How To Open A Demat Account?

Once you have opened both the accounts, you need to link them to your savings bank account.

Now we’ll see that how the entire process works?

Initially, we’ll have to deposit the money in your savings bank account and then we have to transfer the funds to your trading account. So, when you buy shares, you use the money in your trading account and on purchase your shares get digitally deposited in your demat account.

Now, let’s see, what a savings account is?

In simple terms, a savings account is a deposit account in a bank where you receive a nominal interest on your deposited money and it also ensures a minimum safety.

Also Read: How to Open a Bank Account?

These days some of the banks like ICICI Bank, SBI, etc offers 3-in-1 facility where all the three accounts can be opened with the same bank.

This brings to an end to this write-up. I would ask everybody to visit our YouTube channel to improve your understanding of the general finance and the stock market.

Stay happy, stay blessed and keep learning!!

What is the use of saving account in share trading

Hello Sami,

Thank you for your comment.

The funds are transferred from your savings account to your trading account from where it is transferred to your broker’s account when you buy a share.

Similarly, when you sell a share, the sale proceeds are transferred to your savings account via your trading account.

You can read more basic finance blogs

Happy Reading!!

Great info, thanks for the share!

Hi,

Thank you for Reading!

Keep Reading

It was really great blog provide helpful information !

I conceive this web site has got some real good information for everyone. “The best friend is the man who in wishing me well wishes it for my sake.” by Aristotle.