When it comes to managing my finances, I use some basic personal finance rules. I believe that you may find it useful for your own purpose as well.

| Table of Contents |

|---|

| Asset allocation rule |

| Strategy for your windfall gains |

| Avoid using credit-card |

| Rule of 72 |

| Retirement plan should hold a priority |

| Create an emergency fund |

| Bottomline |

Here’s a list of some of the basic personal finance rules to manage your Personal Finance

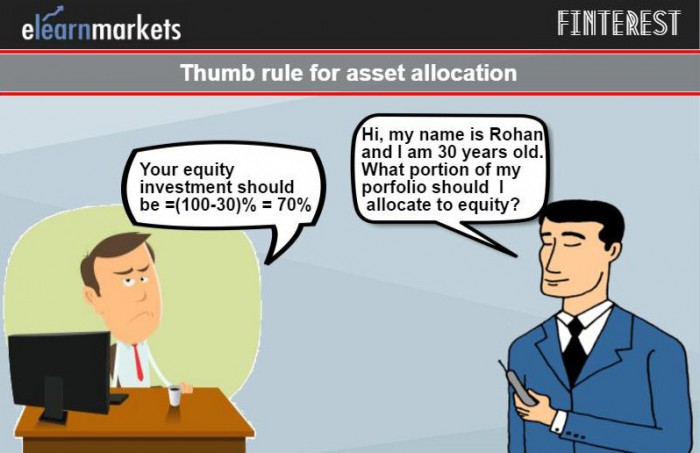

1. Asset allocation rule

It’s a widely regarded rule of asset allocation where you will invest X% of your portfolio in stocks and ‘X’ stands for 100 minus your age.

The remaining part will be invested in the low-risk asset class say bonds.

The best part about this rule is that with your increasing age, the proportion of your risk in your portfolio will also come down.

Manage your Finances with Financial Planning Made Easy course from Market Experts

2. Strategy for your windfall gains

If you ever receive a windfall gain in the form of a lottery etc, don’t spend it lavishly.

You may party with 2-3% of the money but rest keep in a safe place so that it’s not affected by your initial emotion.

Try to live your life as it was before so that you can give time in making better decisions to spend it wisely.

3. Avoid using credit Card

Avoid the usage of credit card since it may lead you to a big disaster if used casually.

The big problem with the debt is that when debt starts pilling up, it becomes even more difficult for you to get out of the debt i.e. it’s like a vicious cycle.

Moreover, the high-interest cost can make your purchase expensive, which might snatch away your mental peace.

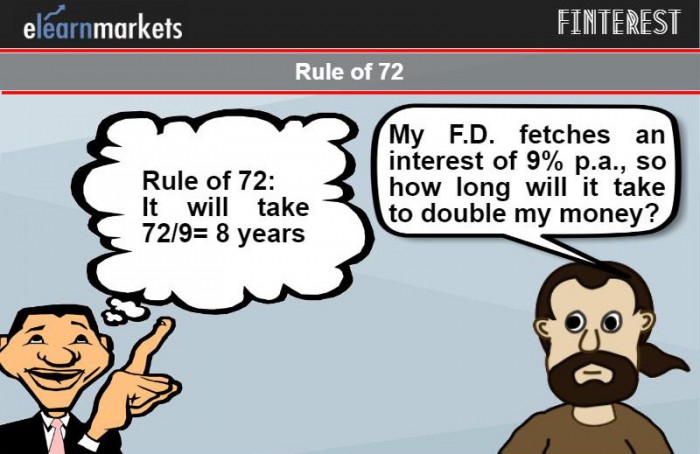

4. Rule of 72

As per this rule, divide the number 72 by the expected yield in order to determine how long it takes for your investment to double.

5. Retirement plan should hold a priority

Often people start planning for their retirement in their late 50’s.

Rather it should start at a very early age, more specifically once you start your job.

Moreover, you should give priority to your retirement over your children’s education since they can get an education loan but you won’t get a retirement loan.

Dwight L. Moddy said-

Preparation for old age should begin not later than one’s teens. A life which is empty of purpose until 65 will not suddenly become filled on retirement

6. Create an emergency fund

Make sure that your emergency fund takes care of about 8-9 months of your household expenses.

In terms of priority, you should create an emergency fund first, then pay off your high-interest debt and then only start investing.

However, apart from these, the most basic rule which one must begin with is to start saving.

You must set aside a suitable portion from your income and whatever left should be employed for your expenses.

To manage your personal finances, download Kredent Money App, a one-stop tool to assist you in your financial journey.

However, this is just the opposite which others do.

So stop relying on others to manage your personal finance because no one can better manage your personal finance than you can do.

To know more about the important steps in managing your personal finances, you can watch the video below:

Bottomline

We hope that the above write up has helped you to get a clear understanding of the different important steps for managing your personal finance.

Feel free to give your feedback by writing back to us by using the comment box below.